5 Reasons Why ‘Friendly Fraud’ Is Far From Friendly

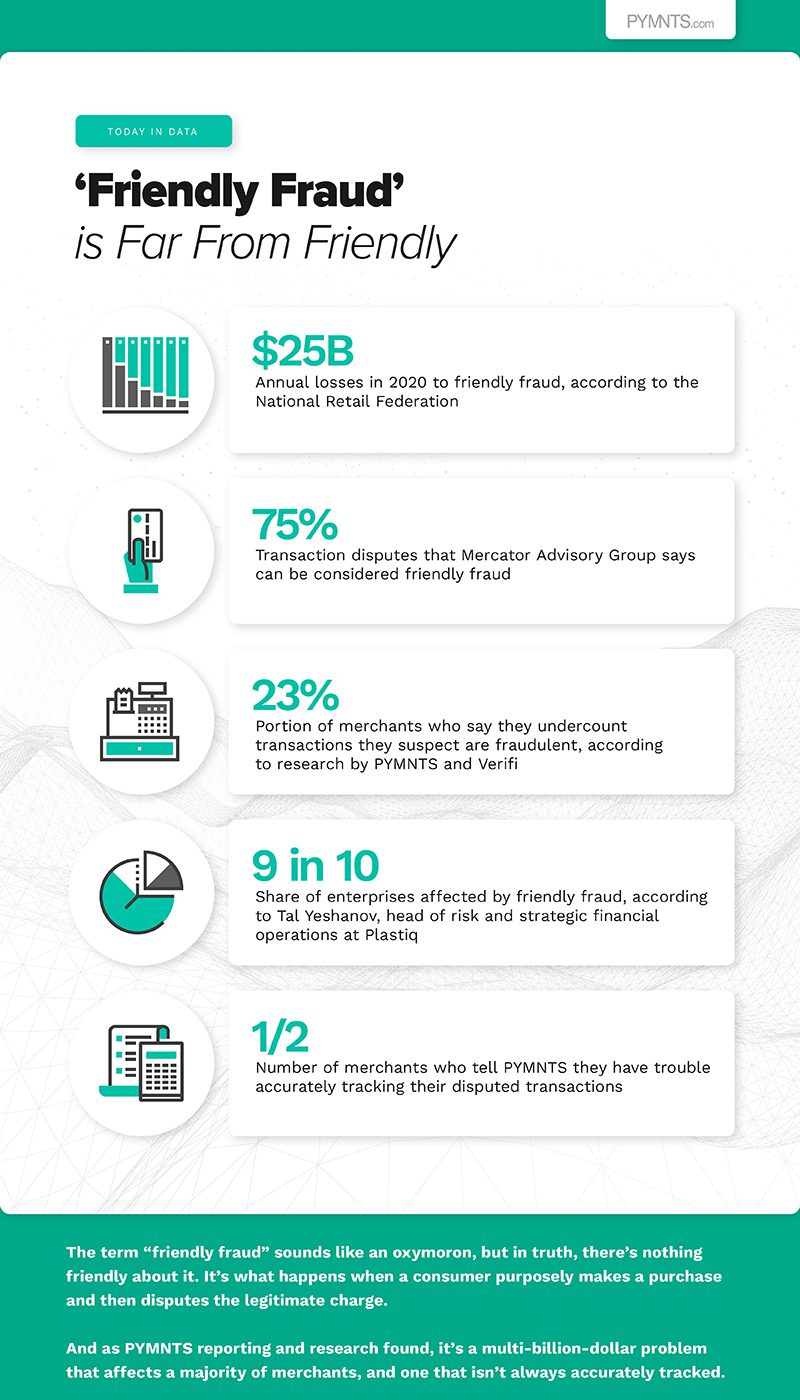

The term “friendly fraud” sounds like an oxymoron, but in truth, there’s nothing friendly about it. It’s what happens when a consumer purposely makes a purchase and then disputes the legitimate charge.

And as PYMNTS reporting and research found, it’s a multi-billion-dollar problem that affects a majority of merchants, and one that isn’t always accurately tracked.

Data

Data

$25B: Annual losses in 2020 to friendly fraud, according to the National Retail Federation

75%: Transaction disputes that Mercator Advisory Group says can be considered friendly fraud

23%: Portion of merchants who say they undercount transactions they suspect are fraudulent, according to research by PYMNTS and Verifi

9 in 10: Share of enterprises affected by friendly fraud, according to Tal Yeshanov, head of risk and strategic financial operations at Plastiq

½: Number of merchants who tell PYMNTS they have trouble accurately tracking their disputed transactions