With the advent of remote work, limited time and the increasing demand for convenience, ready-to-eat meals have experienced a surge in popularity among consumers.

Cost, too, was a key driving force behind the rise in ready-to-eat meal demand. While restaurant takeout meals provide convenience and variety, they can be costly, particularly with added delivery service charges, tips and price markups from third-party apps.

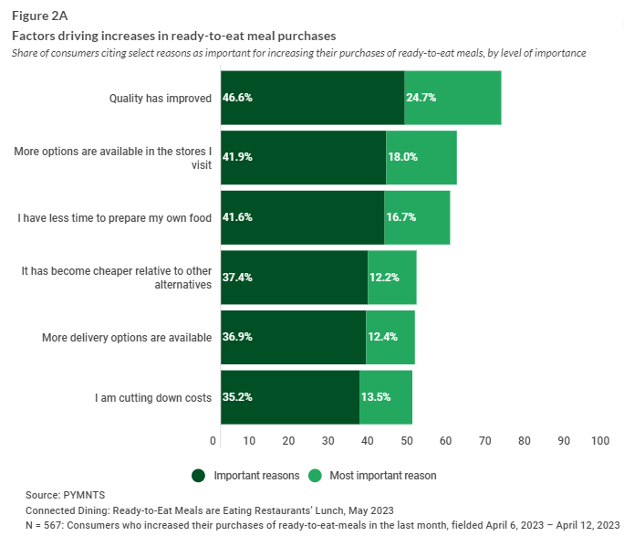

Ready-to-eat meals, on the other hand, present a cheaper alternative, which is evidenced by the 37% of consumers who reported that the affordability of prepared meals was the main reason for the increase in consumption of these meals.

In fact, nearly 100 million consumers in the United States, many of whom are regular restaurant-goers, purchased ready-to-eat meals in a single month, PYMNTS Intelligence shows, with about a quarter of them buying these prepared meals at least once a week.

In the “Connected Dining: Ready-to-Eat Meals are Eating Restaurants’ Lunch” report, PYMNTS leverages insights gathered from a survey of about 2,400 U.S. consumers to evaluate factors driving increases in ready-to-eat meal purchases in the last year and the potential for these meals to eat into restaurants’ market share.

Findings captured in the study show that food quality has played a significant role in the growing popularity of ready-to-eat meals, with nearly 50% of consumers citing improved quality as the top reason they increased their consumption of ready-to-eat meals in April this year compared to a year ago. Millennials and bridge millennials were observed to value quality the most.

Additionally, ready-to-eat meals offer the convenience and time-saving benefits that these consumers require, especially as they navigate long working hours, daily video calls, and the additional responsibilities of cooking for their families and managing remote schooling.

This was the case for 41% of survey respondents, who said having less time to prepare their own food was a key factor in why they purchased more ready-to-eat meals in the last year. Another 41% of consumers attributed the increase in ready-to-eat meal purchases to the availability of a wider range of prepared meal options.