The Commerce Department released July’s retail sales last week, showing an increase in seasonally adjusted retail spending – up 1.2 percent overall last month, but down from the 8.4 percent growth in June. Analysts reported that physical retail sales, seasonally adjusted, were up 2.7 percent overall in a trailing 12-month period, and that businesses had mostly recovered all of the losses that had been incurred in the March-through-May lockdown.

What we see in those numbers are the glimmers of a “V-shaped” recovery in those segments where consumers really value and want to return to the physical retail experience – with restaurants leading every other sector.

We also see the struggle facing nearly every other category – the ones that aren’t so dear to the consumer – as they try to climb back out of their physical retail trough.

And what we also see is only one part of the retail sales story.

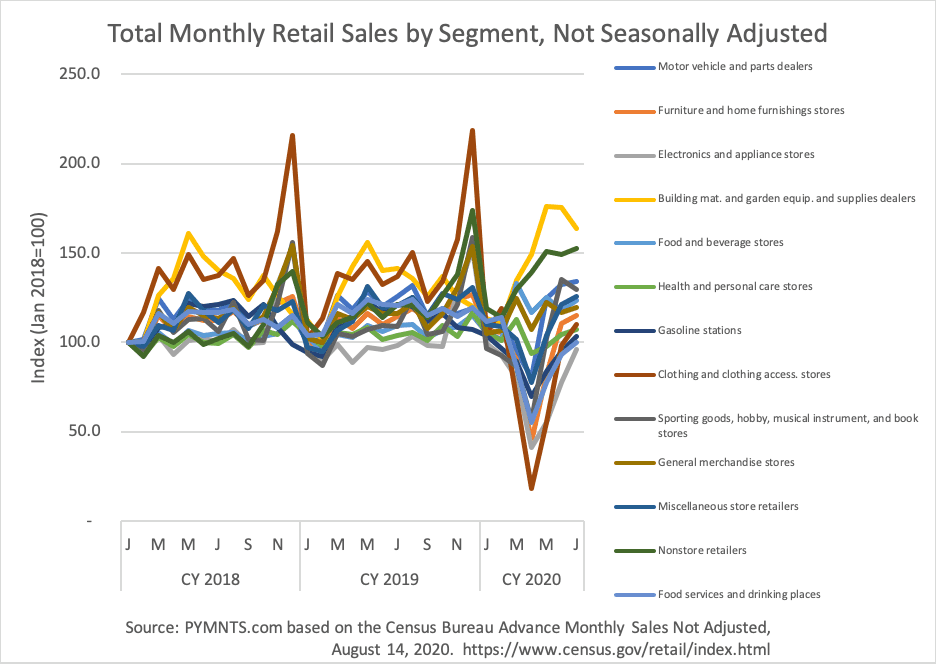

Looking at non-adjusted retail sales, the storyline is a bit different: It’s more aligned with what consumers are actually spending and where they are spending it.

And where are they spending their money? Online.

