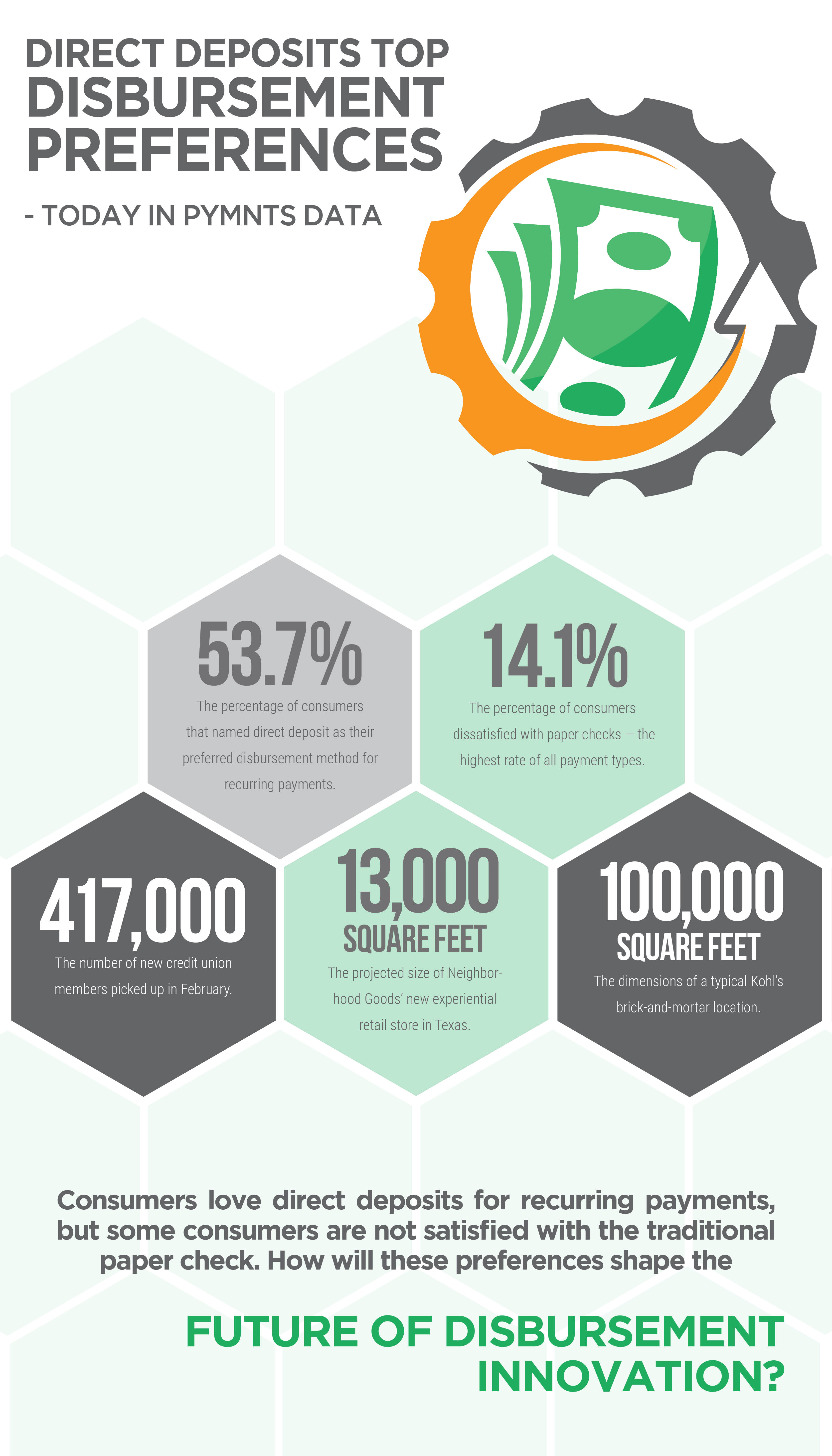

Direct Deposits Top Disbursement Preferences

Consumers love direct deposits for recurring payments, but some consumers are not satisfied with the traditional paper check. How will these preferences shape the future of disbursement innovation?

Consumers love direct deposits when it comes to recurring disbursements, but they aren’t always satisfied with paper checks. When it comes to banking, credit unions notched new members in February. And new experiential retailers are experimenting with smaller footprints than those of traditional department stores.

14.1 percent: The percentage of consumers dissatisfied with paper checks — the highest rate of all payment types.

53.7 percent: The percentage of consumers that named direct deposit as their preferred disbursement method for recurring payments.

417,000: The number of new credit union members picked up in February.

100,000 square feet: The dimensions of a typical Kohl’s brick-and-mortar location.

13,000 square feet: The projected size of Neighborhood Goods’ new experiential retail store in Texas.