Retail Merchants Focus on Loyal Subscribers to Shore Up Sales

In the last two years, due to persistent inflation and consumers returning to normal life, retail product subscriptions have steadily decreased from pandemic boom times to reach levels equivalent to 2019. This sharp correction in demand is common across all retail categories. To combat cancellations, companies are focusing on enhancing the quality of customer services, offering enhanced features and putting technology in place. Merchants are now investing more in tools, systems and retention initiatives to better understand consumer behaviors and make more intelligent business decisions.

Downturn Trend

Most retail subscription products saw subscriber declines in the last year across all demographics and subscription modalities. According to PYMNTS Intelligence data, consumers holds 2.2 retail product subscriptions on average, the lowest level recorded in two years. The share of consumers holding subscriptions of this kind has dropped by 10% this year. The pronounced drop in sales has led some retailers to adopt more aggressive strategies, including price discounts and free shipping, and also offer differentiated service to regain customers and attract those with the highest lifetime values (LTV).

Customer Churn

The primary reason for canceling a subscription is cost, as cited by 6 out of 10 respondents who canceled. Surveys demonstrate that discontinuing certain benefits in loyalty programs, such as free shipping or the availability of different payment choices, damages the customer experience and directly translates into subscription cancellations. For instance, PYMNTS Intelligence research found that 17% of subscribers would terminate their subscriptions if the merchant couldn’t refund an unsatisfactory item.

Furthermore, subscribers want a smooth shopping experience. Per a PYMNTS Intelligence study, 27% of users are likely to cancel their subscriptions if they experience any service interruption due to failed payments. Subscription companies see an average decrease of 9% in revenue due to this factor, and this effect can be even stronger when failed payments impact the most profitable customer groups. In 4 out of 5 cases, payment failures are due to system frictions and not attributed to customers. Solving technicalities such as false declines or issues with the payment processing software can help merchants retain customers.

Loyalty

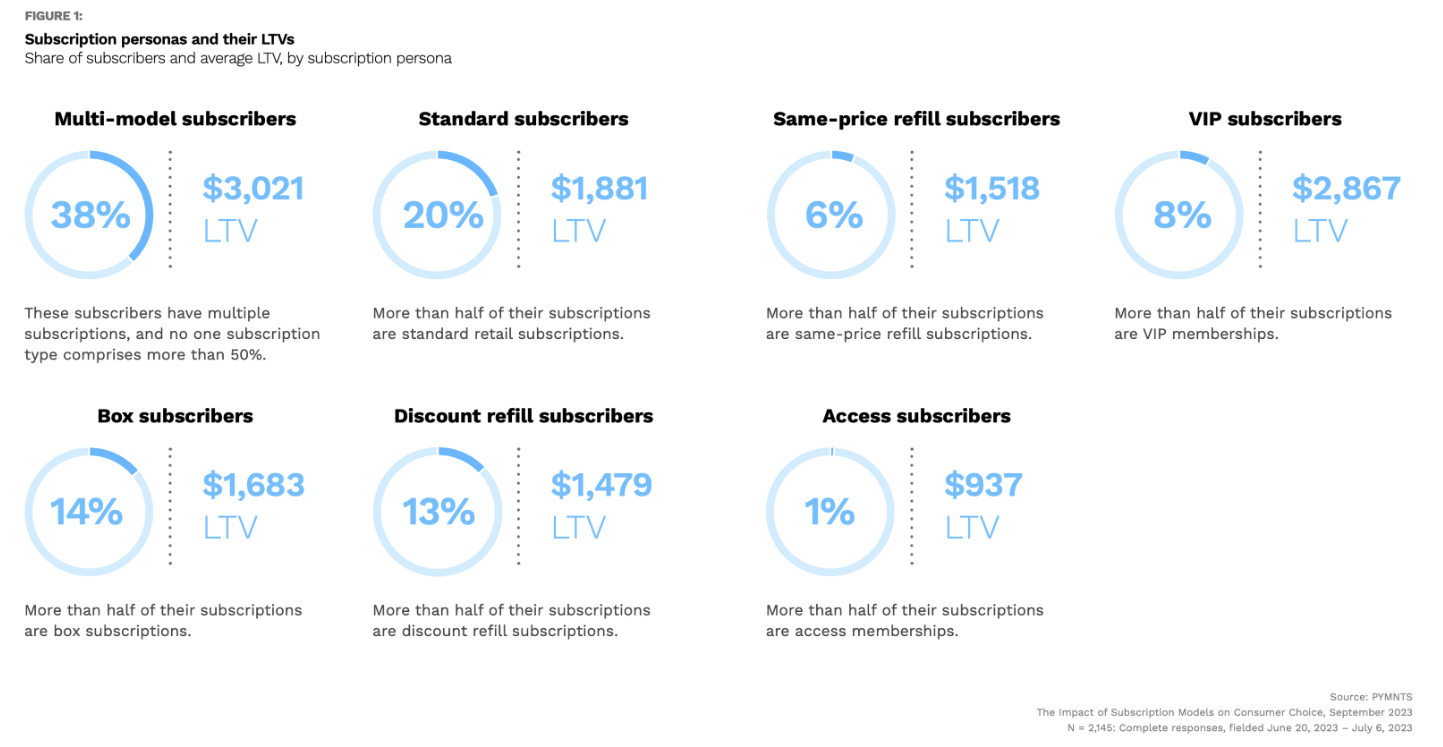

Findings in a study done jointly by PYMNTS and sticky.io show that loyal customers comprise 30% of consumers and are the cornerstone of retail subscription commerce, concentrating 80% of the market revenue. Loyalists have high LTV, spending an average of $65 per month on their subscriptions and maintaining them for an average of 30 months, resulting in a projected LTV of over $2,500.