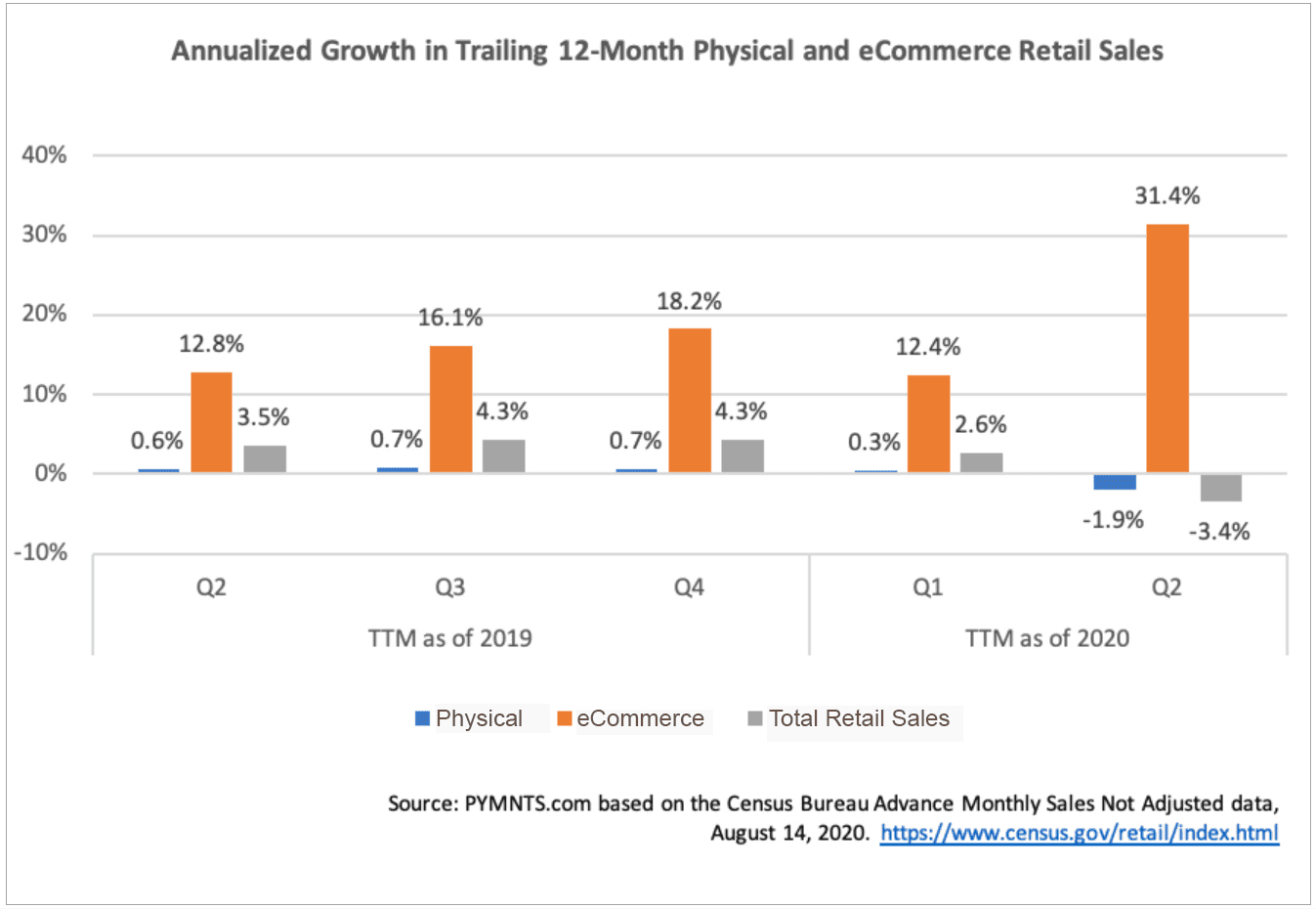

Using Census data, the trailing 12 months of non-adjusted physical retail sales show a decline of 1.9 percent and quarter-over-quarter growth of 1.6 percent.

The Census will release its Q2 eCommerce sales results today, but we’ve been using our own methodology to forecast eCommerce sales for some time, given the lag in Census reporting. And we’ve found our models to be remarkably consistent over time.

Using those models, the trailing 12-month, non-adjusted, online retail sales numbers show an increase of 31.4 percent and a quarter-over-quarter growth of 27.9 percent — growth that is 30 times that of non-adjusted physical retail sales over the last 12 months, and a nearly 15-times growth quarter over quarter.

That growth in online sales comes during a time period when consumers could (and did) get out and about, visiting those brick-and-mortar establishments that they felt would add value to their shopping experiences and reduce the health and safety risk of shopping in a store.

Granted, the growth of eCommerce sales is on a much smaller base of retail sales, but the trendlines are clear: The consumer’s digital shift is real, and it appears to be accelerating.

There are many reasons for that — and we’ve highlighted them consistently since March, in the published PYMNTS research of the pandemic-induced shopping behaviors of more than 20,000 American consumers.

