Despite Inflationary Advantage, Walmart’s Grocery Share Slips

One might expect that, in light of consumers’ rising inflationary concerns, Walmart’s grocery sales would spike, given the mega-retailer’s ability to price out competitors. The numbers tell a different story.

By the Numbers

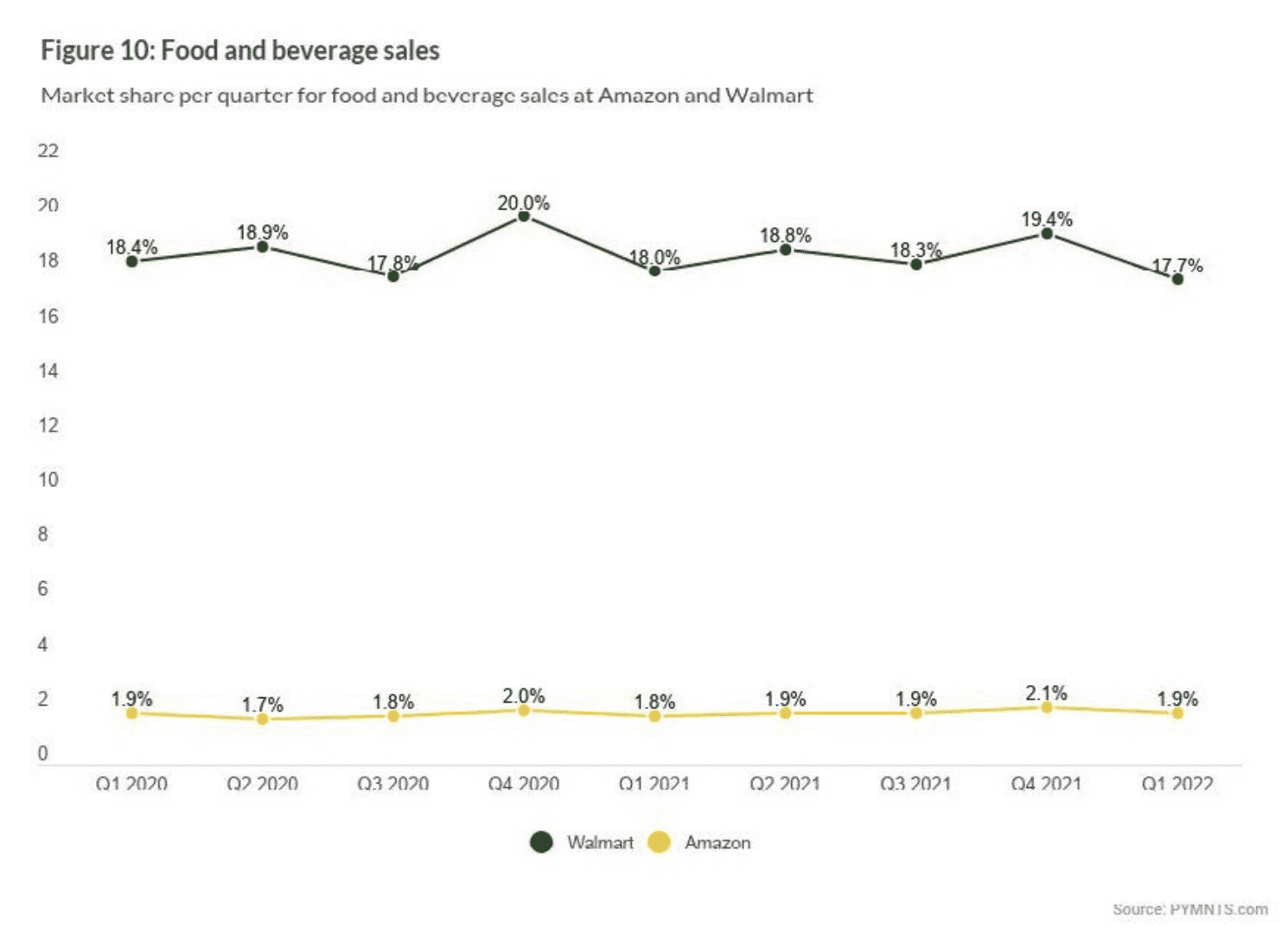

Research from PYMNTS’ study “The Ongoing Battle for Consumer Retail Spend: Amazon Versus Walmart Q1 2022: The Grocery Wild Card” found that the mega-retailer’s share of the total food and beverage market slipped to 17.7% in the first quarter of 2022, marking a 1.7 percentage point decline from Q4 and a 0.3% contraction from a year ago.

Get the study: Amazon Versus Walmart Q1 2022 – The Grocery Wild Card

What It Means

What It Means

Walmart is doing everything in its power to boost its grocery offerings in a move to regain the lost share. Most recently, the retailer announced Wednesday (July 6) that it is combining its direct-to-fridge grocery delivery service InHome with its Walmart+ membership program, making the former an add-on available to the latter’s subscribers.

Read more: Walmart Ups Deliveries by Combining InHome, Walmart+

“When Walmart+ members ask for something, we work around the clock to make it happen for them,” Chris Cracchiolo, senior vice president and general manager of Walmart+, said in a statement.