Noodles & Company Finds Omnichannel Approach Boosts Top Line Results

The pandemic may be easing, but a recent PYMNTS report in collaboration with Paytronix found 92 percent of vaccinated consumers said they plan to stick with mobile and online order-ahead, curbside pickup and delivery capabilities that gained traction during the pandemic. The study has raised the stakes on the customer data they collect. Each piece of information, such as order history, birthdays and time of day orders are placed provides more ways to create a seamless guest experience.

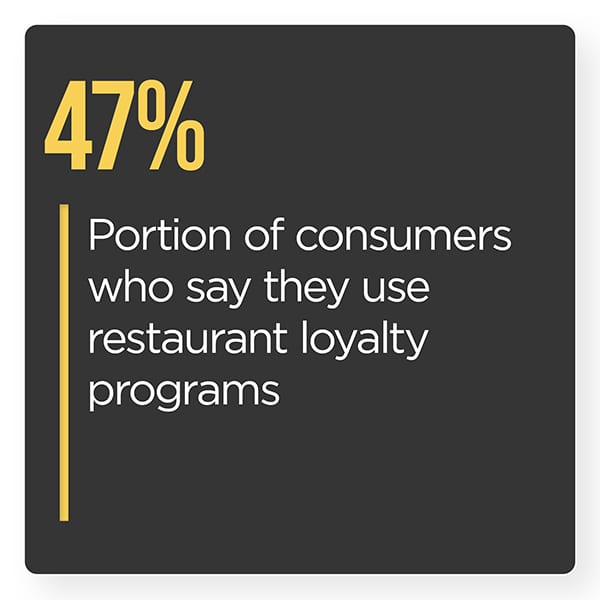

Digital transformation appears to have permanently altered consumers’ expectations for both in-pe rson and digital food ordering experiences. This means that restaurants must offer the technologies, loyalty programs and other features that allow consumers to order, pay and receive the personalization they crave across all channels.

rson and digital food ordering experiences. This means that restaurants must offer the technologies, loyalty programs and other features that allow consumers to order, pay and receive the personalization they crave across all channels.

The July edition of the Order To Eat Tracker® examines how restaurants are working to meet consumers’ digital-first expectations and building multichannel dining experiences, as well as to drive more on-site restaurant spend as customers return to physical locations.

Around The Order To Eat Landscape

New food services data reveals 25 percent of online orders placed last year were for delivery, but how the food got to its destination was a factor. The 2021 Paytronix Order and Delivery Report found that brands with in-house drivers reported 44 percent of orders placed for delivery, while those using third-party services saw 12 percent. Meanwhile, a Paytronix spokesperson told PYMNTS that sales generated via digital ordering platforms more than tripled after the pandemic’s onset.

Ghost kitchens are expanding. The nation’s fast-food chains, including Burger King, Wendy’s and Chick-fil-A, are interested in developing more cooking spaces that can help them fulfill online food orders that are then delivered by third-party delivery services. Dan Rowe, CEO of Virginia-based franchise development company Fransmart, recently stated that it is cheaper and faster to serve customers via virtual or ghost kitchens, as these third-party operations typically optimize food preparation.

A recent study examining  hot-button issues in the restaurant and food services sector is spotlighting an impending food fight between fast food and fast-casual eateries. The survey of more than 1,800 Americans in April found it’s unclear whether fast-casual brands can win back customers they lost to fast-food restaurants in the past year. So far, data suggests long wait times are making fast-food restaurants vulnerable as they compete for diners. However, brands that boosted technology and logistics investments to deliver fast and friction-free service during the pandemic are leveling the playing field.

hot-button issues in the restaurant and food services sector is spotlighting an impending food fight between fast food and fast-casual eateries. The survey of more than 1,800 Americans in April found it’s unclear whether fast-casual brands can win back customers they lost to fast-food restaurants in the past year. So far, data suggests long wait times are making fast-food restaurants vulnerable as they compete for diners. However, brands that boosted technology and logistics investments to deliver fast and friction-free service during the pandemic are leveling the playing field.

For more on these and other stories, check out the News & Trends section.

Noodles & Company On Digitally Innovating To Help Drive Brick-And-Mortar Sales

The pandemic forced the restaurant industry to adapt overnight to higher volumes of mobile and online orders as well as skyrocketing demand for digital and contactless payment innovation. Investing in omnichannel approaches is helping these eateries not only meet consumers’ new digital-first expectations but also refuel brick-and-mortar sales as consumers begin to eat in public once again. Colorado-based fast casual chain Noodles & Company is one such eatery that has harnessed digital innovation to drive stability amid the restaurant industry’s ever-changing landscape, according to Brad West, the business’s chief operating officer. In this month’s Feature Story, West details Noodles & Company’s transition to a digital focus and how the chain is rising to meet consumers’ expectations, no matter the channel.

To get the full story, download the Tracker.

Deep Dive: Taking A Holistic Approach To Fueling Restaurant Spending

One of the best ways to keep customers loyal is to engage them with personalized offers and promotions. About 95 percent of loyalty rewards program members have expressed a desire to interact with their favorite restaurants using the latest technologies and digital channels. This means that restaurants must support tools that serve customers regardless of whether they are ordering in person, online or via app. This month’s Deep Dive explores the importance of taking an omnichannel, holistic approach to driving restaurant spending by using digital ordering channels to support both in-person dining and takeout sales.

One of the best ways to keep customers loyal is to engage them with personalized offers and promotions. About 95 percent of loyalty rewards program members have expressed a desire to interact with their favorite restaurants using the latest technologies and digital channels. This means that restaurants must support tools that serve customers regardless of whether they are ordering in person, online or via app. This month’s Deep Dive explores the importance of taking an omnichannel, holistic approach to driving restaurant spending by using digital ordering channels to support both in-person dining and takeout sales.

Read the full Deep Dive in the Tracker.

About The Tracker

The Order To Eat Tracker®, a PYMNTS and Paytronix collaboration, is a monthly report that examines the restaurant sector.