That data shows a consumer who first shifted to digital out of health and safety reasons, but who now likes that digital shift enough to stick with it for all or part of their shopping experiences — most particularly for retail and grocery products.

There’s another reason for this digital shift, one that was beginning to get traction before COVID-19, and is gaining momentum as a result of it.

And that’s the rise of the auto-refill economy.

This is different from subscriptions that allow ongoing access to a particular product or service, most commonly involving content like newspapers or streaming services. The replenishment models establish auto-order frequencies for depletable physical products that people consume on regular basis.

Marketplaces and brands now make it easy now to auto-refill everything from paper towels to pet food, skin crèmes to salty snacks, bottled water to baby wipes. Most offer suggestions for the appropriate replenishment schedule, and all aim to eliminate consumers’ FORO: fear of running out.

Auto-refill offers consumers the convenience of never having to remember to order the items that are always on their shopping list, and eliminates the friction of having to do without an essential product.

This “set it and forget it” model has the potential to accelerate the consumer’s shift to digital and make it that much more enduring.

And across a growing number of important retail segments.

CPG Goes Online — And To Auto-Refill

The middle aisles of the grocery store aren’t the places where grocery stores make their biggest margins, but it is where most every consumer entering the store shops. Those aisles (and you know them well) are where the non-perishable pantry items — canned and packaged goods, baking products, cereal, paper goods, cleaning and laundry supplies, and pet food — are found. It’s also where the stuff that takes up the most room in grocery carts — and consequently, in the trunks of consumers’ cars — are bought.

Sales of those middle-of-the-aisle products spiked in the physical stores in the early days of the pandemic, as consumers rushed to stock their pantry shelves with those non-perishable items. CPG companies reported record sales of comfort foods sold in a can, bottle, box or plastic bag — soups, salty snacks, cereal, canned spaghetti, you name it.

It’s also where CPG companies have reported seeing big spikes of online sales, particularly to new consumers. PYMNTS research, done in collaboration with sticky.io, reports that 45 percent of U.S. consumers have tried a new brand in the last 60 days, and have made that purchase directly from the brand via an online channel.

Not surprisingly, each of those companies is investing heavily in building out eCommerce capacities — both via their own platforms and via the eCommerce platforms that serve the grocery stores carrying their products.

PepsiCo said its Q2 eCommerce sales doubled quarter over quarter. The company has established its direct-to-consumer (DTC) online pantry so that consumers can order their salty snacks directly from the source. Reynolds reported that 26 percent of its customers in Q3 2020 use eCommerce to buy their products. P&G reported that eCommerce is now 10 percent of its business, growing globally by 35 percent in Q3 2020.

General Mills reported that its U.S. business saw a 250 percent increase in eCommerce in its Q4 2020, now accounting for 9 percent of its total business. Why wasn’t that number higher? For one reason: There wasn’t enough capacity at the store level to meet delivery demand, the company’s president of North American retail reported to analysts.

Think about that for a minute: About 10 percent of CPG sales for these massive players now come from digital channels. These are products that, not that long ago, were almost exclusively purchased in the physical store.

It’s a remarkable shift, in the space of just a few short months, in a category that many thought would take years to move even the tiniest bit of volume online.

Of course, we see this in our own data as consumers have shifted more and more comfortably, it appears, to a digital-first grocery shopping experience.

Before the pandemic, the weekly trek to the grocery store was a force of habit.

In early March, it was driven by the fear of running out, as consumers hoarded whatever they could get to avoid going to the store any more than they had to.

Two months later, we saw the shift to digital come out of fear of getting the virus while under lockdown.

Today, we see the ranks of these digital-first grocery shoppers on the rise, with five times as many consumers shopping for groceries online compared to early March. In a study PYMNTS fielded in mid-July, roughly 20 percent of U.S. consumers reported shopping for groceries online, while fewer than 4 percent did in March.

More than 15 percent of those consumers say that most or some of those digital habits will stick, a number that continues to increase each time we go back into the field.

