It’s A Small (Connected By Payments) World After All

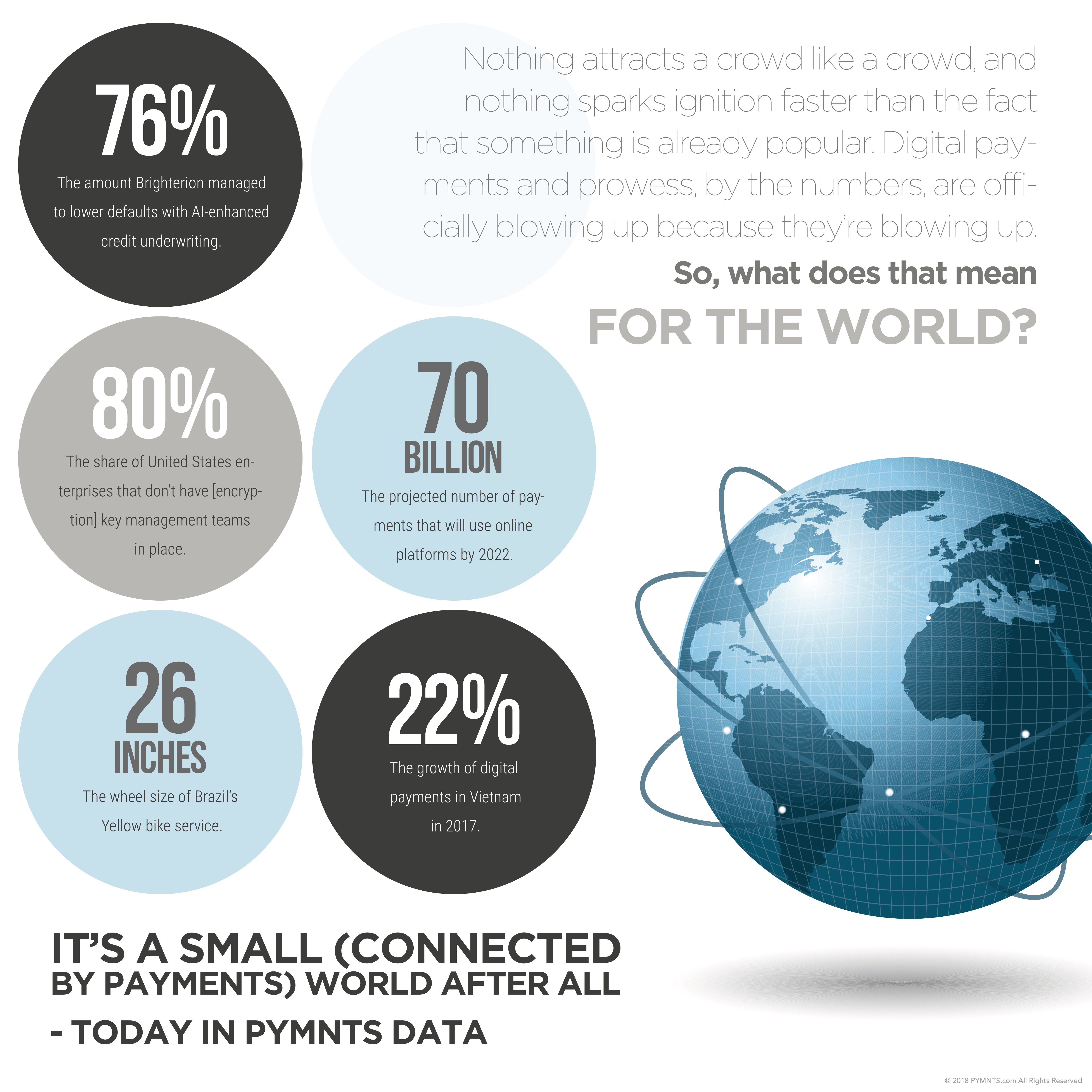

Nothing attracts a crowd like a crowd, and nothing sparks ignition faster than the fact that something is already popular. Digital payments and prowess, by the numbers, are officially blowing up because they’re blowing up. So, what does that mean for the world?

According to the latest edition of the Payments Powering Platforms tracker, in the next four or five years, consumers globally will be making nearly 70 billion payments per year via online platforms. Those payments will make all kinds of services possible in places where they’ve never been: Brazil is getting its own ridesharing platform with Yellow, while Vietnam will see its digital payment volume kick up by nearly a quarter over the next few years. But with new power comes new challenges: better credit underwriting standards, for example, or better internal management of data security and encryption keys.

The Data:

70 billion: The projected number of payments that will use online platforms by 2022.

80 percent: The share of United States enterprises that don’t have [encryption] key management teams in place.

76 percent: The amount Brighterion managed to lower defaults with AI-enhanced credit underwriting.

22 percent: The growth of digital payments in Vietnam in 2017.

26 inches: The wheel size of Brazil’s Yellow bike service.