The PYMNTS COVID Data Compendium: The Past, Present And Future Of The New Digital Consumer

The first statewide stay-at-home measures were implemented in California one year ago today, on March 19, 2020. Other states followed, with many — including Ohio and Minnesota, among others — planning to go back to business as usual after two weeks.

The first statewide stay-at-home measures were implemented in California one year ago today, on March 19, 2020. Other states followed, with many — including Ohio and Minnesota, among others — planning to go back to business as usual after two weeks.

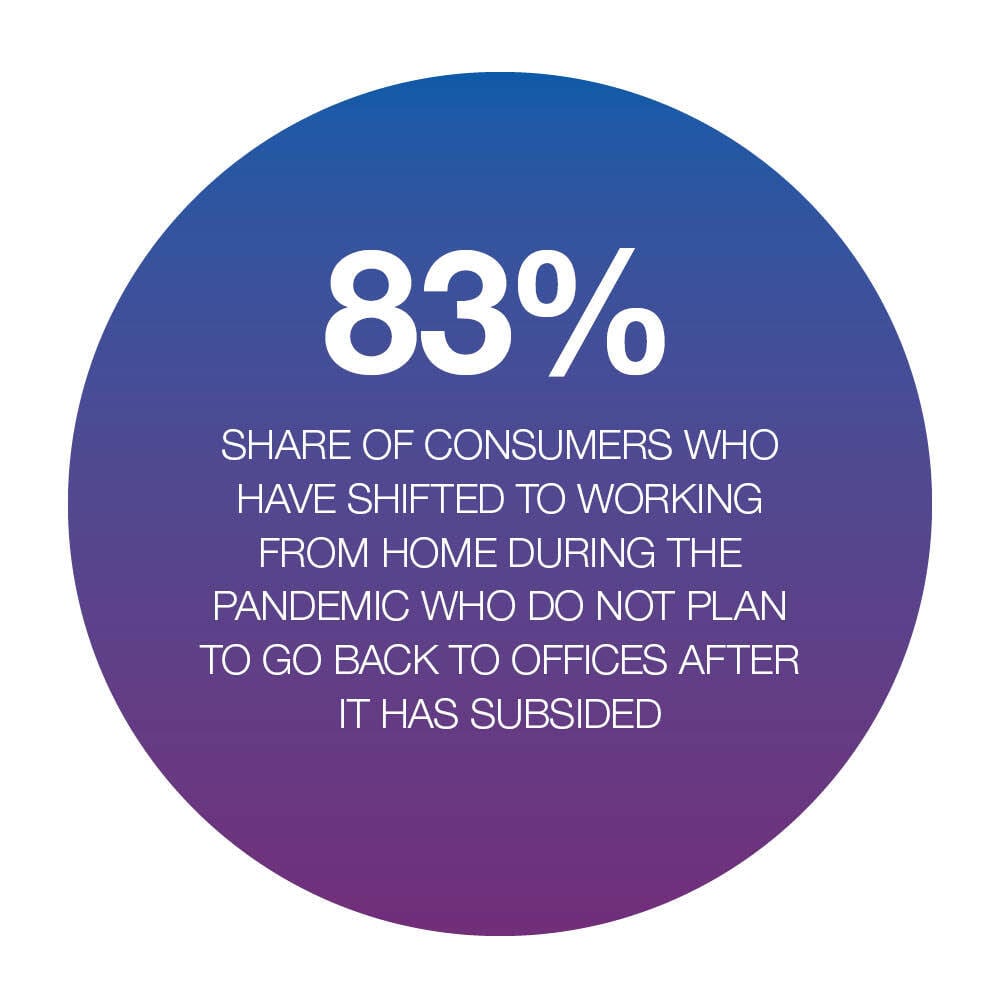

Consumers’ everyday lives have changed drastically since then. PYMNTS’ latest research shows that they have come to appreciate the ease and convenience of working, shopping and ordering food from home — so much so that roughly eight out of 10 of those who have made the digital shift no longer wish to go back to performing these activities out in the world as they did before the pandemic. For example, among the 39 percent of consumers who have shifted from working in offices to working from home since the pandemic’s start, 83 percent want to keep doing so at least as often as they do now, even after it has subsided. There is also 38 percent of consumers who have shifted to ordering more of their food via mobile order-ahead features and 26 percent who have shifted to ordering via third-party aggregators such as Uber Eats, DoorDash and Grubhub. Seventy-seven percent of these digital shifters say they intend to keep ordering their food in this manner at least as much as they do now, long after they can safely return to dining in restaurants.

Consumers’ everyday lives have changed drastically since then. PYMNTS’ latest research shows that they have come to appreciate the ease and convenience of working, shopping and ordering food from home — so much so that roughly eight out of 10 of those who have made the digital shift no longer wish to go back to performing these activities out in the world as they did before the pandemic. For example, among the 39 percent of consumers who have shifted from working in offices to working from home since the pandemic’s start, 83 percent want to keep doing so at least as often as they do now, even after it has subsided. There is also 38 percent of consumers who have shifted to ordering more of their food via mobile order-ahead features and 26 percent who have shifted to ordering via third-party aggregators such as Uber Eats, DoorDash and Grubhub. Seventy-seven percent of these digital shifters say they intend to keep ordering their food in this manner at least as much as they do now, long after they can safely return to dining in restaurants.

With so many consumers planning to stick to their new digital-first routines, it is clear that eCommerce will continue to play a central role in consumers’ lives long after the pandemic has receded. These new digital consumers will be on the lookout for connected purchasing experiences that suit their new routines. What will their newfound taste for digital-first everything mean for the economy in the years to come?

