Walmart+ And Amazon Prime Face Off As Consumers Decide Who Gets Their Business

“Membership has its privileges” was the nine-year ad campaign launched by American Express in 1987 to persuade consumers that it was worth it to pay an annual fee for one of its charge card products. Then, those privileges included travel, dining and hotel benefits, statement credits and spending reward points perks, along with preferred access to concert and theater tickets. As the slogan implied, being an American Express cardmember was the only way to unlock those benefits.

Today, the “membership has its privileges” mantra is at the core of the latest face-off between the two retail behemoths vying for an increasing portion of consumer spend: Walmart and Amazon.

It’s a rivalry that, according to new PYMNTS data, Walmart could intensify with its newly launched Walmart+, as it uses a new membership model to capture more of that spend — beyond grocery, the retail giant hopes.

Today, grocery accounts for 56 percent of Walmart’s net sales, as spend in key retail sectors such as home furnishings, apparel, electronics, sporting goods and toys is consistently shifting Amazon’s way.

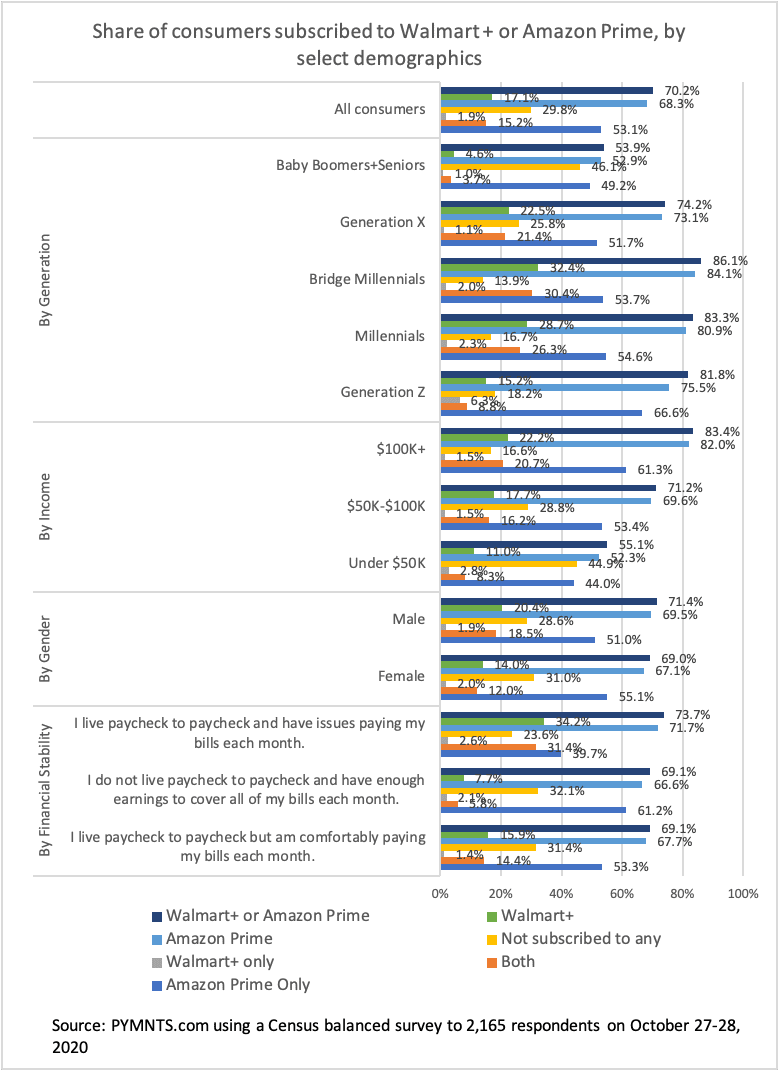

A PYMNTS study of a census-balanced sample of 2,165 consumers conducted Oct. 27-28 of this year reveals that roughly 17 percent of U.S. consumers report having a Walmart+ membership, just a bit more than a month after its launch. That compares to 68 percent of consumers who report belonging to Amazon Prime — a program that launched in February 2005 and now counts 150 million members globally. Of that 17 percent with Walmart+, 15 percent are consumers who already had an Amazon Prime account and about 2 percent of them did not.

