Managing Spend In A Sector Where Unplanned Expenses Are The Norm Issues

More workers in the United States and around the world are beginning to ask for updated expense tools as business becomes more interconnected. The volume and frequency of money and data in typical business practices continue to increase, yet some businesses are still using manual, paper-based expense reporting systems that can lead to costly mistakes.

More workers in the United States and around the world are beginning to ask for updated expense tools as business becomes more interconnected. The volume and frequency of money and data in typical business practices continue to increase, yet some businesses are still using manual, paper-based expense reporting systems that can lead to costly mistakes.

These systems are only becoming more frustrating for workers, especially as the working world’s average age creeps steadily downward. Millennials have been at home in the global workforce for about a decade now, but Generation Z is starting to filter into offices, warehouses and work floors and bringing their fast payments expectations with them.

These systems are only becoming more frustrating for workers, especially as the working world’s average age creeps steadily downward. Millennials have been at home in the global workforce for about a decade now, but Generation Z is starting to filter into offices, warehouses and work floors and bringing their fast payments expectations with them.

The latest Workforce Spend Playbook examines how an increasingly younger workforce is changing employees’ and employers’ approaches to payment and expense spending, as well as the ways manual spending tools could hurt both during tax season and in spend reporting.

The Latest Workforce Spend Headlines

Many workers still track their spending by collecting physical receipts, a time-consuming and often frustrating process. Metro Bank is hoping a new feature that allows employees to take and instantly upload photos of such receipts will help fix that. The solution uses automated technology to categorize and codify relevant data from these documents in real time, thereby trimming the time employees and expense managers need to sort through them.

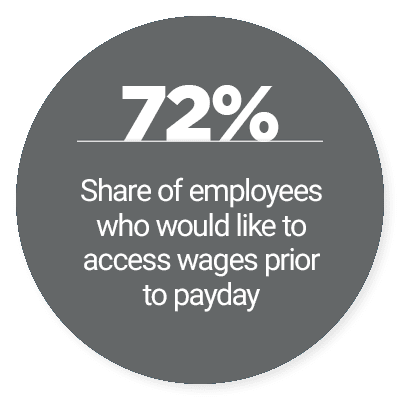

Workers are also beginning to ask for payment capabilities from their employers, including features that afford them earlier access to their money. Seventy-two percent of U.S. employees would like access to their wages before their designated paydays, according to a recent study. Such pay advances are gaining particular interest among workers with income levels below $50,000, with 87 percent of them citing interest.

Workers are also beginning to ask for payment capabilities from their employers, including features that afford them earlier access to their money. Seventy-two percent of U.S. employees would like access to their wages before their designated paydays, according to a recent study. Such pay advances are gaining particular interest among workers with income levels below $50,000, with 87 percent of them citing interest.

American employees would also like faster reimbursements from their employers, with studies showing slow, check-based processes can financially hurt workers. Nearly 40 percent of U.S. employees have used their personal funds for work expenses at least once per month, according to a recent report, and just one-third of respondents were reimbursed for those payments within one week. Lack of quick and efficient payouts can have lasting financial consequences for employees, though, which can also impact their productivity at work.

To learn more about these and other recent headlines, download the Playbook and read its News and Trends section.

Why Deft Spend Management Is Crucial To Successful Event Planning

Large events require event planners to keep track of numerous minuscule details, many of which must be planned far in advance to ensure smooth sailing. Successful event planners have also learned to expect the unexpected, though, from vendors running late to misplaced items to day-of client requests. Managing these expenses requires flexible and easy spend management tools, as on-site event planners must be able to meet these needs and more without disrupting such events, according to Christine Altieri, founder of event management firm AE Events. To learn more about how her company is using flexible spend tools to ensure events go as planned, visit the Playbook’s Feature Story.

How Business And Their Workers Can Avoid Frustrating Tax Mistakes

Tax season can be irritating for all evolved, especially if one’s company still relies on outdated spending tools that require employees to spend hours checking paper receipts and documents. Manual systems can do more than exacerbate tax season frustrations, however. They can make it difficult to identify forgotten expenses or important tax documents that need to be filed. These mistakes can be costly, especially for small businesses, but many of them are turning to more innovative expense tools to ensure this does not occur. Visit the Playbook’s Deep Dive to dig into how companies and employees can avoid costly tax season mistakes.

Tax season can be irritating for all evolved, especially if one’s company still relies on outdated spending tools that require employees to spend hours checking paper receipts and documents. Manual systems can do more than exacerbate tax season frustrations, however. They can make it difficult to identify forgotten expenses or important tax documents that need to be filed. These mistakes can be costly, especially for small businesses, but many of them are turning to more innovative expense tools to ensure this does not occur. Visit the Playbook’s Deep Dive to dig into how companies and employees can avoid costly tax season mistakes.

About The Playbook

The Workforce Spend Playbook, a PYMNTS and Bento for Business collaboration, showcases the shifting spend management solutions landscape and how improved services are affecting SMBs’ in-field expense management, back-office operations and bottom lines.