Online Grocers Gain Traction in Bid to Reach Struggling Consumers

As eGrocers seek to expand accessibility, PYMNTS research reveals that their efforts appear to be working.

The Context

Grocers have been working hard to drive digital adoption not only with high-earning consumers who have a financial safety net and can pay the premium for convenience but also with lower-income groups.

One way they have been doing this is by pushing digital coupons, personalizing them based on consumer data, to assuage shoppers’ price anxieties. Another is by expanding their ability to accept Supplemental Nutrition Assistance Program (SNAP) Electronic Benefits Transfer (EBT) payments, reaching the more than 40 million participants.

Ofek Lavian, CEO and co-founder of third-party payment processors (TPPP) Forage, which integrates SNAP EBT payment capabilities into eGrocery platforms, spoke to the demand for the technology in an interview with PYMNTS’ Karen Webster.

“Instacart’s traditional consumer base is suburban, affluent, middle-aged,” Lavian said. “But what we realize is that there’s actually really strong product market fit, particularly for [SNAP recipients], because one in every four SNAP recipients is actually on some form of disability. Many of them geographically live in food deserts, [and] many of them are 1099 workers, meaning [that] every hour they’re out grocery shopping might be an hour they’re not providing for their families.”

By the Numbers

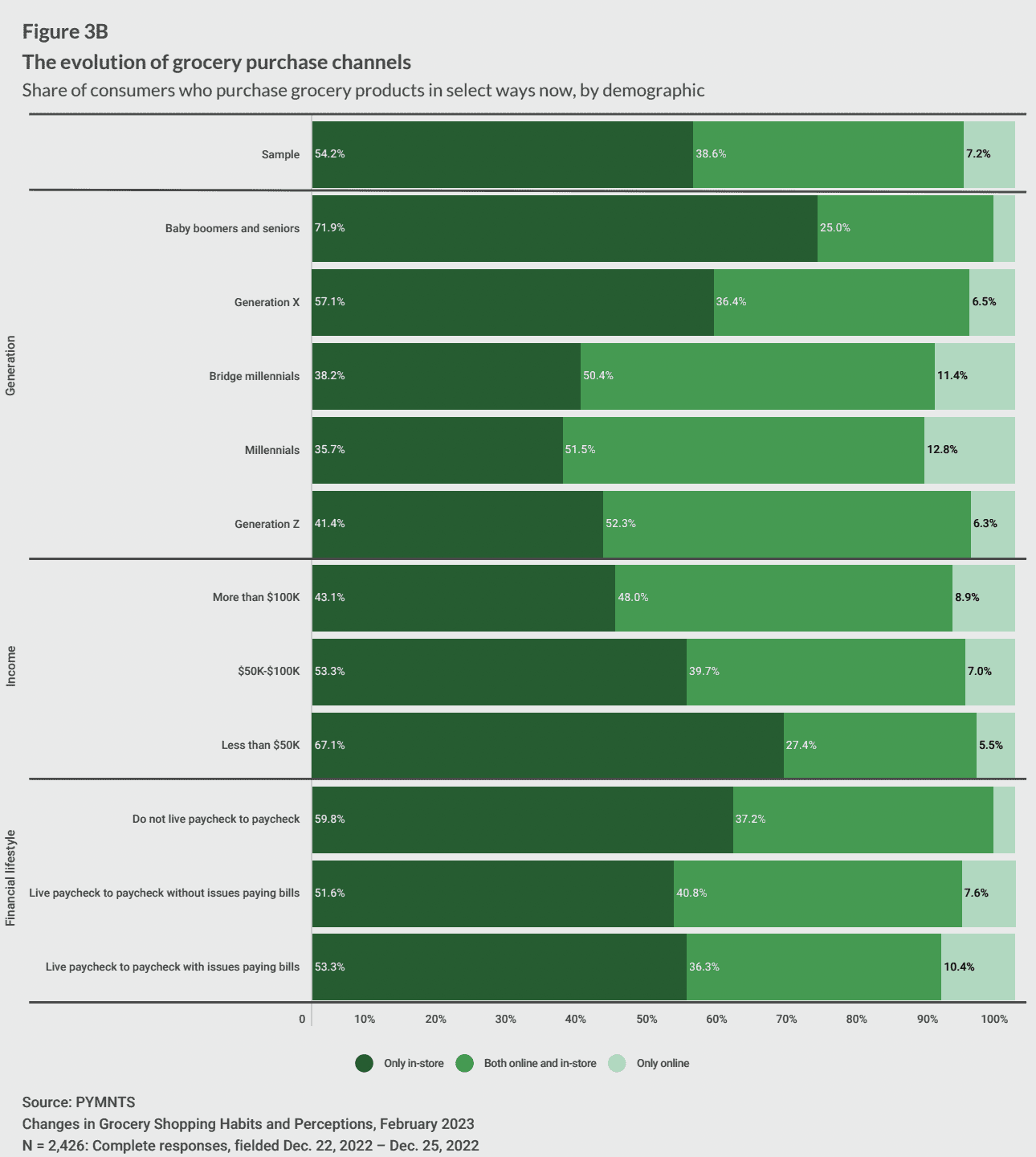

Research from PYMNTS’ recent study “Changes in Grocery Shopping Habits and Perception,” which draws from a December survey of more than 2,400 U.S. consumers, finds that those who struggle financially are the most likely to shop for groceries exclusively online.

The study found that 7.2% of consumers overall do so, while a significantly higher 10.4% of those who live paycheck to paycheck with issues paying bills do the same. This share is higher than that of any other financial lifestyle; consumers who live paycheck to paycheck without issues paying bills and those who do not live paycheck to paycheck are considerably less likely to purchase groceries only online.

Additionally, the share of those paycheck-to-paycheck consumers with issues paying bills who shop for groceries exclusively online has increased dramatically in the past few years. Pre-pandemic, it was only 0.4%.