As the virus remains a health and safety threat for consumers, two-thirds of U.S. consumers still fear spending time in a physical store, even while wearing a mask and despite stores’ precautions to keep stores safe and maintain social distancing. The average consumer used to spend about 43 minutes shopping in the grocery store — but that was before the pandemic. Adhering to social distancing makes that time spent even longer.

It may not be that much of a leap from a consumer who already orders groceries online to a consumer who sets many of her middle-aisle purchases to auto-refill, reducing the time she spends shopping in the physical grocery store to a bare minimum — limiting it to the time she needs to buy the perishable items that she wants to personally inspect.

The Consumer On Auto-Refill

In March of 2015, Amazon introduced the world to Dash Buttons, those little branded plastic buttons that consumers could stick on their washing machines or refrigerators, in the pantry or in the garage — or wherever it made sense around the house — to order the products whose brands graced the front of those buttons whenever they needed a refill.

Initially thought of as an April Fool’s Day joke (they were released on March 31), Dash Buttons were legit. More than legit, actually. The buttons were linked to a consumer’s Amazon Prime account, and each time they were activated, the consumer’s registered card on file was charged.

Dash Buttons were the precursor to what is now Amazon’s Subscribe & Save replenishment business. Subscribe & Save allows consumers to auto-refill — at any given frequency — a growing list of branded items they buy regularly.

Many brands have followed that lead in an effort to lower their own cost of sales and fulfillment by locking a consumer into a set pattern of refills for certain products.

And we see increasing evidence that consumers are opting into auto-refill options for retail products, seemingly inspired by the pandemic-triggered desire to avoid buying these items in physical stores.

In research that PYMNTS will publish soon, done in collaboration with Recurly, we observed a surprising uptick in consumer subscription habits: Out of the national sample of the more than 2,000 American consumers we studied, 40 percent more reported activating subscriptions to consumer retail products than in January — the biggest increase of all the categories we tracked.

These aren’t “box-of-the-month” subscriptions, but auto-replenishment options for products that consumers buy regularly.

One theory is that brands are offering auto-refill options for more of the essential consumer retail products — and that appears to be true.

Health and beauty brands offer a variety of products on auto-refill and via a variety of channels — their own, and others.

So do pet product brands. Packaged Facts reports that 27 percent of pet products will be purchased via online channels this year and that in 2024, online will be the preferred channel. Having pet food on auto-refill ensures that Fido never goes without, and eliminates the need for Fido’s owner to carry a 20-pound bag of dog food to the car every couple of months.

The other theory is that consumers want to reduce the time they spend shopping for the things they buy anyway and that they once purchased in the physical store. Their interest in using digital channels increases the certainty that they will get what they want, when they need it.

Innovations in tech can help brands expand the current range of set-and-forget products to a wider range of categories that consumers consider to be basic and essential, but often forget to reorder until the item has reached the end of its life or has run out.

Innovations in payments tech can remove the friction from those purchases.

And innovations in voice commerce can help propel this shift.

New PYMNTS data shows that roughly 13 percent of the U.S. population made a purchase using a voice-activated speaker over the last 90 days, an increase of 50 percent from this time last year. More than half of those purchases were for grocery items, more than a third were for clothing items and more than a quarter were for health and beauty supplies. That friendly voice assistant on the other end of that experience will seamlessly add those items to a digital shopping list at the most appropriate frequency.

For brands, set-and-forget is an opportunity to build and retain brand loyalty, regardless of where a consumer purchases those items. Not just any cereal, but Cheerios. Not just any corn chip, but Doritos. Not just any paper cup, but Hefty paper cups. Not just any laundry detergent, but Tide. Not just any T-shirt, but Hanes. Not just any face cream. but Le Mer. Not just any running shoes, but Nike Zoom Fly Flyknit.

Auto-refill may be a first step in the consumer’s journey from always buying physical to usually buying digital. Consumers are now gravitating to auto-refill because their needs are predictable — and because buying bulky items in the physical store can be a hassle.

Once they get used to this convenience, it’s easy to go down the shopping list and move more and more items to the digital basket. And even when consumers set and forget it, they’ll still be delighted when those items arrive just in the nick of time on their physical doorstep.