Upscale Restaurants Close Up Shop While Downscale Brands Keep Going

As inflation forces restaurants to take drastic measures, high-end establishments are shuttering dining rooms.

By the Numbers

The December edition of PYMNTS’ Restaurant Digital Divide study, “The 2022 Restaurant Digital Divide: Restaurant Customers React To Rising Costs, Declining Service,” draws from a December survey of a census-balanced panel of more than 2,300 consumers who regularly purchase food from restaurants, seeking to understand how their dining habits have changed.

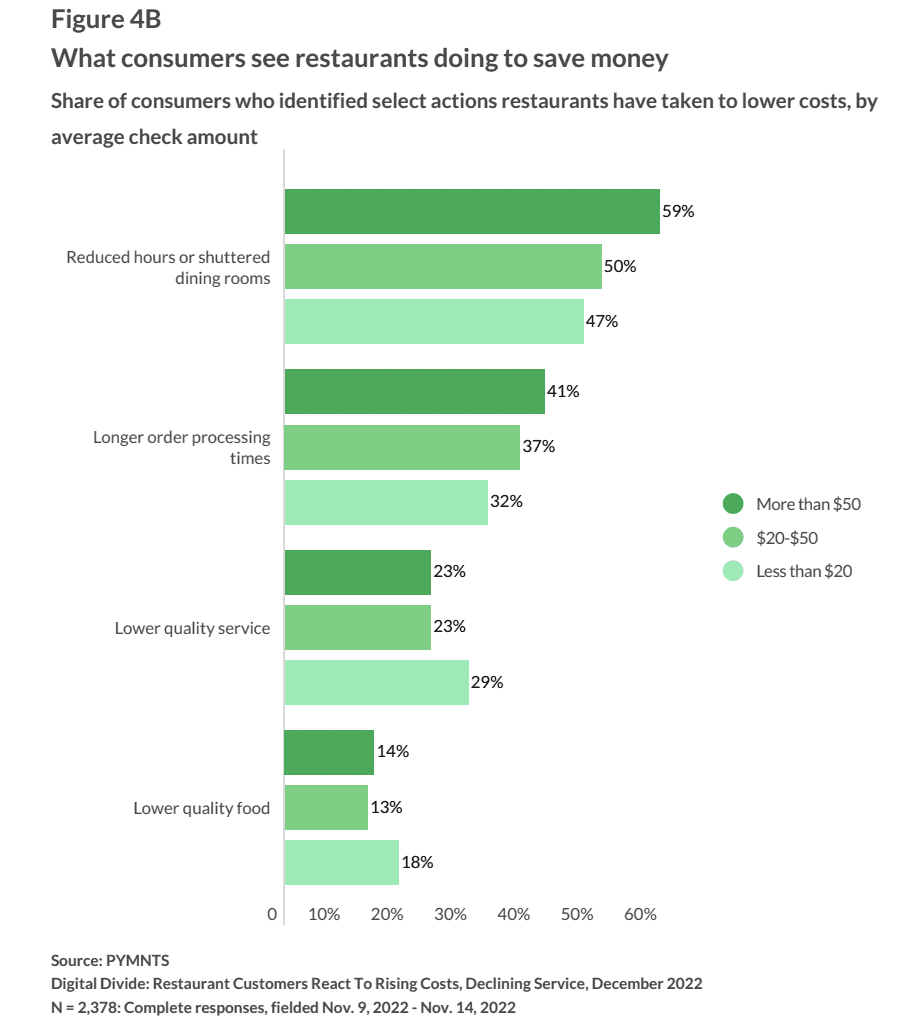

The study found that 59% of consumers have noticed reduced hours or shuttered dining rooms at restaurants where the average check amount is higher than $50. In contrast, less than half of consumers (47%) noticed the same at eateries where that amount is less than $20.

The Data in Context

These restaurants are cutting back their hours as customers rein in spending. The study also found that 76% to 88% (depending on generation) of consumers have cut back. Plus, research from PYMNTS’ study “Consumer Inflation Sentiment: Inflation Slowly Ebbs, but Consumer Outlook Remains Gloomy” found that 78% of consumers are eating at home more often to save money.

It makes sense that, with the vast majority of diners minding their restaurant spending and looking to cut back on unnecessary expenses, the most high-cost establishments would be the first to be cut out, while brands that offer lower-cost meals would remain in rotation.

In fact, some restaurants may be facing not just reduced hours but permanent closure, with independents especially at risk. Research from PYMNTS’ study “Main Street Health Q3 2022: SMBs Battle Inflation,” which drew from a July survey of 533 United States businesses, found that the share of businesses in the food, entertainment and lodging sectors that consider it “less than somewhat likely” that they will continue to operate for the next two years surged from 4.6% to 8.2% between January and July.