73% of Card Users Say They Prefer Cards with Linked Offers — But Just 41% Used Them

Most consumers shop with brands and merchants where they are members of a loyalty or rewards program. Moreover, 4 in 10 consumers prefer cards with personalized rewards as these programs provide economic incentives to increase customer loyalty. One-third say they would switch to shopping with merchants that offer card-linked offers.

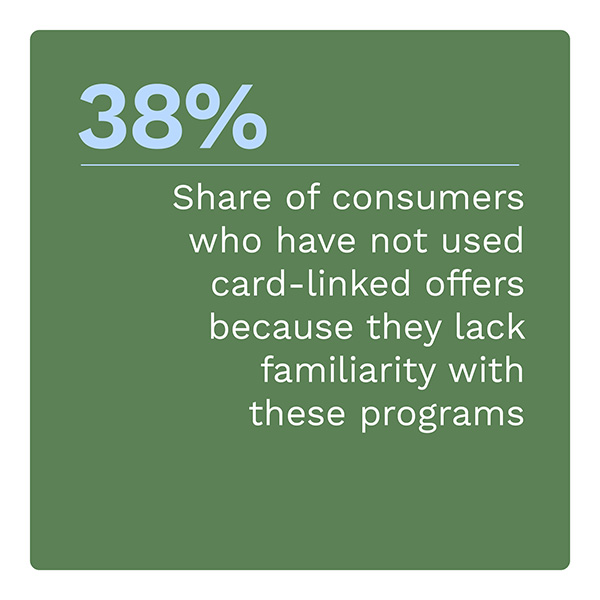

However, merchants and card issuers must boost their marketing. Although 41% of consumers overall used card-linked offer programs in the last year, 38% of consumers who did not use them cited a lack of familiarity as a reason.

However, merchants and card issuers must boost their marketing. Although 41% of consumers overall used card-linked offer programs in the last year, 38% of consumers who did not use them cited a lack of familiarity as a reason.

These are just some of the findings in “Leveraging Item-Level Receipt Data: How Card-Linked Offers Drive Customer Loyalty,” a PYMNTS Intelligence and Banyan collaboration. This report examines how merchants using item-level receipt data can provide card-linked offers that increase consumer engagement and improve customer loyalty. We surveyed 2,069 U.S. consumers from July 17 to July 20 to learn about their interest in loyalty and rewards programs, their preference for card-linked offers and what merchants can do to increase awareness and usage of them.

Card reward programs — particularly personalized ones — build customer loyalty, as most consumers shop with brands and merchants where they are members of a loyalty or rewards program.

Sixty-five percent of card users are loyal shoppers, meaning they shopped with brands or merchants where they are members of loyalty or rewards program in the last 30 days. Millennials are the most likely to be loyal shoppers and most likely to become new customers, meaning they are a key segment for card rewards programs.

Consumers who have used card-linked offers in the last year are highly satisfied with these programs, especially millennials, new customers and consumers with children.

Card-linked offers keep customers engaged, and, as a result, they tend to buy more. Furthermore, consumers who have used card-linked offer programs are highly satisfied with them, whether the offers were product or merchant specific.

Those more likely to use card-linked offers — millennials, new shoppers and consumers with children — are also more likely to be satisfied with these programs than the average consumer. This is especially true for card-linked offers tied to specific products: 85% of bridge millennials, 75% of new shoppers and 69% of consumers with children are highly satisfied with these offers.

More than 6 in 10 consumers report they will use card-linked offers when spending on travel, professional services or groceries in the next three months.

Sixty-four percent of consumers using card-linked offers will likely use them in the next three months when paying for local travel expenses. Meanwhile, approximately 61% of consumers say the same for spending on professional services, long-distance travel and groceries. More than half of the consumers surveyed say they will use card-linked offers when paying for digital streaming services, at 54%; food items from a restaurant, at 53%; and retail products, at 51%.

Despite high interest in card-linked offers, merchants may be leaving a significant share of consumers on the table due to consumers’ lack of familiarity with these programs and may need to boost their marketing campaigns to drive adoption. Download the report to learn how personalized and relevant card-linked offers can drive customer engagement.