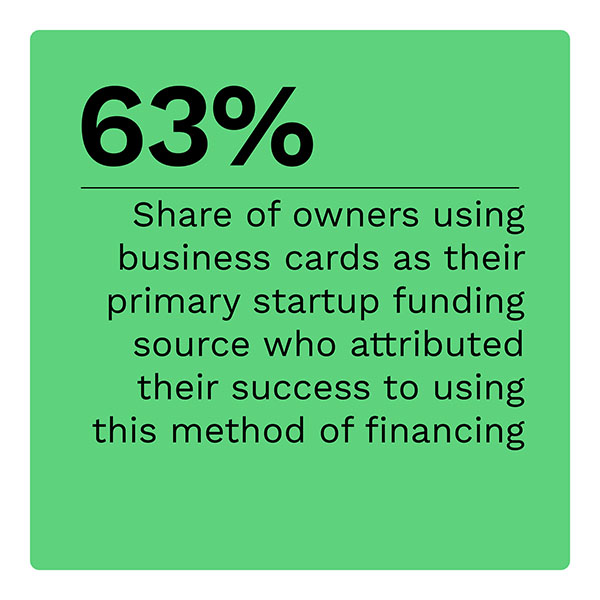

Sixty Percent of Startups Using Cards Credit Them With Business Success

In contrast to typical business loans or personal sources of financing, business cards offer multiple benefits for small- to medium-sized businesses (SMBs). These benefits include easier qualification than bank loans, higher credit limits and other various perks.

![]() According to a recent poll, more than 9 in 10 new business owners who used business cards as their primary startup funding source would recommend these cards to other entrepreneurs. Nearly one-quarter cited fast access to funds as their motivator for using this method.

According to a recent poll, more than 9 in 10 new business owners who used business cards as their primary startup funding source would recommend these cards to other entrepreneurs. Nearly one-quarter cited fast access to funds as their motivator for using this method.

The “B2B and Digital Payments Tracker®” explores the many advantages small businesses see by using business cards for needed capital and financial management.

Using Business Cards to Manage Business Financing

Business cards have been around for decades, but newer and smaller businesses may be less familiar. As an alternative to traditional business loans or personal cards, business cards hold several advantages for SMBs and can play a role in cash flow strategies. Like any tool, business cards come with strict instructions for use, as well as a list of precautions. However, as SMBs consider their options for keeping afloat in the present era, business cards are well worth adding to their navigational suites.![]()

Business cards are sometimes equated with corporate cards, but these cards do not require businesses to be incorporated. This makes the tools available for any size business, from sole proprietorships and up — including side gigs. Business cards offer numerous benefits over personal financing, including higher credit limits than personal cards and perks such as cash-back, travel and mileage-earning rewards. To learn more about how small businesses can manage their cash better by embracing business cards, read the Tracker’s PYMNTS Intelligence.

SMBs Use Cards More Than Any Other Business Financing

SMBs are more apt to hold and use business cards than any other form of business financing, according to PYMNTS Intelligence data. While less than 13% of SMBs reported having access to forms of business financing, such as business loans from online lenders, working capital loans from banks or unsecured business bank loans, 28% of SMBs held business cards.

To learn more about small businesses’ access to and use of credit, read the Tracker’s Chart of the Month.

How Data Is Driving the Future of Small Business Credit

SMBs are a resilient sector. That is why a pullback in lending by both big and small banks is not deterring SMB owners from seeking financing. What is changing is where they are seeking it.

To get the Insider POV, PYMNTS Intelligence tapped interviews with Enigma’s Hicham Oudghiri and Cross River’s Anthony Peculic to learn why more SMBs are moving toward FinTechs and online lenders and away from traditional financial institutions.

About the Tracker

The “B2B and Digital Payments Tracker®” explores the numerous advantages SMBs can see from using business cards for needed capital and financial management.