AMZN vs WMT Weekly: Lopsided Online Fight Cedes Ground to Non-Digital Initiatives

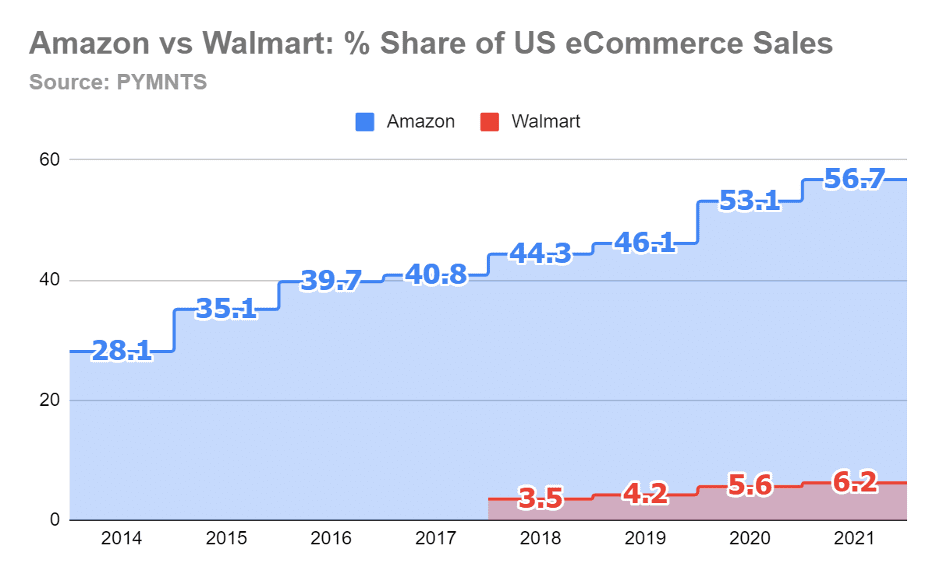

It’s not every day that something can be both astonishing and expected at the same time. But that is a feat Amazon was able to achieve this week as PYMNTS rolled out its latest Whole Paycheck findings which showed the digitally dominant retailer’s share of U.S. eCommerce sales grew to an all-time high of 56.7% last year.

To put that into perspective, the same study found that Walmart’s share of domestic digital commerce had also risen, albeit to 6.2%.

Said another way, for every $100 of purchases made online in 2021, $57 of them went to Amazon.

To be fair, PYMNTS uses a gross merchandise value calculation, which reflects the full dollar amount of items sold, rather than the fractional commission that Walmart or Amazon would book on third-party sales.

Even so, it is a telling indicator of where consumers turn more often than not when they look to buy stuff online. After all, it doesn’t really matter to most consumers who buy, say, a $25 mop on Amazon, pay for it on Amazon, and have it delivered by Amazon, and then (wrongly) assume that all their money will also be going to Amazon, when in fact, more than 60% of the time all but 10% of it is going to a third-party seller. By that accounting standard, Amazon would book $2.50 in revenue, rather than $25.

This eCommerce market share stat is also important for what it says about Walmart, which continues to invest heavily in beefing up its omnichannel capabilities to better leverage its 5,000 physical store advantage. While Walmart’s share of ecommerce has grown 80% in the past four years, Amazon’s majority stake is still over 9 times or 50 percentage points larger.

Fighting Back

Clearly Amazon’s dominance in the digital space is not a new phenomenon, but Walmart’s ongoing response to it is. To that point, the retailer announced an accelerated hiring campaign this week aimed at adding 50,000 workers to its payroll ranging from hourly store workers to truck drivers, distribution center staff and pharmacists. In fact, in a separate but related release, Walmart Global Tech services said it was looking to bring on 5,000 additional IT workers to staff its new tech hubs in Atlanta and Toronto.

“Global Tech is the fastest-growing corporate team at Walmart and our technologists have a legacy of game-changing innovations,” Walmart EVP, Chief Technology Officer and Chief Development Officer Suresh Kumar said in a blog post announcing the staffing plans. With the addition of Atlanta and Toronto Kumar said the company now has 17 tech hubs “that span from Silicon Valley and Northwest Arkansas to Dallas and India.”

The moves come exactly one month after CEO Doug McMillon told investors on the company’s Q4 earnings calls that Walmart was becoming increasingly digital and planning to invest further into technology.

Calling All Entrepreneurs

Part of Walmart’s digital expansion plans also includes adding more sellers and new products to its marketplace, especially those that are made domestically.

The annual “Open Call” event, which attracted 900 would-be entrepreneurs last year, is Walmart’s largest source of new “shelf-ready products made, grown or assembled in the U.S.” the company said, noting the need to serve shoppers both in-store and only across the country.

The program is not just focused on recruiting new talent and will also serve as a way to train and help existing sellers grow their business.

Although the final presentations won’t take place till the end of June, Walmart said more than 2,000 companies have already registered over 6,000 products to present to company executives from both Walmart and Sam’s Club.

Done Deal, New Deal

No sooner had the digitally dominant retailer closed the books on its biggest content acquisition play ever — by way of its $8.5 billion buyout of film and TV content icon MGM — and Amazon rolled out plans for its next big thing: environmentally sustainable “net-zero” grocery stores.

In an announcement about the launch of the revamped enviro-friendly Amazon Fresh store of the future, the company touted a dozen different design features that will make the Seattle test site more efficient, including sky lights, signs made of wood, improved refrigeration and cooking units, and even low-carbon concrete in the floors.

It is also worth noting that Amazon’s net-zero store announcement, as well as one by Target, were made within hours of each other, a coincidence that also marked a major shift away from the present focus on inflation and the price of groceries.The news also comes just two weeks after it was reported that Amazon is closing all of its other non-grocery, 4-Star and bookstore physical locations.