Will 2023 Be the Reset Year D2C Subscription Brands Need?

Direct-to-consumer (D2C) subscription brands felt the sting of inflation in 2022, a beatdown that has set up a sector reset in 2023.

According to the November “Subscription Commerce Conversion Index: Subscribers Seek Affordability and Convenience,” a PYMNTS and sticky.io collaboration, merchant performance, as measured by the Subscription Commerce Conversion Index, stalled after merchants reduced discounts and free shipping offers in September.

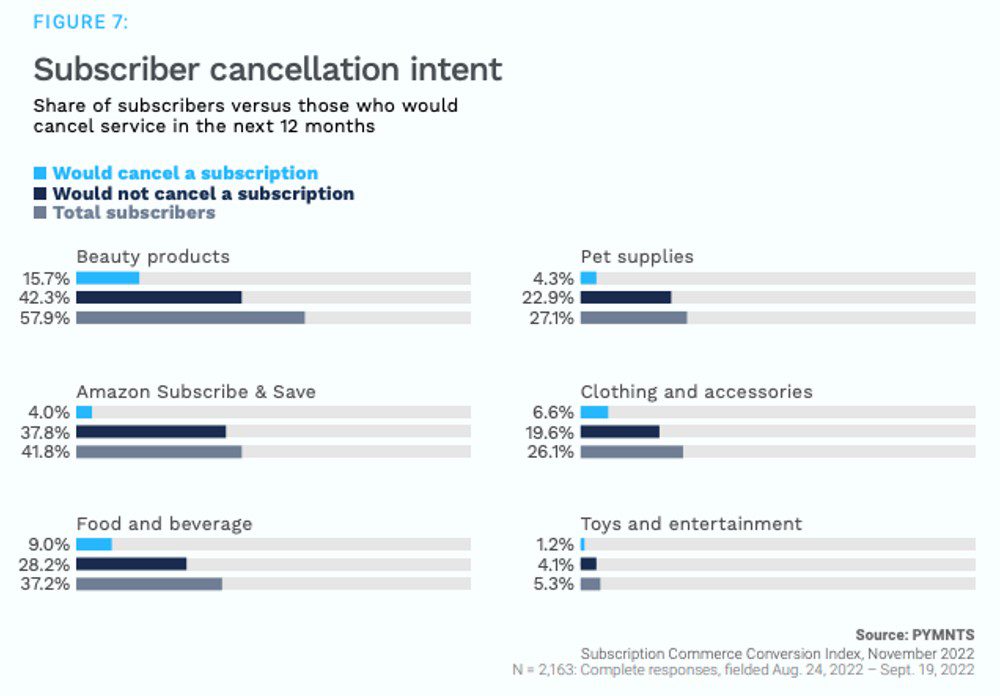

The report found that eight out of nine D2C categories fell in the latest survey, as consumers reconsidered the value and necessity of the many retail and entertainment subscriptions they had amassed during the pandemic boom.

“Fifty-three percent of consumers paying for a streaming subscription and 48% of those paying for a membership would cancel the service if unable to pay other essential bills,” the study reported, with the key determinant of what constituted a valuable subscription often tied to “its ability to fulfill its original purpose as consumers consider their options.”

In the summer, sticky.io CEO Brian Bogosian took the consumers’ position during what some called “the great unsubscribe” of 2022, posing the question to PYMNTS Karen Webster: “How does the normal working family survive, commuting kids to school, paying the bills, the mortgage, and getting food? It puts the highlight on subscriptions. I think merchants will experience churn of consumers if they’re not thinking about ways they can deliver more value along with the convenience.”

While retail subscriptions of nearly every variety saw elevated intentional consumer churn, some categories deemed essential by consumers showed resilience.

Streaming entertainment led that parade, even as mighty Netflix strained under subscriber losses early in the year. Despite that, streaming services like Apple Music and Apple TV+ raised prices, as did Disney+ in the latter’s quest to achieve profitability by 2024.

In the new PYMNTS eBook, “What’s Your Plan? Payments Strategies for a Strong 2022 Finish” Vindicia Chief Strategy Officer Trace Galloway addressed involuntary churn.

“Failed payments are not only a revenue problem but also a branding problem,” he said. “Customer experience is at the core of brand loyalty. Imagine suddenly getting disconnected from YouTube Live because of a single, accidental failed payment and being unable to watch NBA star Stephen Curry make his famous three-pointer in real time. Customers who want hassle-free subscriptions don’t want to think about payments, especially failed ones that cause disconnection and headaches.”

That sentiment was echoed and amplified by sticky.io Senior Product Manager and Integration Specialist Logan Hug, who told PYMNTS that “there are a couple of critical features within your subscription platform that I would highly recommend using. One would be account updater services. Account updater automatically updates subscriber credit card information in between billing cycles.”

He also recommended dunning.

“What I would recommend is a machine learning version of dunning because this can be very complicated,” he said. “If you do not have any form of dunning on a subscription when a decline occurs, you’re effectively canceling the subscription.”

Churn was a recurring theme — no pun intended — as the November Subscription Commerce Tracker®, a PYMNTS and Vindicia collaboration, noted that bundling is a core strategy, and nodded to the rise of ad-supported tiers, which is effective when experience is baked in.

Mass merchants are also big on belonging, which we explored in the PYMNTS study “The Benefits of Membership: Mass Retailers and Subscription.”

“PYMNTS’ findings make it clear that most American consumers value shopping memberships, and several services are leading the pack,” the study found. “Approximately 64% of the adult U.S. population, an estimated 166 million Americans, are subscribed to Amazon Prime. Meanwhile, 28% of the adult population — representing 73 million Americans — have Costco memberships, and a projected 69 million, or 27%, hold Sam’s Club memberships.”