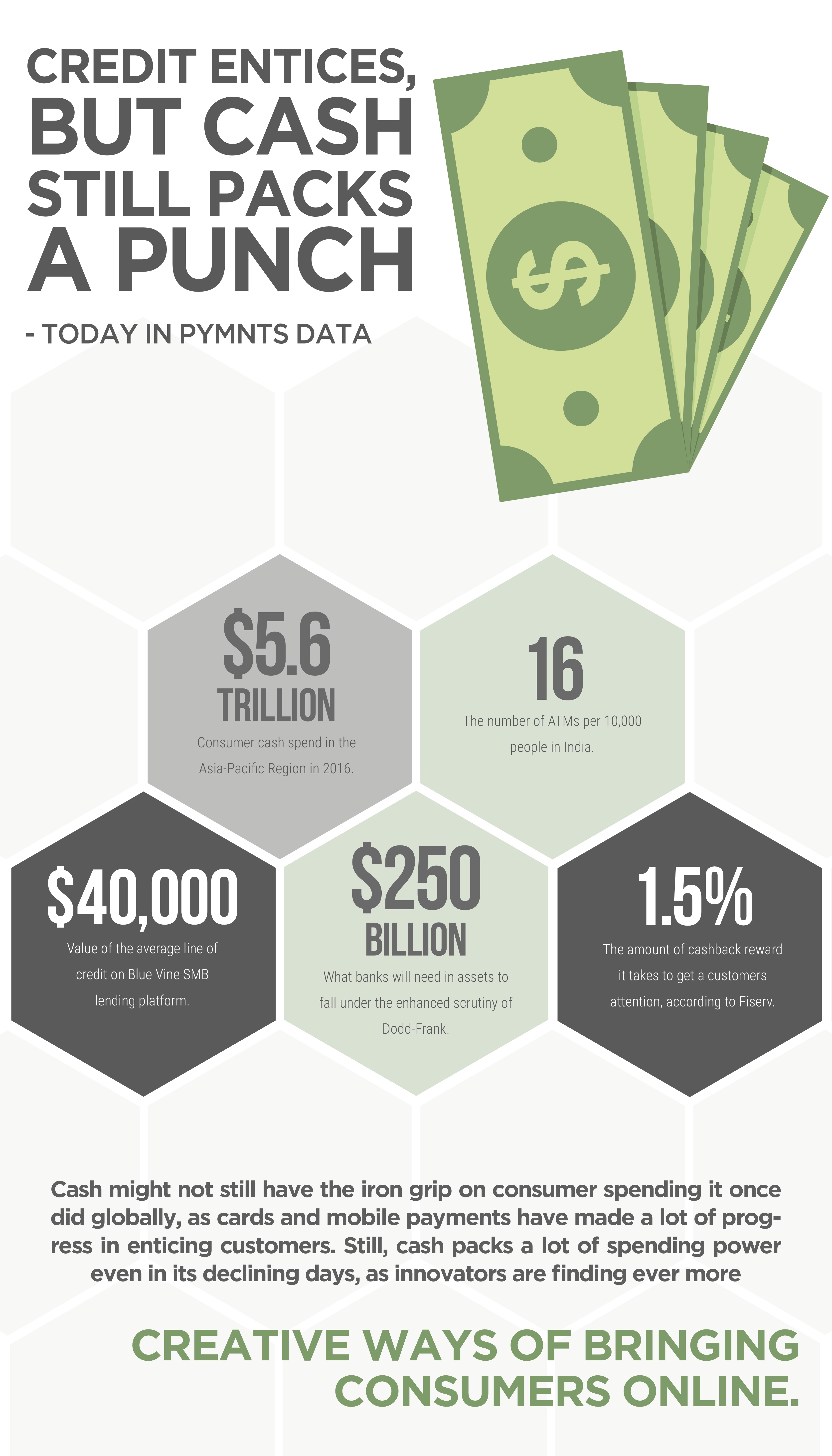

Credit Entices, But Cash Still Packs A Punch

It may no longer be the case that cash is king on a global stage but, in some markets (particularly developing markets, like India), it’s still doing quite well — as consumers are spending trillions of dollars’ worth of it a year. Digital is making inroads but, as Fiserv noted, if brands (particularly credit card brands) want to move consumers out of the cash and even debit orbit, they need to start thinking outside the box when it comes to rewards. And, according to ICBA, they also need to start thinking more about the consumers’ evolving needs. It’s not easy, but, as BlueVine noted, it is a market that is evolving toward digital services and online providers, which is a significant leg up in the global push to digitize financial services.

$5.6 trillion: Consumer cash spend in the Asia-Pacific Region in 2016.

16: The number of ATMs per 10,000 people in India.

$40,000: Value of the average line of credit on the BlueVine SMB lending platform.

$250 billion: What banks will need in assets to fall under the enhanced scrutiny of Dodd-Frank.

1.5 percent: The amount of cashback reward it takes to get a customer’s attention, according to Fiserv.