Walmart to Bargain Hunters: Subscriptions Save Money and Gas

Nothing makes subscribers feel a little, well, special — and boosts their loyalty and urge to spend — like a party in their honor.

Or so Walmart might hope.

In the wake of an earnings report that disappointed investors, and amid margin pressures, the retail giant announced that it will host Walmart+ Weekend, an online-only event that stretches over three days, June 2 to 5.

See also: Walmart Sees Demand Shift for Low-Priced Bacon and High-Ticket Game Consoles

“This is the best weekend to join Walmart+, as only members will have access to the deepest discounts on thousands of the hottest summer items, from a Shark vacuum to a Minnie Mouse playhouse and Samsung Galaxy S7,” a Wednesday (May 18) press release announcing the event stated. “They’ll also have the opportunity to score popular items like PlayStation 5 consoles, Pit Boss Pellet Grills and Gateway Laptops. On top of the deals, customers who sign up in a Walmart store during Walmart+ Weekend and become a paid Walmart+ member will get a $20 promo code off their next online purchase.”

That’s the news. The context is that Walmart is looking to gain more critical mass in its subscription business, where it trails peers even in an age where subscription commerce, by mass merchants, has been taking off.

These commerce juggernauts have been enjoying the fruits of consumer loyalty through these programs as well as higher basket sizes.

The new PYMNTS study “The Benefits of Membership: Mass Retailers and Subscription Services” found that Walmart is the most frequently cited mass merchant with which consumers shopped. Seventy-five percent of consumers shopped there in the past month, but only 21% of consumers have Walmart+ memberships in place. Conversely, 61% of consumers who made purchases from Amazon are Prime members.

Read more: Mass Retailers and Subscription

Will They Stay or Will They Go?

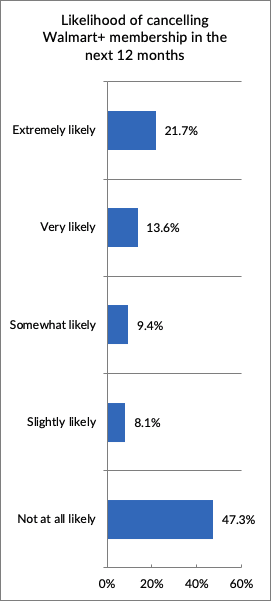

Interestingly, PYMNTS data show that there’s at least some consideration on the part of these subscribers — as many as one-third of them — to, perhaps, step away. The chart below shows the likelihood of Walmart+ subscribers to cancel within the next 12 months.

Clearly there is room for improvement — and amid soaring inflation, companies of all sizes and serving all markets (not just Walmart) will have to examine how they deliver and communicate the benefits of subscription programs.

The total value of purchases made by subscribers is double that for nonsubscribers in all cases, except for Walmart. These members spend just 15% more than nonmembers each month when shopping online, and they also spend 10% less than nonmembers when shopping in stores.

The upcoming Walmart+ Weekend may go some distance in improving those stats — and there’s no time like the present to help consumers battle the impact of inflation’s inexorable upswing.