Walmart’s Vizio Acquisition Could Bring Revenue, Subscribers if It Tracks Data

This week Walmart announced it is buying TV manufacturer Vizio for $2.3 billion.

Walmart (and its affiliate, Sam’s Club) have been selling the Vizio brand for years. This latest move appears to be less about hawking flat screens and more about enabling Walmart to sell ads through the streaming services featured on Vizio products.

“This accelerates Walmart’s advertising as it moves into streaming TV opportunities,” one media analyst told CNN.

But that’s only part of the story. The acquisition could also fortify Walmart+, the retail giant’s subscription service, which was launched in 2020 to compete with Amazon Prime and other subscription heavyweights. Among the benefits Walmart+ offers subscribers is access to video streamer Paramount+. In other words, the recent acquisition may offer Walmart two avenues to gather revenue and data from consumers, through Vizio products and Paramount+.

If one of Walmart’s goals is to boost its subscription business, then Walmart — and every other subscription provider in the market — would be wise to track the metrics that top-performing subscription services use.

According to the findings in “The State Of Subscription Business: Best Practices And Business Performance Drivers,” a study conducted by PYMNTS Intelligence, most subscription-focused organizations are ignoring important data when measuring subscription satisfaction.

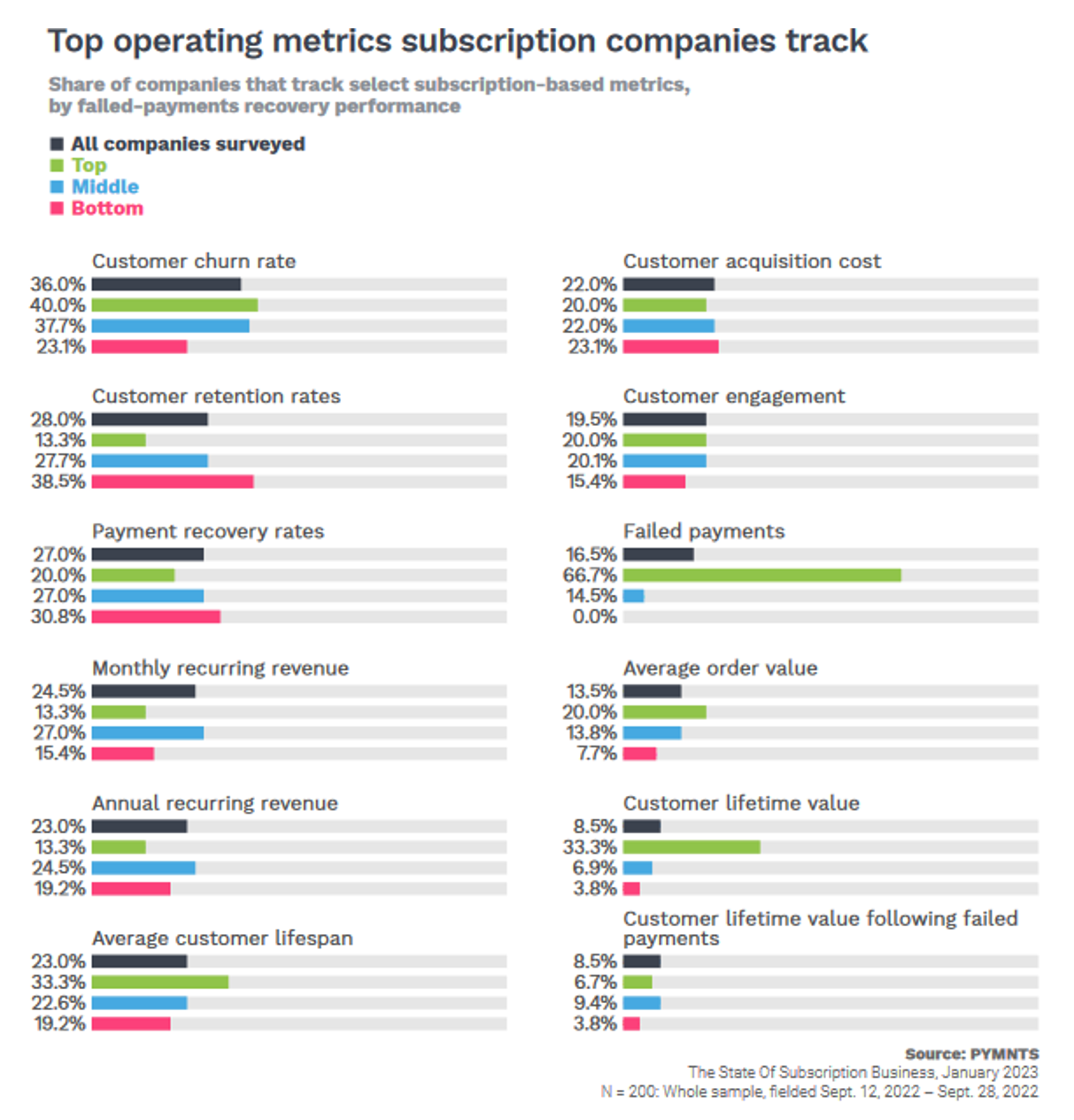

The study surveyed 200 top decision-makers at organizations where at least 40% of revenue derives from subscription relationships. The study found most companies focus on outcome-based metrics rather than underlying drivers of business performance. Namely, 58% of respondents said, to gauge success, they primarily track either customer churn (36%), customer retention (28%) or both.

There is no denying that those are important metrics, but when the study zeroed in on which metrics top-performing subscription companies — those that most successfully mitigated revenue losses due to customer churn — it found that top-performers tracked, on average, three metrics, rather than the two metrics favored by their bottom-performing counterparts.

The three metrics top performing companies track are failed payments (67%), customer churn (40%) and customer lifetime value (LTV) (33%).

“Customer churn,” or subscriber loss, is tracked by both top- and bottom-performing companies. And while 67% of all respondents acknowledge failed payments are important, only 27% connect the dots between failed payments and customer churn.

As the report makes clear: failed payments are, in fact, an involuntary form of churn, accounting for approximately half of all subscriber loss. Yet only 53% of subscription companies track “involuntary churn.” This is even more surprising in light of the fact that failed payments account for 9% of all subscription losses, or about $278 billion annually.

Meanwhile, the top performers surveyed in the report say not only do they track failed payments, but they make every effort to recover those disenchanted subscribers, boasting a success rate of 60%.

An even smaller percentage of respondents — 8.5% — say they track customer LTV, which again might be a surprise since, as the study notes, “customer LTV … plays an especially critical role in the profitability and growth of firms offering subscription-based products and services.”

Yes, less than 9% of subscription companies measure LTV, but the study concluded those companies that track and optimize customer LTV are five times more likely to be top performers. That’s because top-performing respondents say they leverage the LTV findings and use the data to retain customers before they become ex-subscribers. In the case of Walmart, it could track and optimize customer LTV to better understand not only subscription preferences, but retail preferences as well.

As the report concludes: “There is no industry standard for how to define and track it, [but] … LTV matters for all companies … [and] plays an especially critical role in the profitability and growth of firms offering subscription-based products and services.”

Of course, maximizing its subscriber base may be only of several outcomes Walmart is hoping to realize with its Vizio purchase. As has been widely reported, smart TV manufacturers like Vizio not only benefit when they sell products, they also benefit from “post-purchase monetization,” where they generate revenue by sharing data about viewer preferences and practices.