Outsourced Dispute Resolution Services Lowered Credit Card Dispute Losses by a Third

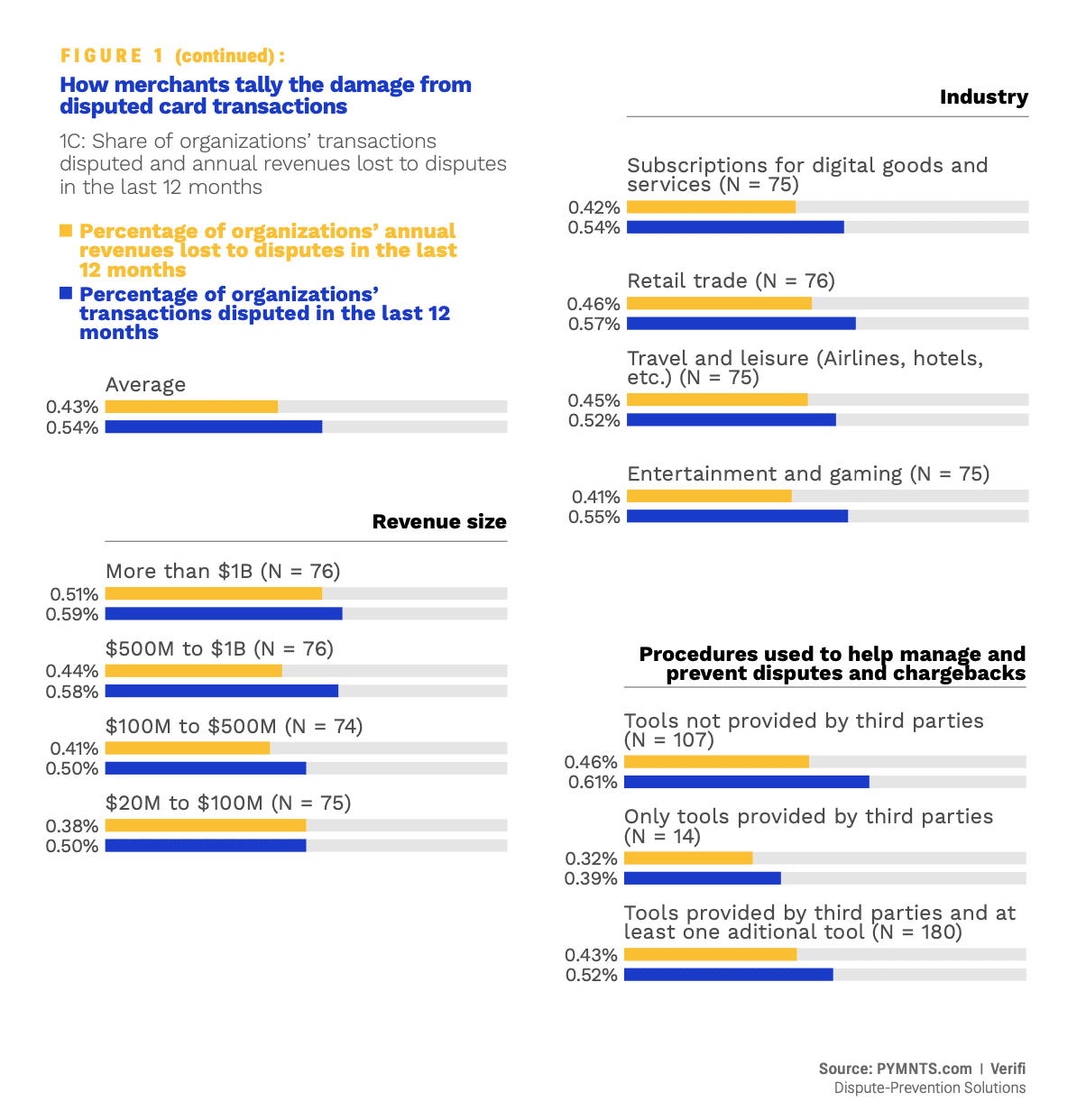

The average business has lost nearly one-half of one percent (0.43%) of its credit card payment revenue to card transaction disputes in the past 12 months, according to “Dispute-Prevention Solutions,” a PYMNTS and Verifi collaboration based on a survey of 301 merchants in four business categories.

Get the report: Dispute-Prevention Solutions

The proportion of lost revenue among the four business categories was nearly even, with entertainment and gaming companies losing 0.41%, digital goods and services subscription providers losing 0.42%, travel and leisure companies losing 0.45% and retailers losing 0.46%.

The average business has had 0.54% of its total credit card transactions disputed in the past 12 months.

Here, too, the percentage was similar among the four business categories, with travel and leisure, subscriptions for digital good and services, entertainment and gaming and retail trade reporting 0.52%, 0.54%, 0.55% and 0.57% respectively.

Merchants that use third-party solutions to manage disputed transactions lose less of their revenues to disputes and chargebacks than other firms.

The 14 surveyed firms that indicated they only use third-party tools lost just 0.32% of revenue, while firms that rely on a mix of in-house and external tools lost 0.43% of revenue — which is in line with the overall average — and those that do not use third-party systems lost 0.46% of revenue.

Those that use only third-party solutions also had a lower percentage of their transactions disputed (0.39%) than firms that use a mix of in-house and external tools (0.52%) and firms that do not use tools provided by third parties (0.61%).

While many merchants count on the effectiveness of their in-house tools to shield them from cardholders who attempt to abuse the dispute-resolution process, PYMNTS’ research has shown that third-party systems are more effective than what many merchants can implement by relying solely on their own resources.