72% of Main Street SMBs Prioritize Ease of Use When Selecting Payment Processor

Whether it’s a quaint local shop, a cozy diner, or a busy salon, payment processors form the backbone of financial operations for small- t0 medium-sized businesses (SMBs) in the United States.

These processors play a pivotal role, streamlining the payment journey as well as enabling swift and secure transactions for purchases, services rendered, and the flow of revenue essential for their day-to-day operations.

In “The Main Street Health Survey Q3 2023,” PYMNTS Intelligence explored the preferences of Main Street SMBs by leveraging insights from a survey of over 500 brick-and-mortar shops in commercial districts across the United States. This study focused on the key services, features and functionalities that SMBs prioritize in their payment processors and offers recommendations for processors aiming to strengthen their foothold within this market segment.

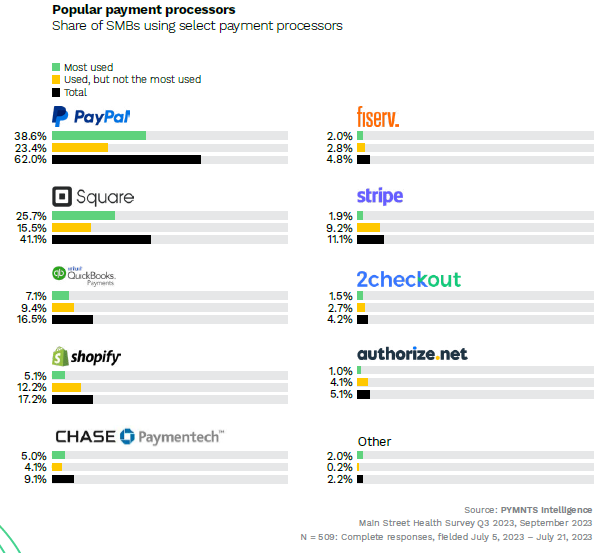

According to findings detailed in the joint PYMNTS-Enigma research study, PayPal and Square are the most popular payment processors among Main Street SMBs, with 85% of SMBs highly satisfied with their current payment processors. Other notable players such as Shopify, Fiserv and Stripe also enjoy considerable popularity among SMBs.

When selecting a payment processor, Main Street SMBs prioritize several factors. Foremost among these considerations are ease of use, deemed crucial by 72% of Main Street SMBs, followed by reliability at 60%.

Additionally, the cost of processing fees hold significant sway, which 52% of small businesses consider important, while 45% of small firms prioritize diversity of payment options. Other important factors considered include support and customer service, integration with other systems, customer preference, contract terms and security features.

The survey also shed light on the factors that motivate Main Street SMBs to switch payment processors. Lower transaction fees were identified as the primary reason, with nearly 60% of SMBs stating that lower fees would prompt them to switch. Ease of use was also a motivating factor, with 42% of SMBs expressing that it would be a reason to switch.

The study also identified specific verticals where payment processors can expand their presence. Hospitality and consumer services SMBs were found to be most likely to switch payment processors, making them potential targets for providers. Hospitality SMBs place high importance on fraud prevention and customer support, while consumer services SMBs value processors that offer multiple payment options.

To further differentiate themselves and win market share, payment processors can offer additional services such as banking, credit, marketing and reporting and data analytics, the study found. These services can attract Main Street SMBs and overcome their inertia in switching processors.

Looking ahead, the landscape for payment processors remains robust, with soaring demand. Providers that understand the needs of specific SMB verticals and extend additional tailored services will not only strengthen their foothold but also maintain a robust customer base within the small business market segment.

Ultimately, prioritizing customer needs and preferences will be the linchpin for attracting and retaining Main Street SMBs in a rapidly evolving and fiercely competitive market.