Walmart+ will want to keep that 17 percent and build on it to close the gap. But it is remarkable adoption in such a short period.

What everyone, especially Walmart, will be watching intently over the next several months is how many Walmart+ members actually pony up the $98 to convert their free trial to a paid membership — and then how many go on to renew after year one. As the recent experience with the ill-fated streaming service Quibi shows, converting only 8 percent of free trial subscribers does not a viable business model make, even with $1.75 billion in the bank.

But these results also suggest that the U.S. consumer seems happy to test the waters — and none more so than the coveted bridge millennials. Those are the 47 million U.S. consumers between the ages of 32 and 42 — the first generation of connected consumers with spending power, who will also serve as the consumer spending pace car for the decades to come.

According to PYMNTS survey data, nearly three times as many bridge millennials are Amazon Prime members as Walmart+ members.

But three in 10 bridge millennials already report having both, just a month in.

Bridge millennials, along with millennials, are part of Amazon Prime’s most loyal customer base. They also comprise the group of consumers that Walmart needs to woo and retain. According to PYMNTS data, 159 percent more bridge millennials and 182 percent more millennials subscribe at Amazon Prime than Walmart+.

Bridge millennials also are more affluent, another category of shopper that has eluded Walmart. Eighty-two percent of consumers earning more than $100,000 subscribe with Amazon Prime; only 22 percent subscribe with Walmart+.

That makes both groups — the higher-income consumers and the bridge millennials — the ones to watch as Amazon and Walmart go head to head in their efforts to capture and keep an increasing share of their paychecks across the major drivers of consumer and retail spend.

The Prime, Plus Membership Face-off: In-store Versus Online

Wooing those consumers may come down to two things: what they want to buy and when they really need it.

Amazon’s introduction of Prime in 2005 was the shot heard across the retail landscape, simultaneously raising the bar for what consumers would come to expect from all of the retailers they shopped while emphasizing the importance of logistics in winning the consumer’s business and loyalty.

Then, the promise of free, two-day shipping on more than one million products came at a time when shipping windows were anything but reliable, speedy or predictable. That became more than just a little incentive for consumers to fork over the (then) $79 annual fee and consolidate more of their shopping and spending on Amazon. Not only did consumers get their purchases in two days, but they didn’t have to spend their time going to a physical store to buy them.

Amazon Prime became the catalyst for the consumer’s shift to digital and for the decline of physical retail.

Fifteen years later, Prime’s 150 million members globally have access to same-day, one- or two-day shipping on most of the items sold on its marketplace, and many more products and categories. That includes some 350 million products when tallying those available from third-party sellers.

Prime members in the U.S. also get same-day delivery (early days of the pandemic notwithstanding) on grocery products purchased from Whole Foods, along with access to an expanded library of streaming music and video content.

Today, the Prime annual membership fee is $119, but is lower for students, Medicaid recipients and EBT cardholders.

During Amazon’s Q3 earnings report, Chief Financial Officer Brian Olsavsky reported that, more than ever, Amazon is seeing higher membership conversion from free trials, renewals and engagement (code for dollar and frequency of spend), although he didn’t share specifics. Third parties report that the Amazon Prime renewal rate after one year is 93 percent, and for those who stick it out for two years, it’s a nearly perfect 98 percent.

Walmart+ launched on Sept. 15 with a membership bundle that seems fairly pedestrian by comparison, even though they say more goodies are coming soon.

Today, Walmart+ membership benefits include free delivery of any order over $35 for any of the 160,000 items in Walmart stores and a 5-cent discount on fuel purchases.

