Lax monetary policy and corresponding low-interest rates formerly allowed companies to access working capital at low costs, but times have changed. Credit is expensive, and CFOs feel the pressure, especially those of Growth Corporates. These organizations generally generate annual revenues between $50 million and $1 billion and can fall through the cracks between solutions tailored for small businesses or enterprises. As a result, many Growth Corporate CFOs feel they must force-fit existing working capital options when needed — or go without.

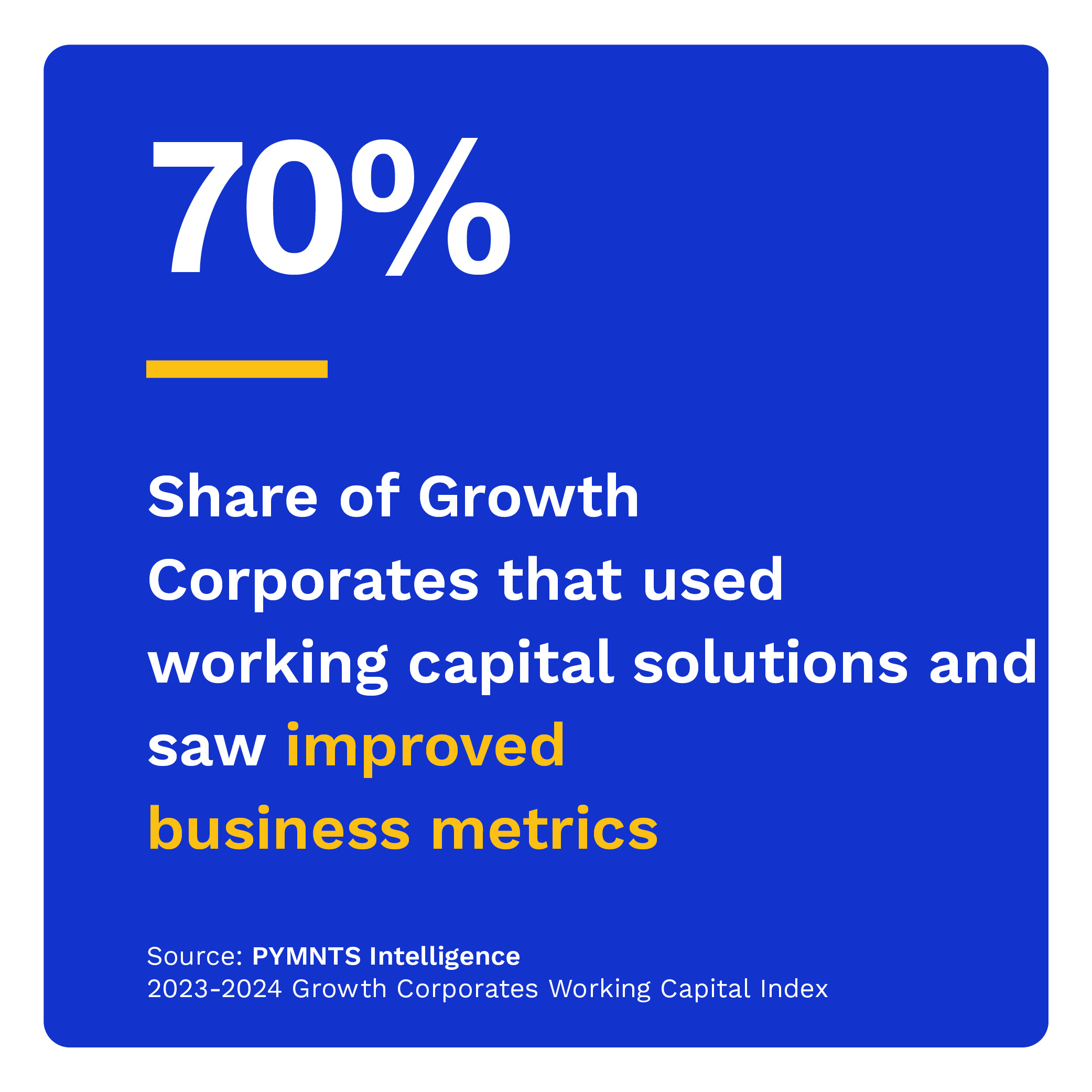

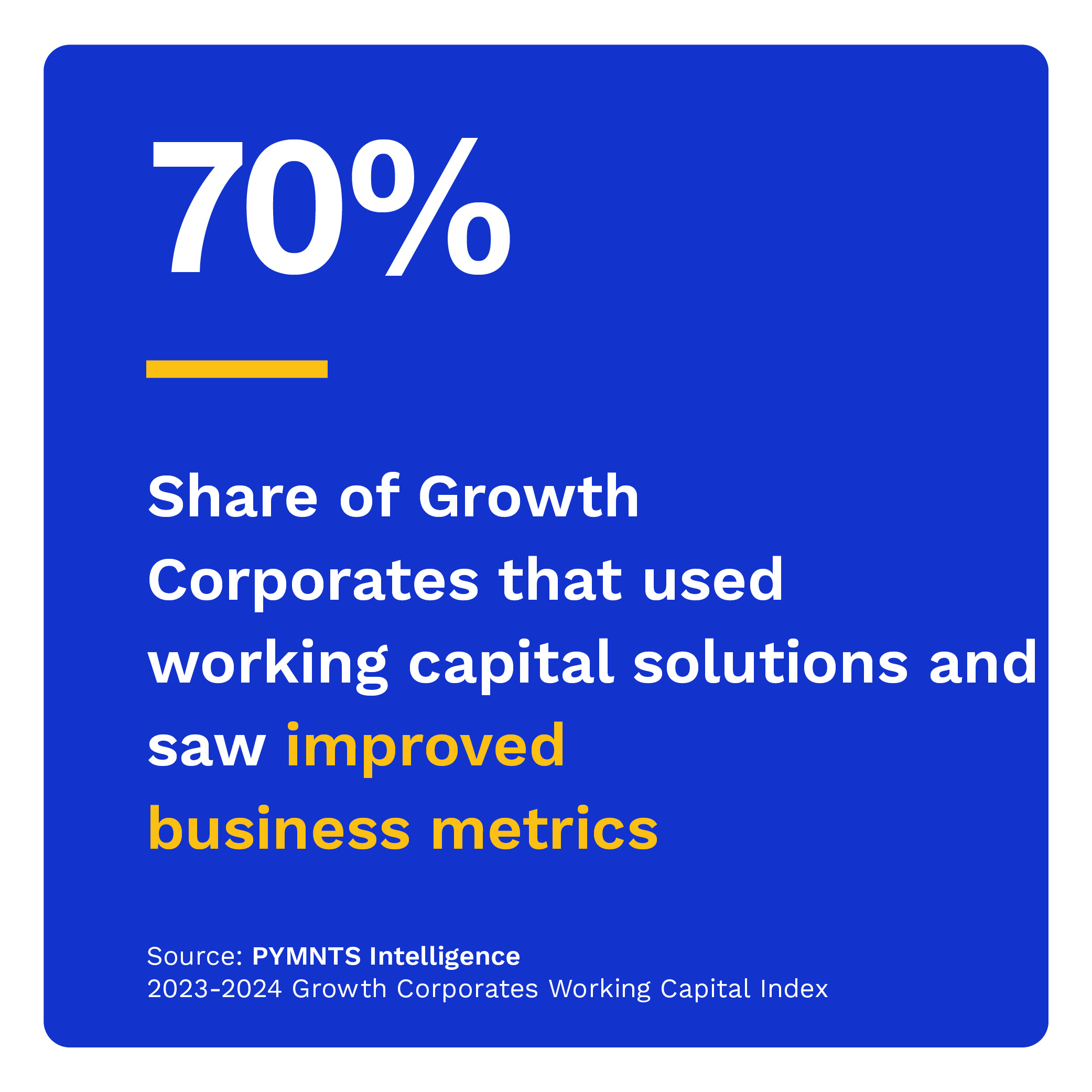

Visa’s report reveals that Growth Corporates using working capital solutions for strategic or tactical purposes experience different levels of operational efficiency. Top performers tend to use working capital strategically — to cover planned cash flow gaps related to predictable business cycles or to invest in business growth. As a result, these businesses annually save an average of $3.3 million. As 70% of Growth Corporate CFOs who used working capital saw better business metrics as a result, it may come as little surprise that nearly all Growth Corporates in our study plan to use working capital in 2024.

These are just some of the findings detailed in “Growth Corporates Working Capital Index,” a Visa report in collaboration with PYMNTS Intelligence. This report examines the impact of working capital solutions on the operational efficiency of businesses, as defined by Days Payable Outstanding (DPO), based on a survey of 873 CFOs and treasurers across five industry segments, five global regions and 23 countries between March 9 and June 12.

Other findings from the report include the following:

Top-performing Growth Corporates are agile and supplier-centric.

The 2023-2024 Growth Corporates Working Capital Index ranks firms from 0 to 100, with 100 representing the perfect ratio of operational efficiency with the use of working capital solutions. Top performers achieved an average working capital index score of 70, three times that of bottom performers. Firms that utilized working capital were more likely to have replaced or upgraded their suppliers, and on average, top performers had a measure of days payable outstanding (DPO) that was nearly a full workweek shorter than average: 46 days, down from an average of 50.