The research also reveals that nearly half of the group of loyalists is predominantly multi-model, meaning that they have multiple subscriptions with no single category comprising a majority. This group has an LTV that exceeds $3,000.

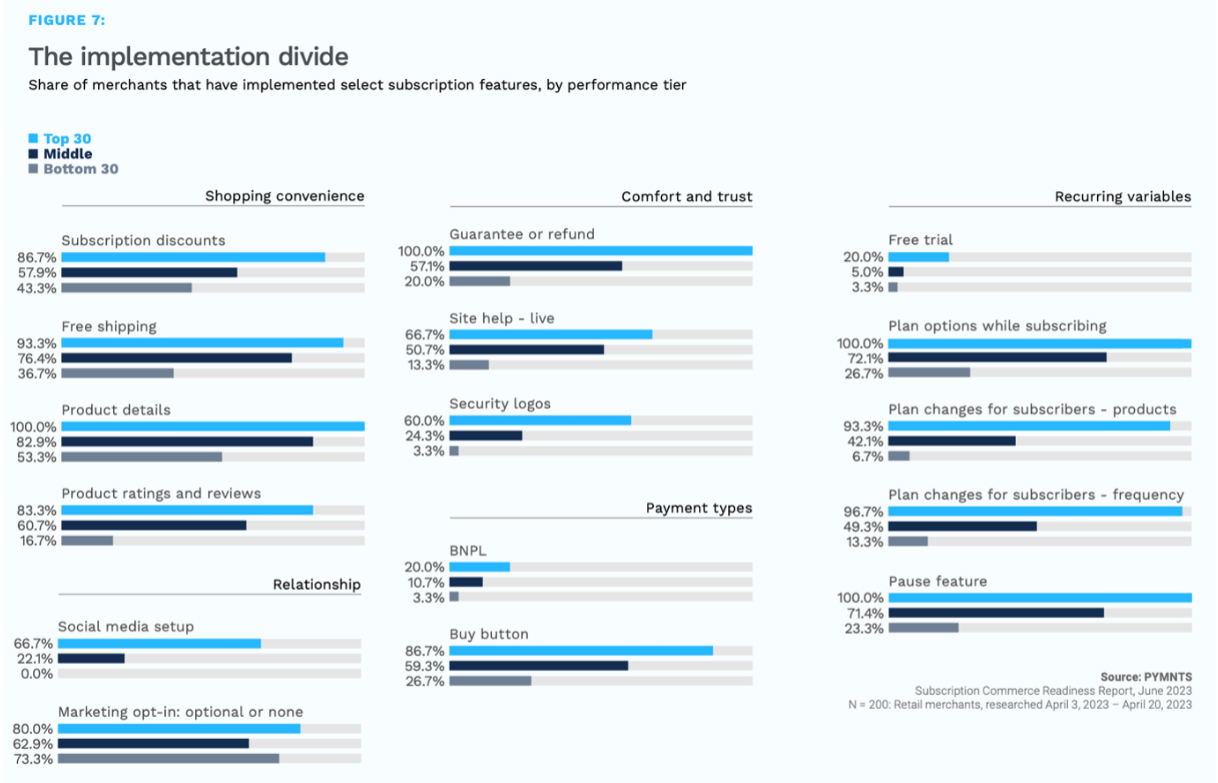

Behind multi-model subscribers, the second most lucrative retail subscription customers are VIP subscribers attracted to special membership tiers. Although they comprise fewer than 1 in 10 subscribers, VIPs represent an exceptionally high average LTV, over $2,800. The top three features that loyalists value the most are guarantees or refunds, the ability to change product selections and the ability to pause services. Moreover, sticking to familiar models is prevalent across other subscription persona.

Enhanced Features

In addition to promotion initiatives and efforts to reduce payment friction, merchants have launched new service modalities to stimulate demand. For example, Amazon is testing a new feature on its app — “Buy Again” — designed to regularly repeat purchases. Other merchants have directed their efforts toward offering greater flexibility to their customers by providing refund guarantees or allowing subscribers to modify their shipping frequency. By contrast, other initiatives focus on enhancing consumer experience and implementing key features impacting conversion and retention rates, such as placing orders through social media. Investing in these features and maintaining consistently good performance in most of them help merchants in customer retention among all reviewed sectors, with a 68% rate, per another market research study.

Some other strategies, however, need to be more utilized, such as offering more free trials or buy now, pay later (BNPL) options to facilitate customer payments. One in 10 consumers plans to cancel their current subscription program when it expires. For customers who are still deciding whether to continue, having more payment flexibility and an enhanced product experience can help persuade them to stay.

The high levels of retail subscriptions recorded during the pandemic appear to be behind us. Today, consumers are demanding improved services, a seamless shopping experience and greater flexibility in their subscription programs. To attract and retain these new customers, merchants will need to take these evolving preferences into account and focus on providing essential features that matter most to customers. This new context reflects a shift from the pre-pandemic “growth at all costs” era, where retention was not given as much importance, to a new one that requires a more customer-centric approach from merchants.