Walmart+, as advertised, also includes mobile Scan and Go in-store using the Walmart app — a feature that has consistently failed to excite Walmart customers over the last six years. Scan and Go was first introduced by Walmart in 2012 and shut down in 2014, was reintroduced in early 2018, and then shut down less than six months later.

Walmart+ is betting that offering fast delivery will scratch the consumer’s itch — and, specifically, the bridge millennials’ itch — to get the products they need from the store closest to them as soon as the same day, provided it is in stock.

With Prime, Amazon is betting that the choice of same-day, next-day or two-day delivery (depending on the product) is a fitting trade-off for access to a bigger selection of products across many different brands and categories.

For Walmart, it’s also a bet that for non-grocery products, all consumers — particularly bridge millennials — find that 160,000 products is a good enough assortment to choose from, provided that what they want is in stock, and that if it’s not, a suitable substitute will meet their needs.

It is a bet not without its risks when one considers that 53 percent of units sold (and therefore bought by its customers) on Amazon in Q2 were from the third-party sellers who add depth and diversity to its product mix.

And it’s a bet that going to the store is something consumers will continue to want to do. Discounts on fuel and scan-and-go features appeal to in-store shoppers at a point in time when more consumers seem to prefer ordering non-grocery products for delivery than going to — and then shopping and buying in — a physical store.

And it’s a big bet that Walmart+ can fashion a bundle that appeals to the more affluent, less financially constrained consumer. PYMNTS data on the characteristics of Walmart+ and Amazon Prime members reveals an interesting aspect of their self-reported financial persona.

More than twice as many consumers who have both Prime and Walmart+ report that they live paycheck to paycheck and have trouble paying their bills each month than those who say they live paycheck to paycheck but comfortably pay their bills each month. For consumers who only subscribe to Walmart+, 85 percent more consumers report that they live paycheck to paycheck and struggle compared to those who say they can pay their bills comfortably. Twenty-five percent fewer Amazon Prime-only customers report the same.

Capturing The Share Of The Consumer’s Whole Paycheck

PYMNTS began tracking the share of consumer and retail spend for Amazon and Walmart two years ago using data compiled from a variety of third-party and proprietary sources. We dubbed the study “Whole Paycheck” — not literally, of course, but as a nod to the categories of consumer spend that Amazon and Walmart had targeted as they broadened their reach beyond the traditional retail spending categories.

For example, although it’s a teeny-weeny portion of real estate overall, one can buy a modular house on Amazon. That’s like the days of the Sears catalog and its sale of prefabricated homes, 70,000 of which were sold between 1908 and 1940 for between $600 and $6,000. And a variety of She Sheds, the hottest and trendiest work-from-home, pandemic-inspired purchase, can also be purchased on Amazon today.

The acquisition of PillPack put Amazon in the online pharmaceutical business, and its addition of product insurance and extended warranties put it into the insurance business. In 2018, Amazon was reportedly in talks with regulators to launch an insurance comparison website.

Amazon now has Amazon Care, a mobile app that connects eligible company employees in the firm’s home state of Washington with healthcare providers by video, text and in some cases in person. Amazon is also one of the three “anchor tenants” of Haven, the healthcare platform that JPMC, Berkshire Hathaway and Amazon all invested in as a way to reimagine healthcare for its employees. One doesn’t have to think too hard to imagine that Haven — or some facsimile of it — could become the baseline for a new healthcare delivery and payments model at some future point.

More than one-third — 56 million — Prime members stream video and music content via Amazon. Amazon reports that more than 40 million videos are accessible to viewers in the U.S., and more than 70 million worldwide. Walmart sold its interest in streaming platform Vudu in April, and currently has no streaming services in its Walmart+ bundle.

At the same time that Amazon has been investing in online capabilities and logistics, Walmart has been investing in making its physical footprint more multifaceted, giving more consumers more of a reason to step inside.

