But close watchers will see that something new has come to Amazon’s subscription page: BarkBox, the well-known direct-to-consumer (D2C) pet products brand that offers heath treats tailored to a dog’s specific needs.

“Every box is created around a fun theme, so each month is a new adventure. BarkBox is more than just a box — it’s a celebration of you and your dog,” noted Amazon’s description of the service. A celebration that once upon a time, one could only get directly from BarkBox’s website.

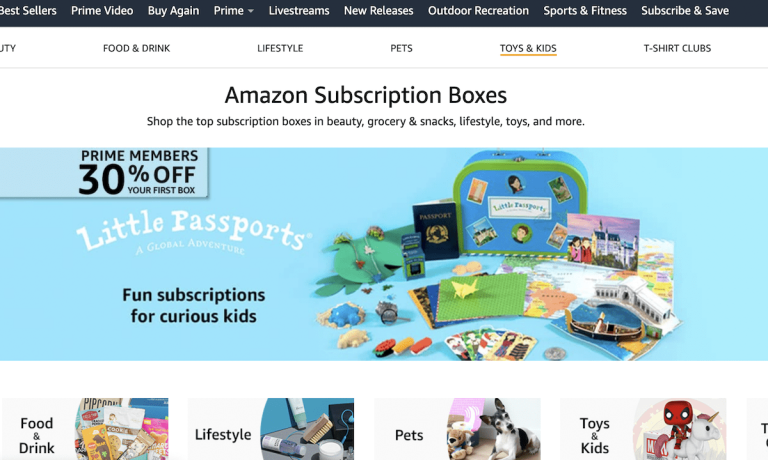

And BarkBox is not the only D2C subscription player to recently make a second home for itself on Amazon. Tea Discovery has placed its Sips by Box on Amazon, as has D2C toy brand Toy Box Monthly. The Amazon marketplace for subscriptions, in short, is beginning to look a lot like the Amazon marketplace in general — not just a place to buy Amazon goods and services, though they do have plenty of their own on offer — but a place to buy everybody’s goods and services.

Amazon’s big third-party expansion in subscription services is a sensible one by the numbers. According to PYMNTS’ most recent Subscription Commerce Tracker, consumer interest in subscription services has exploded since the start of the pandemic: VoD subscriptions, educational subscriptions and, of course, substitutions for physical goods. A recent survey revealed that one-third of American consumers have signed up for subscription apps.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

In fact, as the data in PYMNTS’ Subscription Commerce Conversion Index demonstrated, nearly three-quarters of U.S. adults — 182 million consumers — subscribed to at least one subscription service last July, up 9 percent from February 2020. And while the data demonstrate that many of these consumers signed on with subscriptions in the early days of the pandemic to balance out a specific pain point, like boredom or loneliness, their appeal extends beyond the problems they were first adopted to solve for. Nearly 50 percent of consumers who signed on for a new subscription since the pandemic began have reported that they intend to stick with it even after the pandemic has fully passed.

Advertisement: Scroll to Continue

And merchants, the data demonstrate, are modifying their offerings in response. Sixty percent reported that they have improved their sign-up processes and reduced the time it takes for subscribers to access their services.

And some, as a quick look at Amazon demonstrates, are determining that the best way to make it easier for their consumers to sign on is to put them in a place they are more likely to run into them: the Amazon marketplace, where roughly half the eCommerce action in the U.S. happens annually.

And Amazon is promoting those boxes hard, touting coming Prime Day discounts for sign-ups and other signals to make sure consumers know that whatever type of subscription they are looking for, they can find it on Amazon. Even if Amazon is not actually offering the subscription themselves, they want to be the place where consumers go to find it.

That means BarkBox may just be the beginning — and that Amazon will soon count subscriptions as its latest eCommerce product, as the internet’s “everything store” aims to be home to not only consumer goods, but also to the bespoke subscription services startups building around them.

Read More On Amazon:

Add as Preferred Source

Add as Preferred Source