Visa Direct Powers Real-Time Payroll For Frontline Workers

Americans are worried about their finances, a fact highlighted repeatedly in PYMNTS’s ongoing series of studies documenting consumer behaviors during the global pandemic and their outlook for what’s coming next.

Tens of millions have already lost their jobs. In February, before the pandemic, nearly 40 percent of the workforce was earning under $40,000, according to Federal Reserve data. Among those still employed, nearly half believe their job is at risk, according to PYMNTS’s survey results.

Those who still have a paycheck find that it doesn’t go as far as it once did. For the six out of 10 consumers living paycheck to paycheck, the level of anxiety over making ends meet has escalated. Fifty-five percent of Americans surveyed believe that the pandemic will last longer than their personal savings will.

These data points are deeply troubling, Global Head of Visa Direct Sales Cecilia Frew told Karen Webster in a recent conversation. They reflect the extent to which people’s lives have been shattered over the last 12 weeks.

Visa is attempting to help by using its payments capabilities where they are needed most, giving hourly workers on the front lines access to their earned wages at the end of their shifts. For those workers, it is the difference between going home with groceries and having to tell their families to wait until payday to get what is needed.

“We know that people are in more distress than ever around their finances — many of whom were already in a precarious situation,” Frew told Webster. “It was with that in mind that we worked with our Earned Wage Access (EWA) partners to get the word out to employers that instant direct pay options are out there for their workforce.”

Visa’s EWA partners include technology providers like DailyPay, FlexWage, Instant Financial, PayActiv, and ZayZoon, as well as merchants and payroll companies.

Frew noted that access to wages already earned has been a topic of conversation among employers for over a half-decade. But the road to recovery means that the time for conversation is over — and the time for moving forward is now — both for the sake of workers who need faster access to their wages, and for the sake of employers who need it to motivate and retain their workforce.

Meeting Employee Need

Employers nearly universally want to do right by their employees and make sure they are financially well. That alone, Frew noted, has created a built-in impetus for their interest in tapping into tools to close the cash flow gaps between paydays that can put their workforce in a precarious financial situation. These situations are amplified now, particularly since so many hourly workers also find themselves on the frontline, worried about the impact of their jobs on their physical health. Early access to wages earned is something that can go a long way to alleviating the financial stress that these essential workers face.

“Knowing exactly how much is in my [bank] account when I walk up to the cashier to pay means confidence,” Frew emphasized. “It means not being worried about being declined or having to remove a few items in the basket at checkout. It might seem like a small thing to a lot of people, but for everyone who’s living day to day, paycheck to paycheck, that’s actually a pretty big thing.”

