Subscription Shortcomings Could Take Bite Out of Apple’s Ambitions

The devil, they say, is in the details.

And the details, as outlined in the latest Subscription Commerce Conversion report, offer up data that may bedevil Apple’s efforts to cement subscriptions fully in the connected ecosystem it seeks to build.

We noted earlier this month, around the time of Apple’s “Far Out” event that services continue to be in focus amid slowing revenue growth. The company’s services operations, which include subscriptions, was up 12%, while overall firm revenue gains slowed to 2%.

There are now 860 million paid subscriptions in place, up more than 160 million across the last 12 months. We’re seeing some evidence, too, that new hardware (via the iPhone and fitness watch) may be a way to connect healthcare and other data in ways that bring commerce and subscriptions more fully to the forefront.

And yet.

The latest collaboration between PYMNTS and sticky.io, surveying more than 2,000 consumers, found subscribers are trimming expenses in many cases. To that end, we noted that the share of consumers who don’t subscribe to any service in July rose by 19% from May. Further, the data shows that streaming services lose 10% of their subscriber base on average — the biggest decline out of all the types of subscription services tracked by PYMNTS and sticky.io.

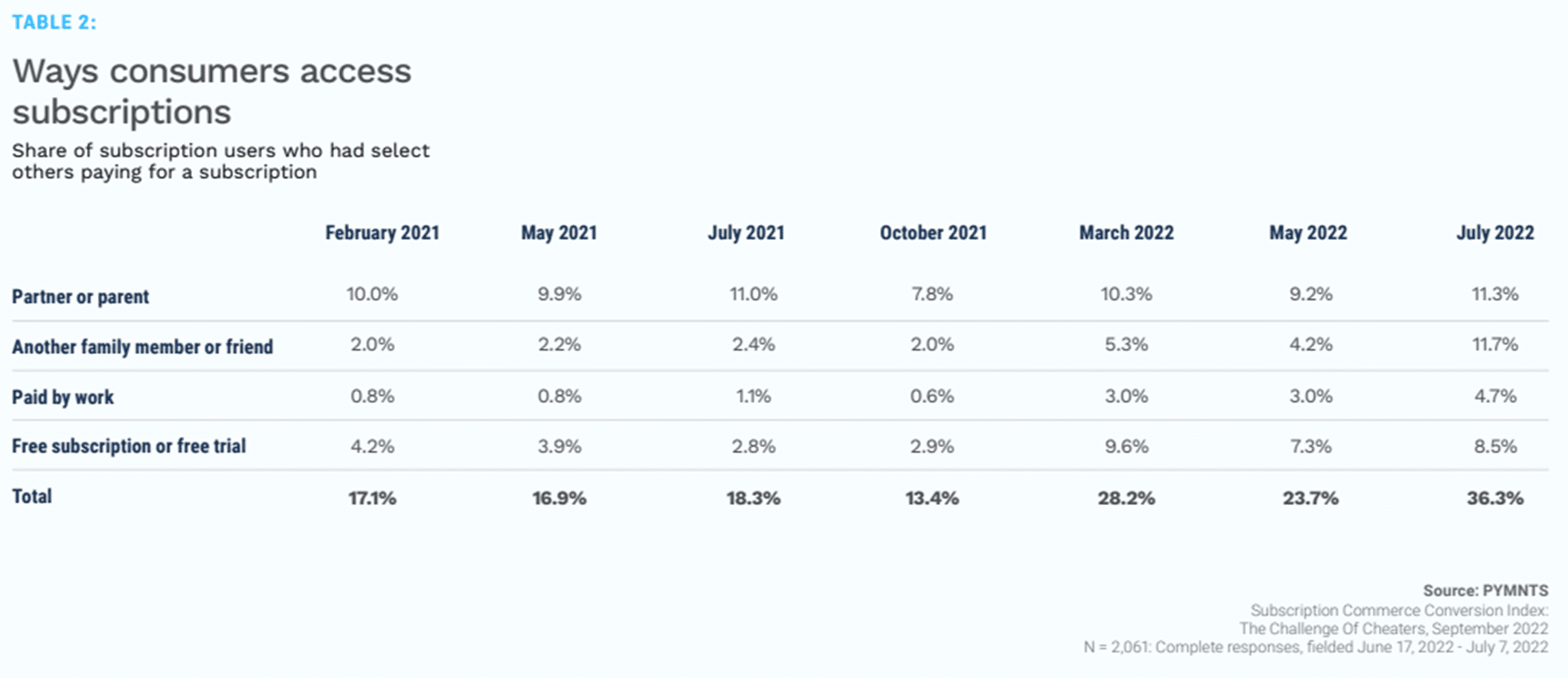

There’s another data point that signals that turbulence might lie ahead: Most Generation Z subscribers and those living paycheck to paycheck who have issues paying their bills have others pay their subscription fees: 51% and 61% of these groups rely on other people to pay those bills.

In a rocky macroeconomic climate, those “subscription lifelines” (our term) may be severed. As families and individuals pull back on what they deem to be nonessential expenses, they may well come to the conclusion that paying for others’ expenses remains — well — non-essential.

More food for thought: 60% percent of subscribers say they at least occasionally “cheat” their subscription service providers — cycling between email addresses to keep taking advantage of free trials, for instance, or exploiting other promotional loopholes. Any subscription provider is going to have to be vigilant about its efforts to stem such activities and those individuals who are caught trying to game the system will naturally “churn” out of that subscription ecosystem.

Building an ecosystem takes time and Apple’s continued shift to build on hardware to gain traction in services will proceed apace across the years and various economic shocks. The subscription part of it all will be critical and volatile.