PYMNTS has spent the last year studying how the ongoing health crisis is altering consumers’ shopping habits, having surveyed a total of more than 21,600 U.S. consumers to date. Our latest study, The New Digital Consumer: How The Pandemic Has Reshaped Consumers’ Shopping Behaviors, surveyed a census-balanced panel of 1,994 consumers to determine how their usage of digital and brick-and-mortar purchasing channels has continued to change. It also examines how the availability of the three U.S. Food And Drug Administration (FDA) emergency use authorized COVID-19 vaccines impacts consumers’ future outlooks and whether they plan on going back to shopping, working and dining in the physical world as they did just over a year ago.

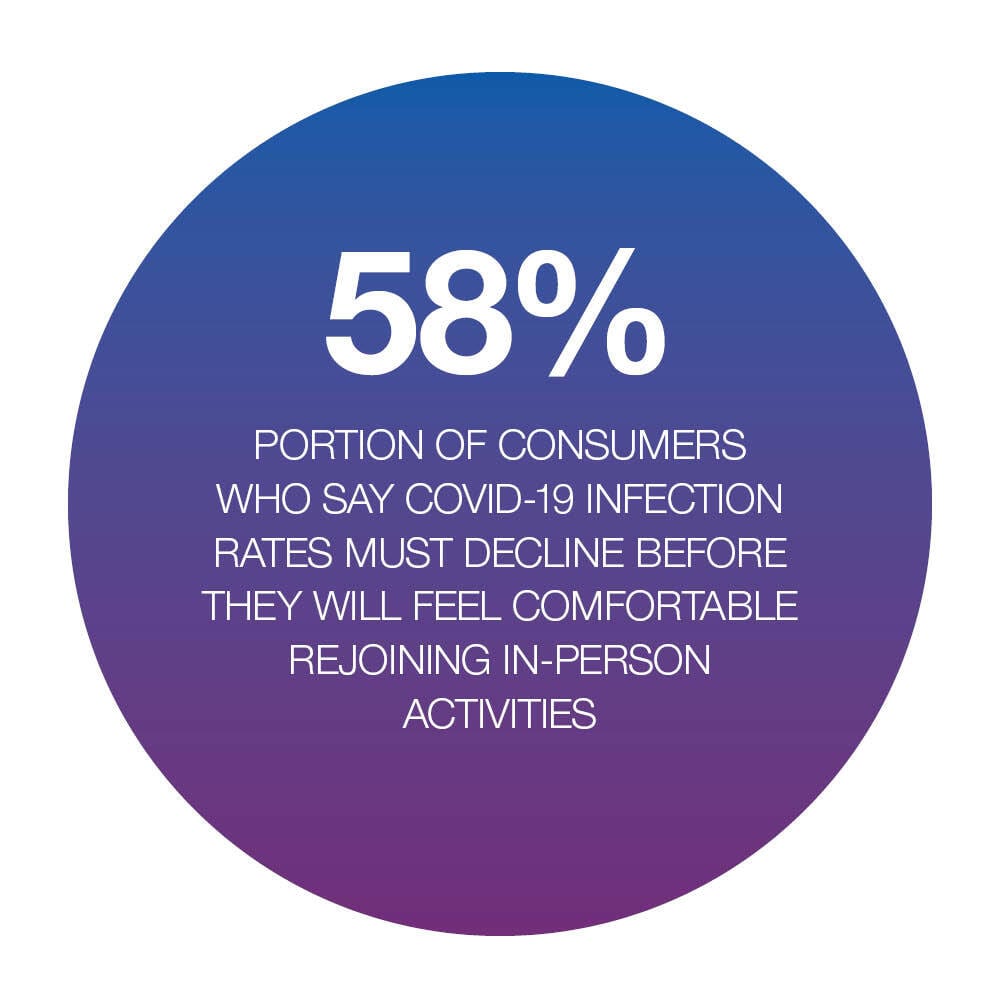

Our ongoing research shows that there is one main area that consumers want to return to normal, however: leisure. Digital consumers plan to keep using the internet to manage their essential activities such as work and grocery shopping after the pandemic subsides, but they are also eager to go back out into the physical  world for fun. The most common reasons consumers say they want restrictions to end are visiting family and friends again, with 60 percent saying they are eager to do so. There are also 54 percent who are looking forward to traveling again and 53 percent who are looking forward to going back out to sporting events, concerts and movies. Therefore, it is clear that entertainment and recreation are at the top of consumers’ minds for what they want to get back to as soon as they can do so safely.

world for fun. The most common reasons consumers say they want restrictions to end are visiting family and friends again, with 60 percent saying they are eager to do so. There are also 54 percent who are looking forward to traveling again and 53 percent who are looking forward to going back out to sporting events, concerts and movies. Therefore, it is clear that entertainment and recreation are at the top of consumers’ minds for what they want to get back to as soon as they can do so safely.

There are also some consumers who have already resumed their pre-pandemic lives: vaccine skeptics. Roughly 17 percent of U.S. consumers say they do not trust the three COVID-19 vaccines and they are among the least likely to have changed their routines since the pandemic began. As much as 65 percent of vaccine skeptics do not shop in stores, dine in restaurants or work on-site any less than they did before lockdowns began, in fact, compared to 55 percent of consumers who trust the vaccines.

Statistics like these help illuminate the sharp divide among the U.S. adult population, but they also provide a glimpse into how digital commerce might be able to help bring the U.S. economy back from the brink in the post-pandemic future. It is also clear that understanding what the new digital consumer wants from their shopping and payments experiences will be key to driving growth.

To learn more about new digital consumers and how their payment and shopping preferences are poised to reshape the future of eCommerce, download the report.