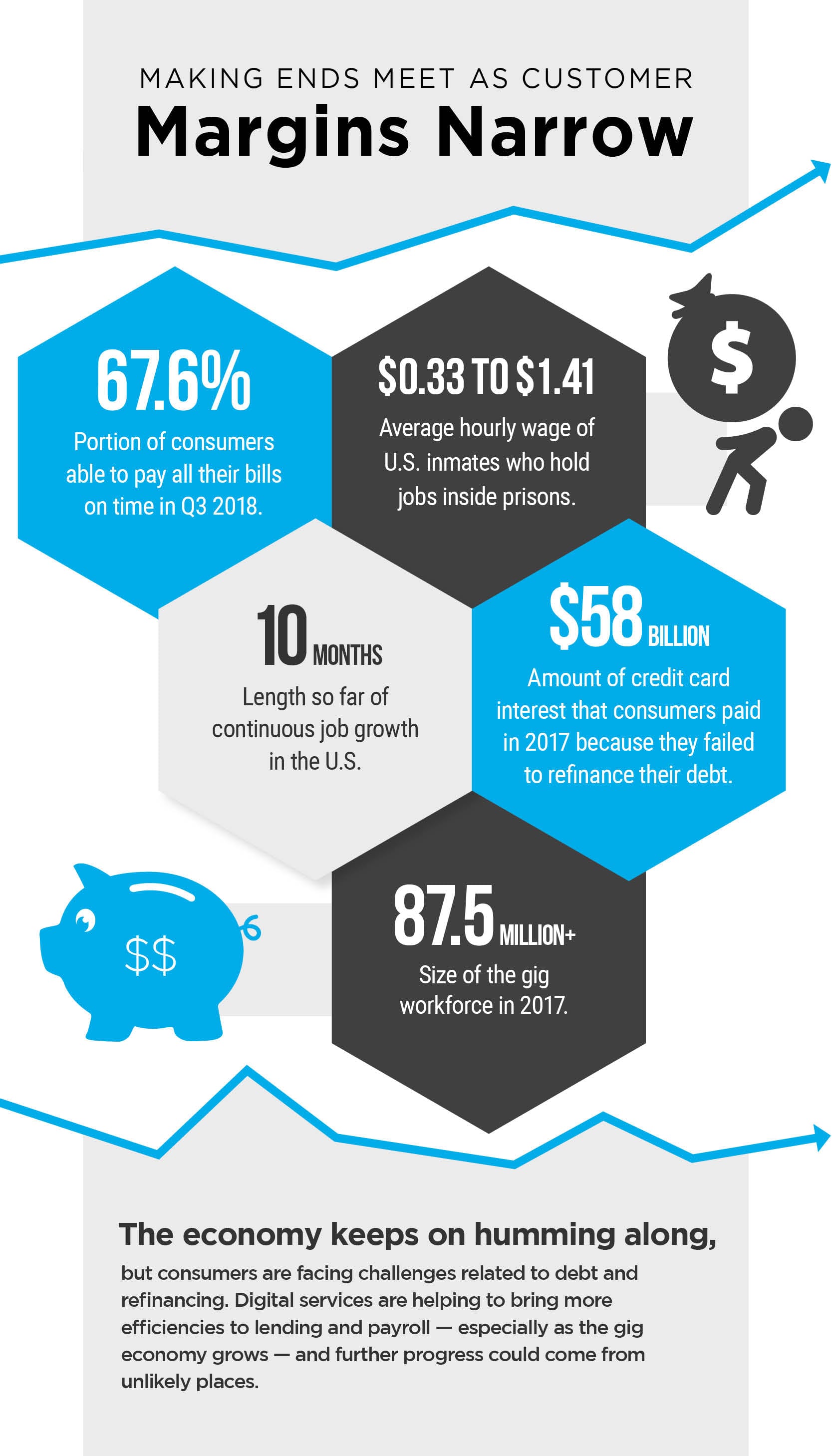

Making Ends Meet As Consumer Margins Narrow

Even as the economy’s ongoing health and the growth in jobs and payroll win praise from multiple quarters, further evidence keeps emerging that U.S. consumers are operating within narrower financial margins than was the case in the recent past. Digital technology, along with the speed and efficiencies it brings, are making it easier to match lenders with consumers, but that doesn’t mean consumers are always operating at an advantage — in fact, they often don’t know how much they could save from refinancing credit card debt. In fact, when it comes to managing personal finances, there is a strong argument to be made that consumers are taking one step forward and then two or three back. Oddly enough, though, new payments and commerce innovation is coming from an unlikely, relatively isolated system where people earn tiny wages for their labor, and tend to exist in the thinnest of margins: prison systems in the U.S., UK and China.

Data:

67.6 percent: Portion of consumers able to pay all their bills on time in Q3 2018.

$0.33 to $1.41: Average hourly wage of U.S. inmates who hold jobs inside prisons.

100 months: Length so far of continuous job growth in the U.S.

$58 billion: Amount of credit card interest that consumers paid in 2017 because they failed to refinance their debt.

87.5 million+: Size of the gig workforce in 2017.