Walmart has expanded its healthcare capabilities in its stores over the last several years, more recently opening healthcare supercenters that provide comprehensive health, dental and vision care services to consumers. It’s a model that many in the healthcare space consider a real threat to the classic insurance and care delivery model. Walmart was also an early innovator in incentive programs to boost adherence to doctors’ visits and healthcare protocols for Medicaid patients.

Walmart also reportedly spent $200 million to buy CareZone, a tech platform that helps consumers manage and pay for their prescriptions online.

Their big moat, of course, is grocery, where Walmart stands as the country’s largest grocer, but also where rivals, including Amazon and others, have been chipping away at that share, given the pandemic’s impact on how consumers want to use physical stores to shop for anything.

Consumers who are fearful about shopping in grocery stores due to coronavirus concerns have taken to other outlets to get what they need — and have driven an unprecedented spike in the share of online grocery sales.

The latest PYMNTS data, collected at the end of September across a census-balanced sample of more than 32,000 U.S. consumers, shows that 17.2 percent of them now shop for groceries online, which is 13.3 percent more than those who reported shopping online in March of 2020. More than 64 percent of those consumers cited concerns over contracting COVID in those stores as the reasons for wanting to stay away; a full 86.6 percent of them say that some or all of those digital-first grocery habits will stick once the pandemic is in the rearview.

Amazon has been a big beneficiary of that digital shift, but so have other grocery chains where consumers now find it more convenient to shop online using services like Instacart’s — a platform that Walmart is now pilot-testing in Southern California.

Kroger and Target have also stepped up their own investments in logistics to meet the consumer’s desire for order-ahead and delivery.

And where Walmart, with Walmart+, wants to shore up a share of spend that has been flat for many years, and that now seems at risk of being the retail reinforcement that it has been for many years.

Fighting For Share

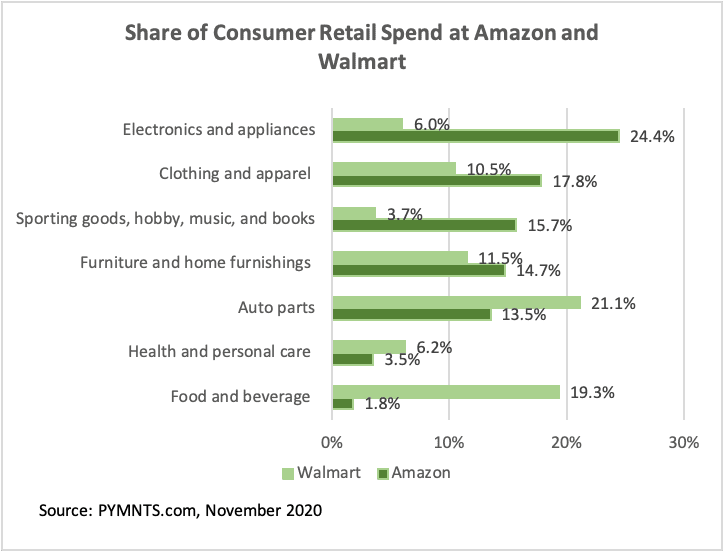

By the numbers, retail takes a little less than a third (30.8 percent) of the U.S. consumer’s paycheck and drives 70 percent of GDP. Eight percent of that goes to food and beverage; another 5 percent goes to health and personal care. The rest — some 18 percent of consumer spend — is accounted for in the individual retail product categories where consumers have grown much more comfortable making purchases online: home furnishings, electronics, apparel and sporting goods. All categories where Amazon is consistently outpacing Walmart in its share of consumer spend.

Taking Q2 numbers as the benchmarks for now (we won’t have Walmart’s Q3 until it reports earnings on Nov. 17), we see a story of a consumer at the end of June whose default seemed tilted in Amazon’s favor.

Take sporting goods.

In Q2, Walmart sales in the category were largely flat (from $3.4 billion in Q1 2020 to $3.6 in Q2). By contrast, Amazon added almost $2 billion in sporting goods sales, from $16.5 billion in Q1 to $19.4 in Q2. Product selection across a diversity of price points seemed to be the reason, appealing to the bridge millennials and affluent consumers who want more choice and are willing to pay more to get it.

