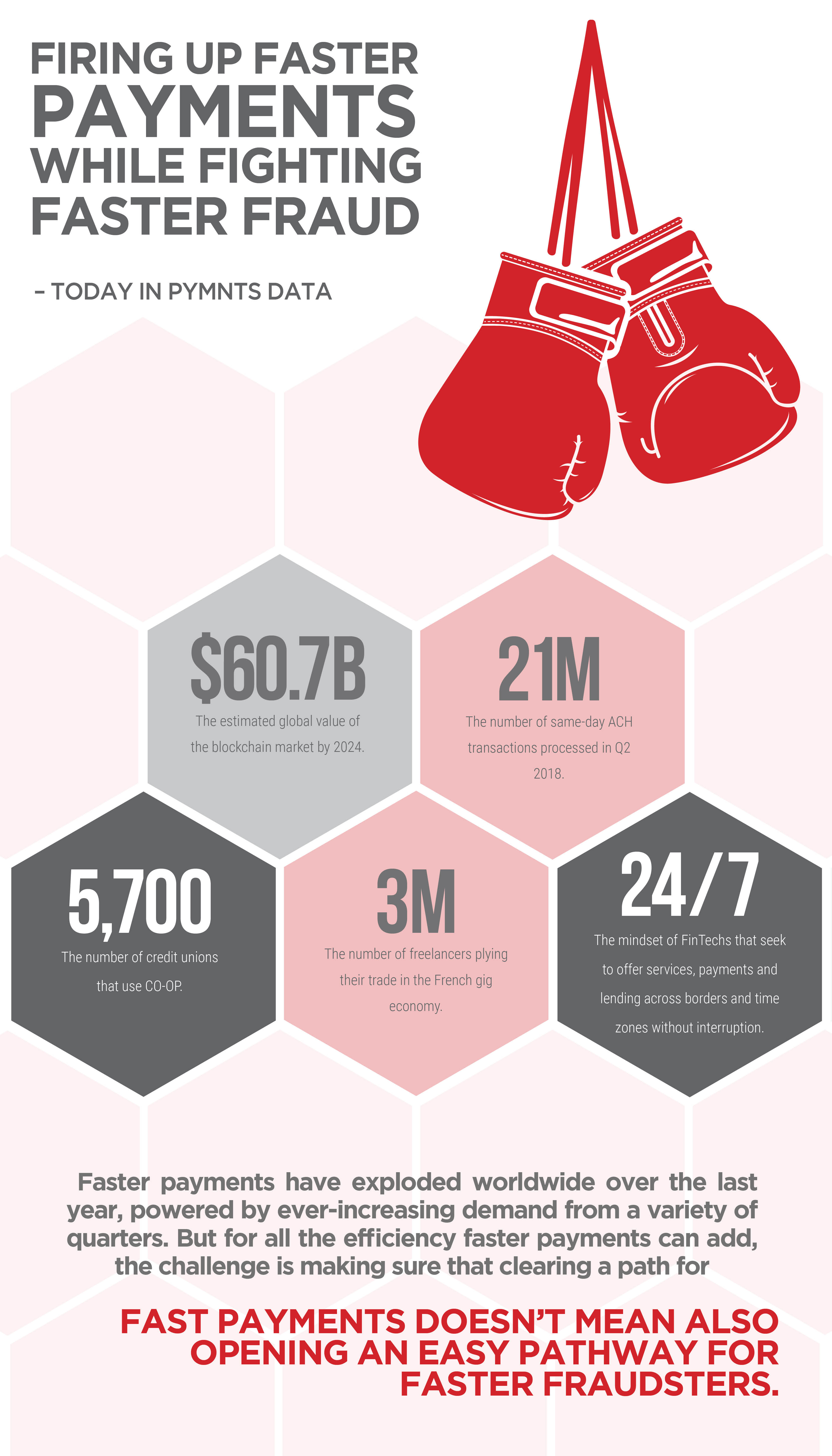

Today In Data: Firing Up Faster Payments While Fighting Faster Fraud

Faster payments pack a lot of potential – technologically speaking and in terms of usefulness. And they are clearly providing for a need wanted for filling, attested by the explosive growth they’ve demonstrated worldwide over the last few years. The opportunities are wide-ranging – for financial institutions, for workers and for merchants, all of whom can do more when they have quicker access to their cash. But with the power of faster payments comes the potential for faster fraud. Which means keeping pace isn’t just about speeding up the payments, but also about staying ahead of the fraudster.

Data:

$60.7 billion: The estimated global value of the blockchain market by 2024.

21 million: The number of same-day ACH transactions processed in Q2 2018.

5,700: The number of credit unions that use CO-OP.

3 million: The number of freelancers plying their trade in the French gig economy.

24/7: The mindset of FinTechs that seek to offer services, payments and lending across borders and time zones without interruption.