1 in 5 Low-Revenue SMBs Say No to Borrowing

Many small and medium-sized businesses (SMBs) adhere to lean business practices where decisions to borrow money must be weighed against an array of factors including objectives, revenue levels, cash flow and expenses.

This is likely why SMB executives tell PYMNTS Intelligence that what they look for most when considering borrowing options is flexibility. But flexibility alone does not work for all entrepreneurs. As we reported in “SMB Borrowing Dynamics: Trends, Tools and Decision Drivers,” a collaboration with U.S. Bank, low-revenue SMBs (those earning less than $1 million in annual revenue) are almost twice as likely as the average SMB to say no to borrowing altogether.

The report, which draws on insights from more than 2,660 SMB executives, found 90% of SMBs utilized at least one type of borrowing tool in the last year, underscoring the important role borrowing plays in the day-to-day operations for most SMBs. Our data also revealed that revolving credit products — such as credit cards and lines of credit — are the most widely used borrowing tools, with 73% of SMBs occasionally tapping into those and 45% of respondents saying revolving credit tools are their go-to resource.

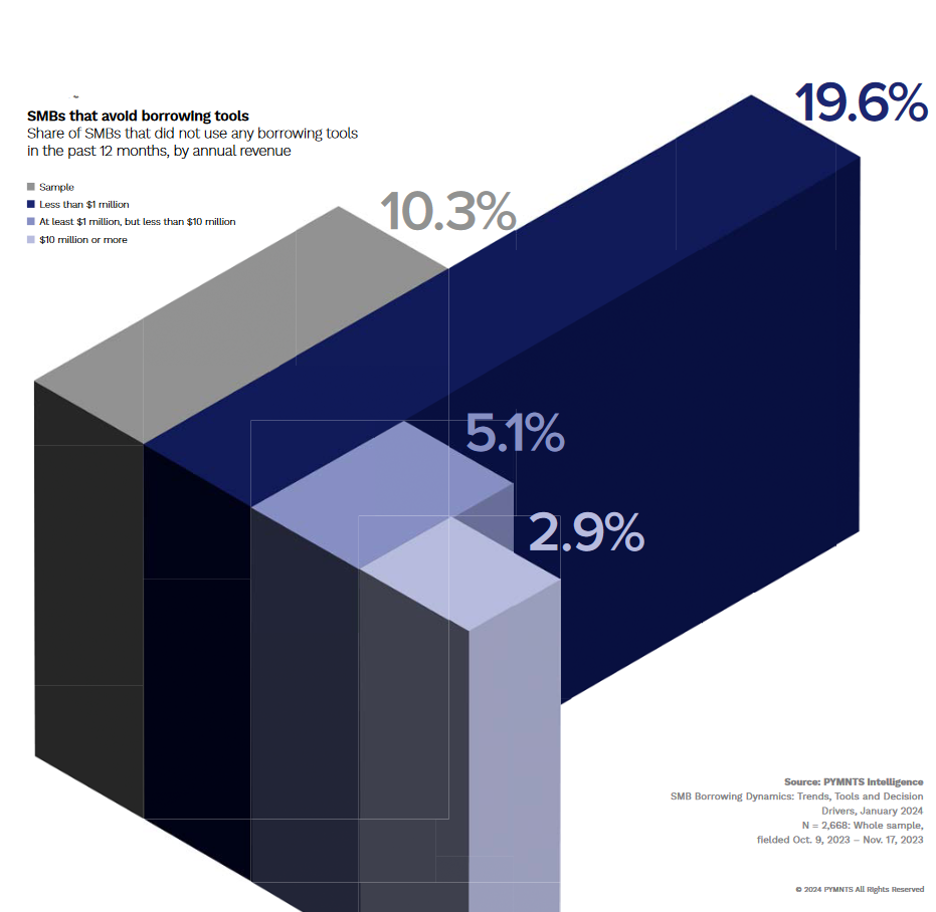

But as mentioned, the enthusiasm to borrow aligns closely to how much revenue a company generates. PYMNTS Intelligence data shows that 1 in 5 businesses earning less than $1 million annually declined to borrow at all in the 12 months prior to being surveyed for our report.

Meanwhile, only about 5% of medium-revenue SMBs (those earning at least $1 million, but less than $10 million) and about 3% of high-revenue SMBs (those earning $10 million or more) refrained from borrowing during that same time period.

This divide highlights the caution many small businesses must exercise in managing their organizations. When asked why they avoided borrowing, 18% of low-revenue SMBs cited the costs of borrowing as their top concern; slightly more than 18% told us they didn’t want to take on additional debt.

The caution that low-revenue small and medium-sized businesses voice around borrowing suggests there may be market opportunity for to financial institutions hoping to cater to low-revenue SMBs — one perhaps featuring lending terms business owners can live with and the flexibility most SMB executives say they value.