Visa Launches Advanced Identity Score To Help FIs Fight Application Fraud

It’s the battle against fraud that can be lost right at the beginning.

Bad actors, are, increasingly, targeting online card applications, using stolen personally identifiable information to apply for credit, leveraging those ill-gotten credit lines to make fraudulent purchases.

There’s increased urgency on the part of financial institutions (FIs) to spend more time and money on battling fraud at the point of onboarding, especially as card-not-present transactions surge in the lingering wake of the coronavirus.

U.S. financial institutions, according to estimates by Aite, will spend as much as $781 million to battle credit application fraud in 2022.

Consider the fact that, as estimated by Javelin Strategy and Research, the combined estimated losses of new account fraud and account takeover in the U.S. alone topped $10.2 billion last year.

But the costs tied to such fraud can be even greater, with ripple effects that last far beyond the initial financial injuries done to card holders, FIs and merchants.

A poor customer experience can cause FIs and enterprises to lose customers, of course. And for the customers, there’s the rabbit hole of trying to prove that the bad guys co-opted their names, social security numbers and other data. Account fraud can take 15 hours for cardholders to resolve — hardly the most productive use of anyone’s time.

Against that backdrop, FIs must walk a tightrope, balancing customer security with the customer experience, minimizing onboarding friction while meeting regulatory requirements.

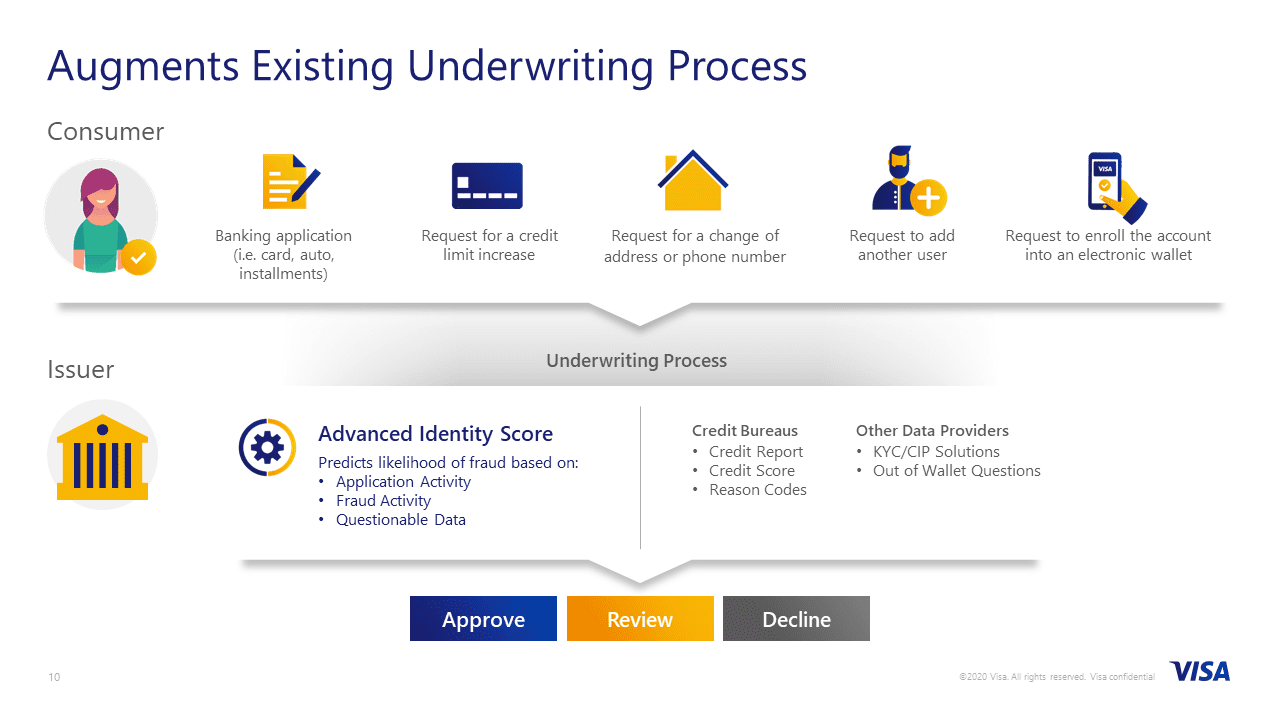

To give FIs another arrow in the quiver, on Monday Visa unveiled its Advanced Identity Score, billed by the company as a solution that scores new credit card applications for risk, regardless of brand, in real time.

In an interview with Karen Webster, Melyssa Barrett, vice president of identity and risk products at Visa, said the score leverages advanced technologies such as AI and machine learning to predict application fraud. The approach is different from those that may already be utilized by FIs to address application fraud, applying techniques such as biometrics and various other stepped-up levels of authentication.

Visa, said Barrett, is using analytics in tandem with a proprietary centralized U.S. database that includes virtually all new (and past) card applications from Visa issuers. The database, at launch, includes information spanning 100 million new applications, 12 million fraud cases and more than 8 million bankruptcies annually.

Visa, said Barrett, is using analytics in tandem with a proprietary centralized U.S. database that includes virtually all new (and past) card applications from Visa issuers. The database, at launch, includes information spanning 100 million new applications, 12 million fraud cases and more than 8 million bankruptcies annually.

That combination of data and advanced technologies can pinpoint and score risk even in applications coming from higher FICO score bands (700 and above), where fraudsters may be hiding. Barrett said, too, that the identity score can be customizable to match issuers’ risk tolerance across a variety of credit decisions, such as automated approvals or declines — or to refer certain decisions to manual verification.

The data include application velocity, and data from government agencies and third party sources to give a holistic view of risk. Such authentication is crucial in streamlining the decisioning process and advancing “good” applications while reducing false positives.

Barrett told Webster the new risk solution provides a more complete and accurate picture of applicants’ identities.

“When it comes to identity and risk management, there are so many smaller hills along the way that you have to scale and figure out: Is this a fraudster? If not, are they a victim of identity theft?” Barrett explained.

Those considerations are only two among many that issuers must grapple with when they find anomalies and must approve or deny applications. The database, she said, and the attendant risk score, can give issuers access to suspicious activity without having to incur the expense of reaching out to credit bureaus for data.

Drilling down a bit into mechanics of bringing the solution to market, Barrett said that Advanced Identity Score had been in testing mode, is being made available immediately (in the U.S., with eventual availability beyond this country) and is being offered through the payment giant’s wholly-owned consumer reporting agency, known as Advanced Resolution Services.

Drilling down a bit into mechanics of bringing the solution to market, Barrett said that Advanced Identity Score had been in testing mode, is being made available immediately (in the U.S., with eventual availability beyond this country) and is being offered through the payment giant’s wholly-owned consumer reporting agency, known as Advanced Resolution Services.

She added that even as FIs can rely on the data to ensure they are in compliance with the Fair Credit Reporting Act, consumers can identify what’s in their files, too. They can lodge disputes in order make sure data is as accurate as possible when they look to add authorized users, request credit line increases or to add their information to an electronic wallet.

“The consumer has a voice in the process,” she said.

With a nod to broader applications of the risk solution including other account openings beyond cards, Barrett said because the offering is brand-agnostic, the data housed in the database may be used by non-banking financial companies across a variety of credit products. Those products can include automobile and other types of loans, helping build a “trusted digital identity” for the consumer as they transact across accounts and FIs.

“The utilization of artificial intelligence to bring all of this information together and provide an empirical score,” predicted Barrett, “will provide unique value on top of some of the other risk management tools that are out there.”