Growth Corporates across regions and industries are optimistic about 2024 and plan to increase their use of working capital solutions.

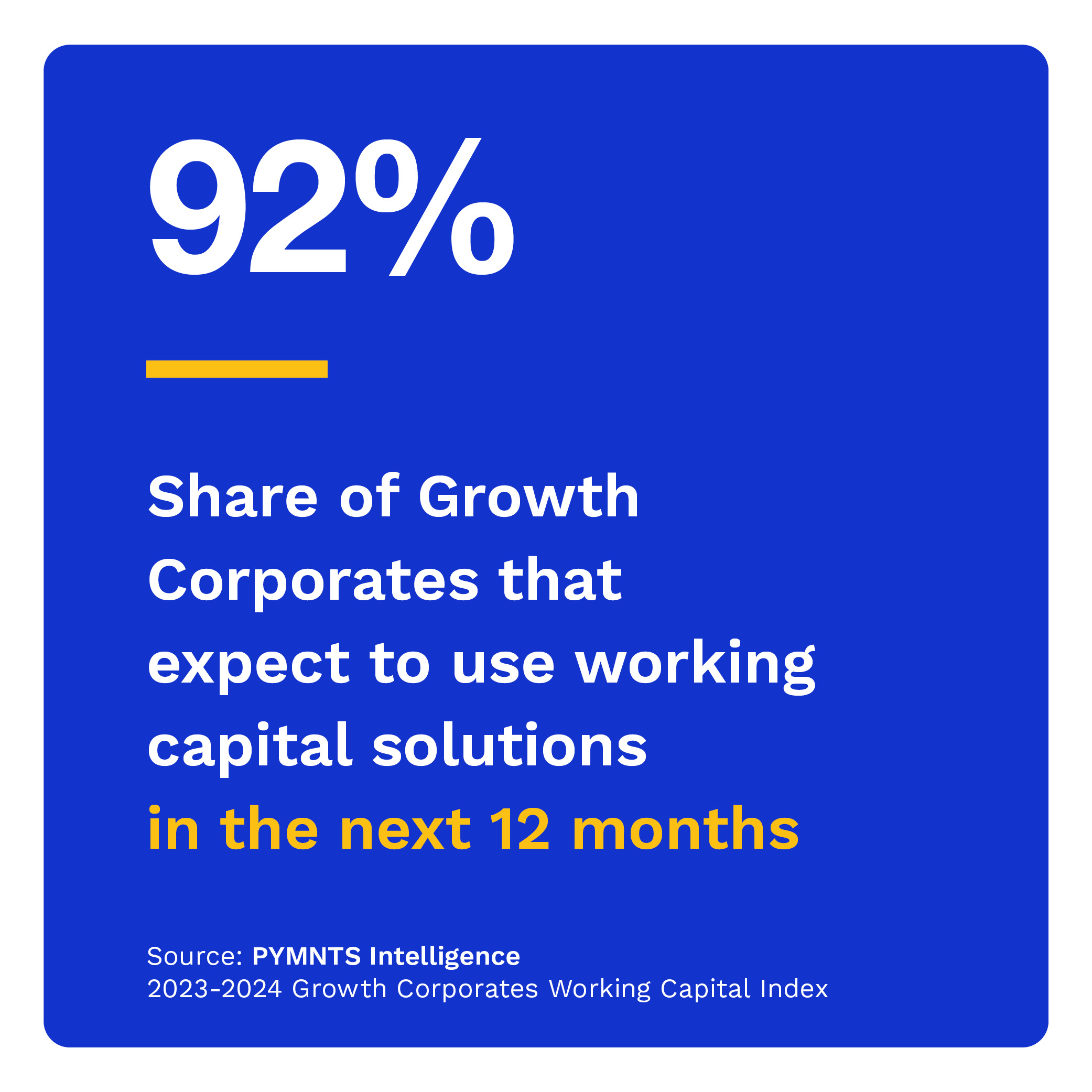

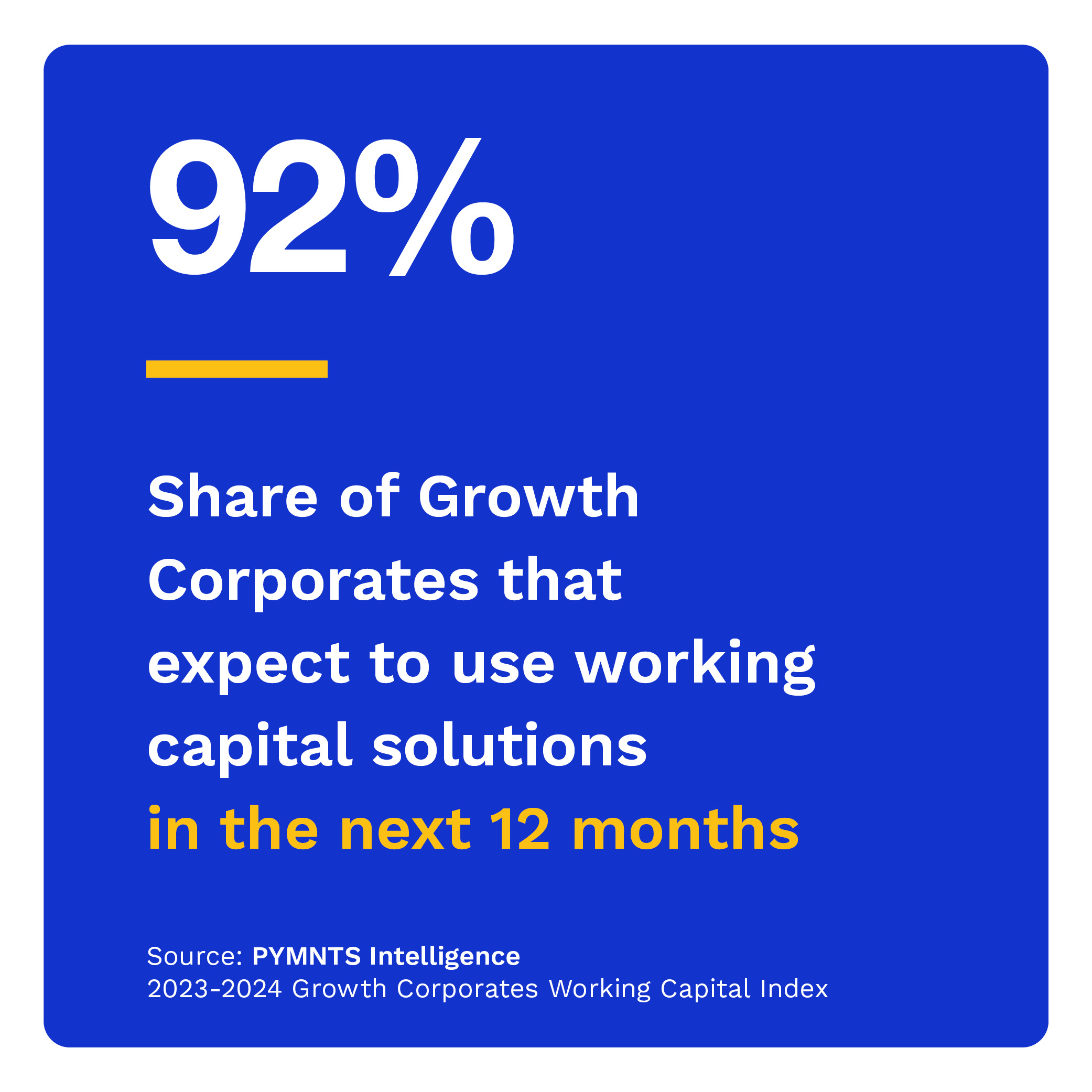

Growth Corporate CFOs are shrugging off predictions of a global recession and expect easing credit conditions and improving business conditions in 2024. Ninety-two percent of Growth Corporate CFOs plan to use working capital solutions in the next 12 months, a 30% increase in utilization. The number of working capital solutions CFOs will use is expected to double. The largest increase may occur in sectors and regions that did not use working capital solutions at all or very much in the past year, including firms in CEMEA and the healthcare/medical sector.

Advertisement: Scroll to Continue

Virtual cards are becoming Growth Corporates’ all-purpose working capital solution.

More than two-thirds of Growth Corporate CFOs who used virtual cards view them as a versatile working capital option, and use is expected to triple in 2024. CFOs who use virtual cards as a working capital option tend to have higher buyer-supplier payment integration. Those who used virtual cards as a working capital option in the previous year show the greatest potential for operational efficiency improvements in 2024.

Other insights involve perceptions of working capital use, who CFOs turn to for advice about working capital and why misalignment between working capital products and sector needs hampers many Growth Corporates’ efficiencies. Download the report to learn more about how Growth Corporates are utilizing working capital solutions.

See More In: Growth Corporates, Growth Corporates Working Capital Index, Main Feature, News, PYMNTS Intelligence, PYMNTS News, virtual cards, Visa, Visa Growth Corporates Working Capital, working capital, Working Capital Index, working capital solutions