Apple – Phone Home

“There’s no place like home” are the famous words spoken by Judy Garland, playing the character of Dorothy, at the end of the iconic movie, “The Wizard of Oz.”

All it took were three clicks of her ruby-red slippers and those five words to transport Dorothy back to Kansas and her beloved Auntie Em and Uncle Henry after she, her dog Toto and her farmhouse were uprooted and transported to the Land of Oz in a tornado.

It may not be that easy for Apple, a tech giant that seems to have missed one of the most important anchors of connected commerce – the home – along with trendlines that suggest the smartphone is slowly becoming less central to the consumer and the commerce experience.

We saw that this year when we analyzed the results of our third annual How We Will Pay Study. This study of more than 5,000 U.S. consumers across a nationally representative sample found that they are using their place of residence – along with a curated selection of connected devices – as a home base for many more of their connected commerce experiences than we’ve seen in years past.

We attribute that shift to two things.

The first is the rapid adoption and usage of voice-activated devices and apps that make it convenient for consumers to make purchases at home while doing other things like cooking, cleaning or watching the kids.

All without having to be tied to a smartphone, tablet or PC.

The second, and perhaps more obvious, is the increase in the number of apps consumers now access, using any connected device, to do things at home that they could once only do in a particular physical place – like going to the store to buy things or to the theatre to watch a movie or to a stadium to see a live sporting event.

More telling, our research shows that consumers are going to the store to buy things much less frequently, and are using connected devices to make purchases much more than last year. Consumers are spending more time at home without the fear of missing out – or going without.

It’s why I think Apple’s announcement last week that it would release its original movies in theatres before streaming them to its Apple TV+ service is an interesting window into their strategy for winning the hearts and pocketbooks of connected consumers – and also how different it is from the strategies of its Big Tech rivals Amazon and Google.

Doubling Down on Content

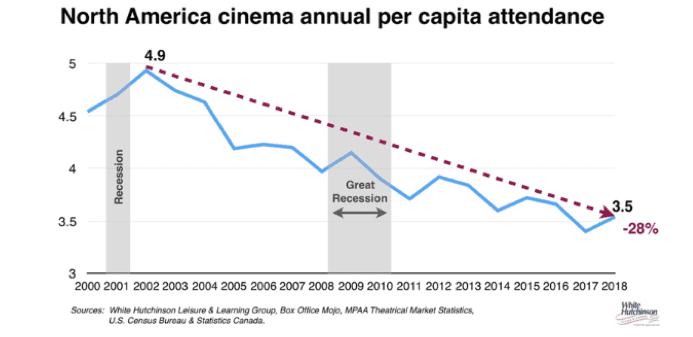

Apple’s streaming content announcement comes at a time when movie theatre attendance is at an all-time low and competition for streaming content is at an all-time high.

Naturally, Apple’s content release strategy isn’t about pumping up another ailing brick-and-mortar business, but about attracting movie producers to work with them to create original content.

Movie producers like to see their original content played out on the big screen first, since box office sales keep movie producers in business and keep big stars interested in playing their parts, so to speak. They, as well as the directors and artists, are more interested in making deals with distributors that let their movies play in theatres before dumping them into those big, “all-you-can-eat” streaming movie bundles.

But Apple’s announcement – and its entire Apple TV+ programming initiative – also comes at a time when the streaming content business is becoming incredibly competitive and saturated.

There’s Netflix, Amazon Prime, Hulu and now Disney, on top of Comcast and the cable operators and their content packages, all vying for the consumer’s attention span and monthly subscription dollars.

Really, who’s not getting into this business?

The digital streaming providers have already eaten the lunch of the cable providers whose subscribers are cutting the cord with great abandon. And all of them, with the exception of Disney, already have a huge critical mass of eyeballs that regularly tap into a critical mass of content on any connected device they happen to have – their Samsung or Pixel phone, their LG TV, their Lenovo PC or their iPhone or tablet.

And, it happens mostly in their homes.

Consumers will ultimately slim down the number of subscription services to only those that offer the best mix of content – movies, sports, original programming, old favorites, etc.

Apple is investing heavily to make sure they stay on that list.

But so what if they do – in the big picture of how the connected consumer and connected commerce plays out?

Apple’s streaming content investment is part of the company’s bigger strategy to beef up its Services offerings. Last quarter, for the first time since the iPhone launched, Services revenue topped iPhone sales. Apple hopes that Services will keep existing iPhone users in the ecosystem, drive more sales of the product and keep them hooked. Original content, like movies and book deals with Oprah, is part of that plan.

All of that is important, given the slump in the number of iPhones sold in the U.S. and worldwide.

All of that is important, given the slump in the number of iPhones sold in the U.S. and worldwide.

Sales are an important indicator of the health of the iPhone business, but more telling is the number of units sold. iPhone sales also include healthy aftermarket sales of used (and previously counted) iPhones. Knowing how many new units shipped and sold is a better indicator of how well the iPhone truly fares on the global smartphone stage.

Since Apple no longer reports the number of iPhone units sold, it’s hard to know precisely the extent of the sales slump. Several analysts estimate that iPhone shipments are down in the 10 to 11 percent range so far this year. Analyst firm Piper Jaffray recently projected that units sold could scooch slightly higher this year given the lower cost of the iPhone models, but that overall sales will decline by 1 percent through the end of this year because iPhones cost less than they once did. Jaffray predicts that new iPhone sales won’t spike again until Apple releases its 5G model in 2020.

The basis for that forecast is Jaffray’s annual survey of iPhone users, conducted shortly after the latest iPhones were introduced, which found that only 51 percent of current users said they were interested in upgrading their phone this year, compared to the 69 percent who said they were interested last year.

