Millennials With Debt and Dependents Most Likely to Feel the Financial Crunch

PYMNTS’ research finds that 60% of United States consumers live paycheck to paycheck as of March 2023. Our data also reveals significant generational differences in how the rising cost of living impacts consumers’ financial lifestyles.

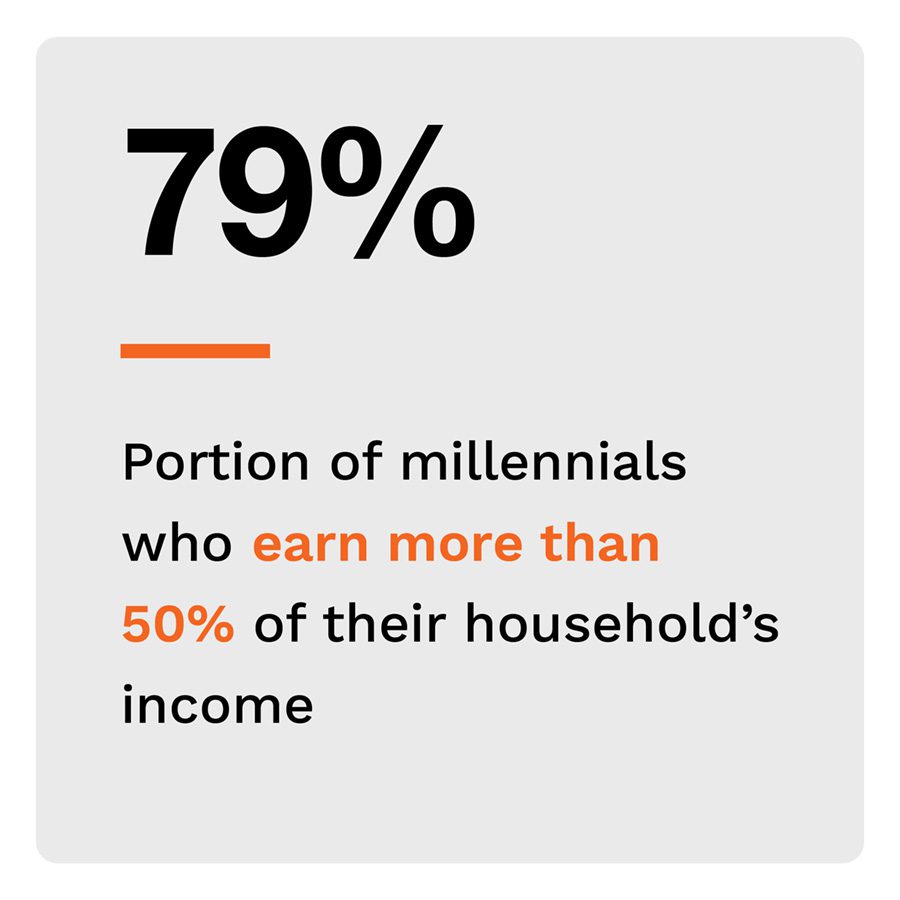

For instance, millennials are the most likely to live paycheck to paycheck, with 73% currently doing so. In a year-over-year comparison, this share has stayed the same, but the share of Generation Z consumers living paycheck to paycheck has risen to 66%.  The share of baby boomers and seniors living paycheck to paycheck has leveled off after a considerable increase in the first months of 2022.

The share of baby boomers and seniors living paycheck to paycheck has leveled off after a considerable increase in the first months of 2022.

Supporting dependent family members and paying off debt are key reasons millennials cite for living paycheck to paycheck, while one-third of Gen Z cite nonessential spending. Baby boomers and seniors, meanwhile, are less likely to have debt or face life-changing events such as relocation or divorce, and they are more fiscally conservative.

These are just some of the findings detailed in this edition of “New Reality Check: The Paycheck-to-Paycheck Report,” a PYMNTS and LendingClub collaboration. The Generational Deep Dive Edition examines why U.S. consumers across all generations live paycheck to paycheck and identifies the financial stressors the different generations face. This edition draws on insights from a survey of 3,363 U.S. consumers conducted from March 8 to March 17, as well as analysis of other economic data.

More key findings from the study include the following:

• Gen Z consumers are the only age group spending on clothing or electronics while living paycheck to paycheck, probably because more than half still live with parents or siblings.

• Gen Z consumers are the only age group spending on clothing or electronics while living paycheck to paycheck, probably because more than half still live with parents or siblings.

The likelihood that a consumer has spent $100 or more on a nonessential expense decreases significantly for paycheck-to-paycheck consumers, except for those in Gen Z. Among Gen Z consumers, 75% of those not living paycheck to paycheck have spent $100 or more on a nonessential expense, while 73% of those living paycheck to paycheck spent as much on a nonessential expense. Living with parents or siblings probably gives them a buffer that consumers in other stages of life do not have.

• Older generations face fewer financially distressing events.

According to PYMNTS’ data, 62% of overall consumers experienced a financially distressing event such as a job loss, failed investments or relocation in the last three years. However, just 51% of baby boomers and seniors report experiencing one of these events over that same period. Our data also shows that Gen Z consumers and millennials were more likely than average to report experiencing at least one of these events.

• Less than one-tenth of baby boomers and seniors are paying off credit card balances with an installment payment plan, compared to four in 10 millennial and Gen Z consumers.

Credit cards are a popular credit product: 89% of baby boomers and seniors, 87% of millennials and 73% of Gen Z consumers have at least one credit card. Older consumers are less likely to carry balances and less likely to have an installment plan to repay the balance. For example, while 44% of millennials and 38% of Gen Z consumers report having installment plans, just 7.6% of baby boomers and seniors say the same.

Consumers of all generations are adapting to the current economic landscape even though rising inflation and financial stressors make it difficult for many to make ends meet. The strategies they use depend on the stage of life they are in.

Download the report to learn more about the generational differences of U.S. consumers living paycheck to paycheck, the financial stressors each group faces and how they are coping with this financial lifestyle.