Keeping Workers With Faster Paychecks

Keeping Workers With Faster Paychecks

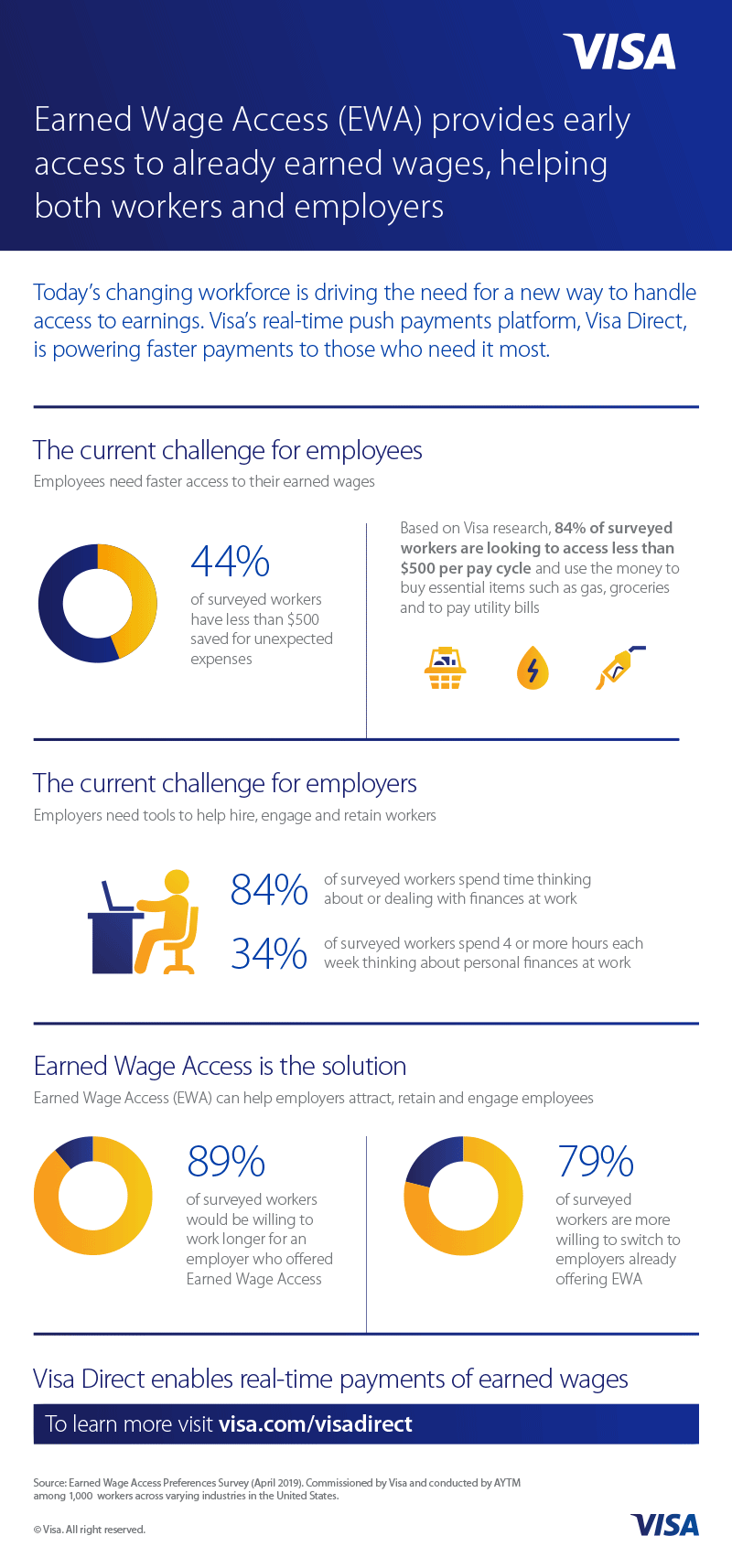

A workforce distracted by trying to mathematically make ends meet while at work also takes its toll on businesses, Frew explained. According to Visa’s research, roughly a third (34 percent) of workers spend four hours or more a week thinking about their personal finances while at work, and 84 percent of workers spend at least some time thinking about finances at work.

As cash strapped, anxious consumers doing the math begin rethinking their priorities around work, payments and getting paid, getting paid quickly is a powerful incentive to determine where to work and how much work they will do for an employer that provides a faster payroll option.

As faster access to wages rolls out, employees just aren’t staying with firms longer, they are willing to work longer hours, are more engaged by their tasks and begin to demonstrate what Frew called “a productivity bump.” In short, employees who aren’t wondering about the balances in their bank accounts turn out to be more loyal and more interested in the work they are doing — and more productive.

“We have gotten interesting feedback from employers that some of their employees who call in sick for a shift log onto a gig platform to do work because they can get paid immediately when they’ve finished working,” Frew said.

That anecdote is unsurprising though; of the customers who have accessed part of their wages early, 84 percent have accessed $500 a month or less to pay for essential items like groceries, gas or bills, she said.

What has been available for gig workers for years is now technically feasible for employers in a way that it never has been before. Paying workers at the end of a shift required employers to run payroll once a day. Today, innovators do an integration to a payroll system, manage the flows and make money available to workers via an app.

“The integration processes very fast, as in a matter of weeks,” she said. “And then it’s just a matter of making sure that the employees know about it. Once they do, and once they use it, the satisfaction goes up dramatically.”

Frew emphasized that what was once a “nice to have” option for the workforce is now a must have. In an environment when almost everyone is feeling the financial pressure, improved access to wages develops an even more widespread appeal. Businesses can tap the tools that already exist to rise to meet their workers’ changing needs, she noted.

Otherwise, they risk losing their employees to the employers that do.