Amazon’s share of spend in sporting goods in Q2 was four times that of Walmart’s — in a category that many might characterize as the most essential non-essential product category of the pandemic.

Then there is the electronics and appliance category, where Amazon’s share of spend increased from 22.6 percent in Q1 to 24.4 percent in Q2 — and where Walmart dropped from 6.2 percent to 6.0 percent in Q2.

Same story.

Take home furnishings, where Amazon caught up to Walmart on total spend percentage in 2019 and continues to pull ahead. In Q2, Amazon accounted for 14.7 percent of consumer spend, compared to Walmart’s roughly 12 percent. But like sporting goods, Amazon continues to pull more dollars in home furnishings: $9.3 billion for Q2 compared to $7.3 billion for Walmart, in a category where Walmart’s physical store footprint should have provided an advantage — especially when, as an essential store, its doors remained open.

In Q2, Walmart’s biggest percentage sales growth outside of grocery came in apparel, where it added more than $5 billion to its Q1 tally and took 10.5 percent of spend. But Amazon still outperformed in this category on a total spend basis, going from $13.7 billion in Q1 to $16.2 billion in Q2 for 17.8 percent of total consumer spend. Apparel is an area where both Walmart and Amazon have been increasing their focus — including Amazon’s recent launch of its Luxury Stores and Walmart’s partnership with ThredUp, which brings reCommerce into the mix for its online shoppers.

In a category where PYMNTS data show that consumers are now shifting more of their spend.

The Bottom Line: The Consumer’s Whole Paycheck

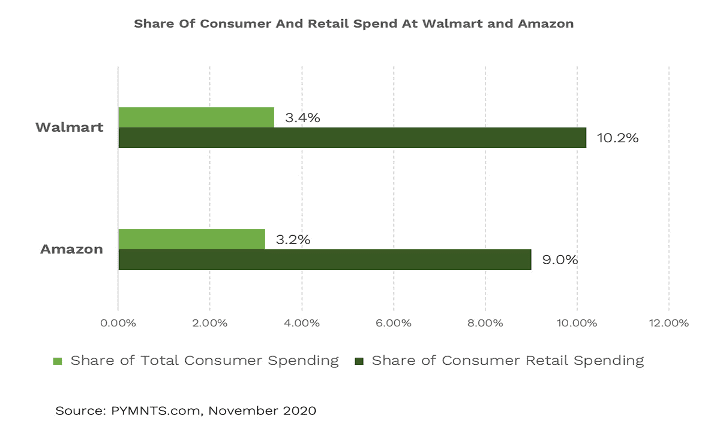

Here, though, is the picture that speaks a thousand words: the share of consumer and retail spend that is Amazon’s, and that which is Walmart’s.

It’s the proverbial horse race.

What this picture doesn’t reflect, but which the full data set does show, is Amazon’s momentum in the key retail categories that drive spend. What you see in this chart is puts and takes between two retail giants.

What you don’t see is how Walmart’s share has remained flat or declined as Amazon’s share has grown.

As PYMNTS data show, Walmart+ is an opportunity for Walmart to secure the loyalty of the shoppers it now has, and to also bring new, younger, higher-spending shoppers onto its turf.

Time will tell whether Walmart+ goes beyond locking its current consumers into a model with more predictability of their loyalty and spend.

Doing that will likely require more than just piling on more features. Grocery may be Walmart’s moat, but Amazon’s might be Subscribe and Save — eliminating the need to buy household staples and health and beauty items — shifting the buying experience to simply the paying and putting away experience.

The success of Walmart+ will also require Walmart to recognize that the store model as it was in January of 2020 is no longer the experience consumers want — and tens of millions of them have shifted to digital channels and to providers that give them what they want and need.

And reverse inertia — the undoing of the digital habits they’ve taken the time to establish and use, and have grown to like — will likely be a battle very hard-fought.