The average upgrade cycle for iPhones, according to some analysts, is now a full four years, up from three just a year ago.

Without a reason to buy new hardware, consumers remain content to upgrade the OS on the phones they already own to get new features and functions.

That’s bad news for Apple looking ahead.

The Looming Threat

Regardless of what Apple may say, more so than any of its Big Tech rivals, it is heavily dependent on the iPhone being a hit, and being the primary device consumers use to power their connected everything experiences, including commerce.

Everywhere and anywhere, including the home.

That’s because Apple’s only connected commerce offerings are the iPhone, tablet and smartwatch. Keep in mind, too, that Services revenue also depends heavily on Apple keeping, at a minimum, its existing share of devices.

Oddly absent from the Apple stage last month at the launch of its new iPhone and Watch was any announcement of a smart home device. The HomePod, first introduced at Apple’s WWDC in 2017 and released in early 2018, is described on the Apple site as a speaker with incredible sound quality.

Big yawn.

And there’s been nothing since.

That stands in sharp contrast to the Amazon Devices Event held last Wednesday, which saw Amazon launch a whole new suite of Alexa-powered devices to take her anywhere in the home – including appliances – as well as in the car and in consumers’ ears via earbuds and smart glasses.

That also stands in sharp contrast to Google’s upcoming Made By Google day, scheduled for Oct. 15 in New York. Google expected to release a new version of its Pixel phone as well as new versions of its Google Home devices, aiming to make Google Assistant more accessible throughout the home, too.

The Bet That Didn’t Pay Off

Two years ago, with the launch of the HomePod, Apple appeared to have made a bet that, since one of the most frequent asks of Alexa and the Echo was to play music, consumers would want better sound quality to listen to their voice-activated music selections at home.

As it turned out, most consumers really didn’t.

While Apple was busy competing in the high-end speaker market with HomePod, consumers were getting comfortable listening to music they asked Alexa to play on the Echo, and later experimenting with using a voice assistant named Alexa, and Google Assistant, to help them navigate their daily activities at home.

Amazon and Google both scratched that consumer itch, introducing devices and a range of skills that expanded the number of things consumers could do with those devices – first with smart speakers, later with mini versions of those speakers to put around the home and security systems to protect the home, and now with devices with screens that give consumers a new alternative to sitting down at a PC to search for information.

Consumers now use those devices to play music, get the news of the day, find the closest pizza place, figure out what to make for dinner, get tips on how to housetrain their new pup.

And buy things.

Consumers seem hooked on using those devices, in their homes, to access a variety of new experiences that, yes, they once did on their smartphones, but now don’t have to.

According to our How We Will Pay study, the ownership of voice-enabled devices, particularly voice assistants, has more than doubled in the three years since we started the study. This year, we found that roughly one in every three consumers (31 percent) now own voice-activated devices, up from 27 percent in 2018 and just 14 percent in 2017.

Nearly 10 percent (9.6 percent) of voice-activated device owners owners now use voice-activated devices to make purchases, up from 7.7 percent in 2018. Purchases made via voice-enabled devices while performing other activities are up across the board.

In fact, there is not a single-use case in which consumers are using voice-enabled devices less often than they did in 2018.

So, while Apple is thinking like a hardware company and developing a 5G phone to hook consumers to their content, Amazon and Google are thinking like technology companies using software and payments to power new connected experiences, including those that involve finding things to buy and making those purchases, that go wherever the consumer wants to take them.

Amazon and Google have each created a skills marketplace and voice SDKs for developers to create new ones. Today, Amazon has 56,750 skills to Google’s 4,253. Amazon is also spearheading the voice interoperability initiative with 30 leading tech companies to make voice interoperable – and highly distributed – across applications, devices and connected endpoints.

All of those endpoints will ultimately enable commerce or provide an onramp to it — 5G will only accelerate those opportunities by layering a high-capacity, high-speed data network everywhere. All that will boost incentives for innovators to develop skills and use cases to enable it – and for consumers to use it.

The Way Home

The iPhone introduced consumers to a device that changed the way they accessed the internet – using apps and a piece of hardware that blurred the online and offline worlds in ways they could have never b imagined. The iPhone and its apps ecosystem opened up entirely new commerce opportunities that have driven untold value over the last decade. There is no doubt that the iPhone was a remarkable innovation.

Yet, in four short years, voice-activated devices have introduced a portability to commerce that will take that opportunity and those sources of value to an entirely new level.

Not only are these voice-activated experiences multi-modal – brought to consumers by Amazon and Google via speakers with screens – but they are also multi-device. Consumers who use voice to enable purchases do so using voice-activated devices in their homes, as well as via apps on their phones while out and about, including in their cars. Of the 31 percent of voice device owners who use their voices to make a purchase, 45 percent do so across multiple voice-enabled environments. Voice and voice activated devices make it possible for commerce to follow the consumer, and not the other way around.

And it all started in the home.

Of course, I know that just because Apple is getting into streaming big-time, and getting onto the big screen at theatres near you, doesn’t mean they don’t also have something up their sleeve for voice-connected devices. Maybe the next version of the HomePod will crush it.

But there’s no evidence now that they have a strategy for competing with Amazon and Google in what’s likely to be the next really, really, really, really big thing: voice and the continuous commerce experiences it will unlock across the tens of millions of new connected endpoints that will – and already do – live outside the Apple ecosystem.

They don’t have the e-commerce assets, nor the cross-platform mindset, that both of those tech giants have and are leveraging to deliver a connected commerce experience beyond the smartphone.

Apple getting into motion pictures could be another canary in the coal mine when it comes to its long-term future.