Financially Secure Consumers Splurge on Travel

Travel is one of the top ways consumers with healthy financial safety nets treat themselves, PYMNTS Intelligence research finds, and airlines are reaping the benefits.

By the Numbers

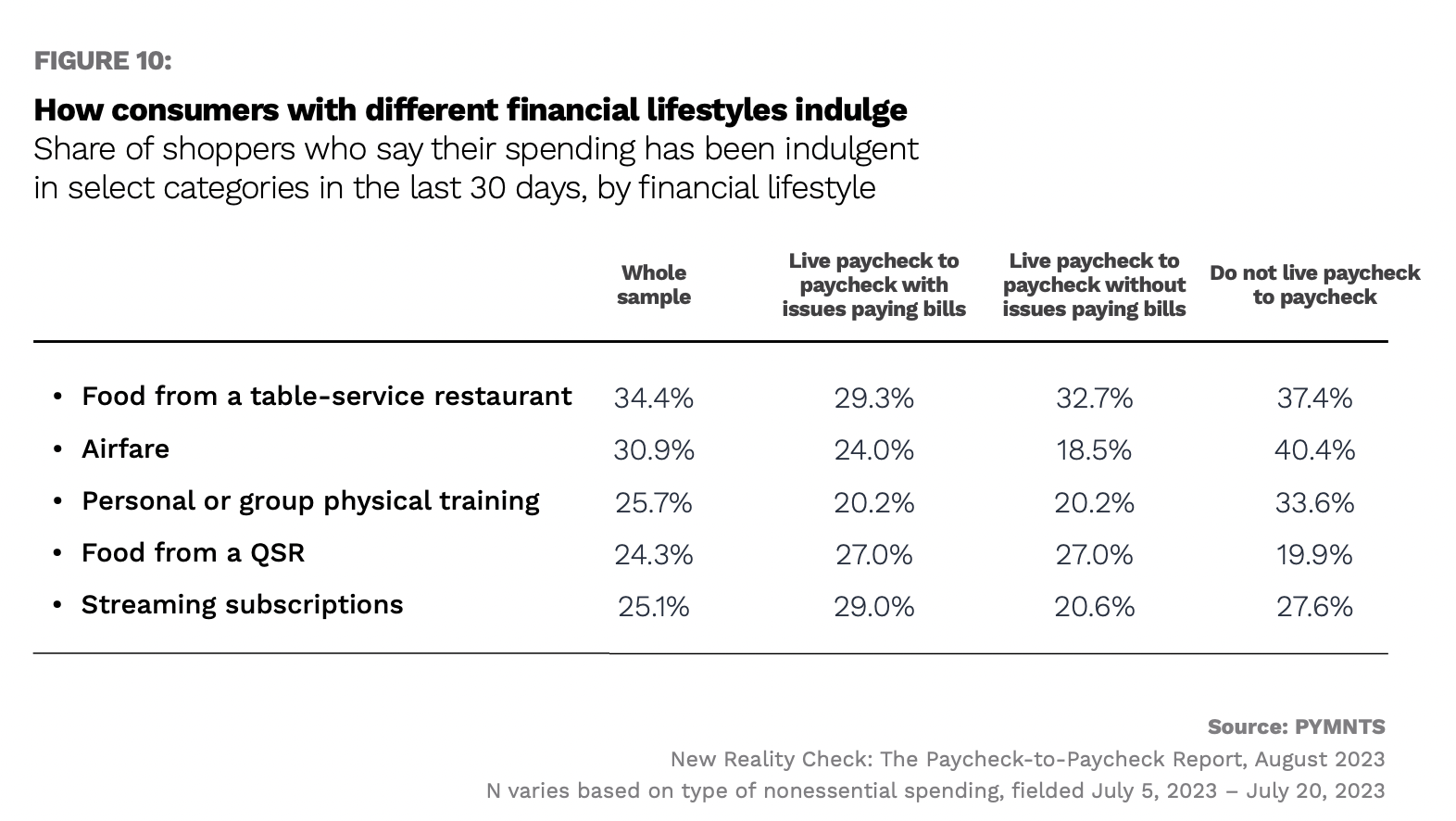

The PYMNTS Intelligence 2023 study “New Reality Check: The Paycheck-to-Paycheck Report: The Nonessential Spending Deep Dive Edition,” created in collaboration with LendingClub, drew from a survey of more than 3,400 U.S. consumers to understand the impact of nonessential spending on consumers’ ability to manage expenses and put aside savings.

The results reveal that, for consumers with financial security — those who do not live paycheck to paycheck — 40% say their spending on airfare has been indulgent, a greater share than said the same of any other type of purchase.

The Data in Context

Indeed, airlines are seeing continued spending on travel.

“We produced record full year revenues of approximately $53 billion, driven by strong demand for our product and record revenue from our travel rewards program,” American Airlines CEO Robert Isom told analysts on the company’s most recent earnings call. “Demand remains strong, and we’ve seen robust bookings to start the year as travel trends have begun to normalize across entities.”

Similarly, Delta Air Lines is seeing consumers splurge on premium travel experiences.

“We expect demand to remain strong, particularly for the premium experiences that Delta provides,” Delta CEO Ed Bastian told analysts on a call in January discussing the company’s Q4 2023 results. “Consumer spend is continuing to shift from goods to services, and our customer base is in a healthy financial position, with travel remaining a top priority.”

These comments not only reflect the resilience of the travel industry but also highlight the enduring allure of exploration and adventure for those with the means to indulge. As the economic landscapes continues to evolve, it remains clear that, for those with cash to burn, taking to the skies is a top priority.