Half of Loyal Customers Have Multiple Subscriptions, Data Shows

Retail product subscribers’ spending patterns and demographics can vary significantly, and understanding these dynamics can aid providers in minimizing churn and targeting the most valuable clientele.

Against this backdrop, subscription models have emerged as a prominent feature, offering a range of benefits such as frequency, flexibility, discounting and special access as providers craft tailored strategies to maintain a competitive edge in the market.

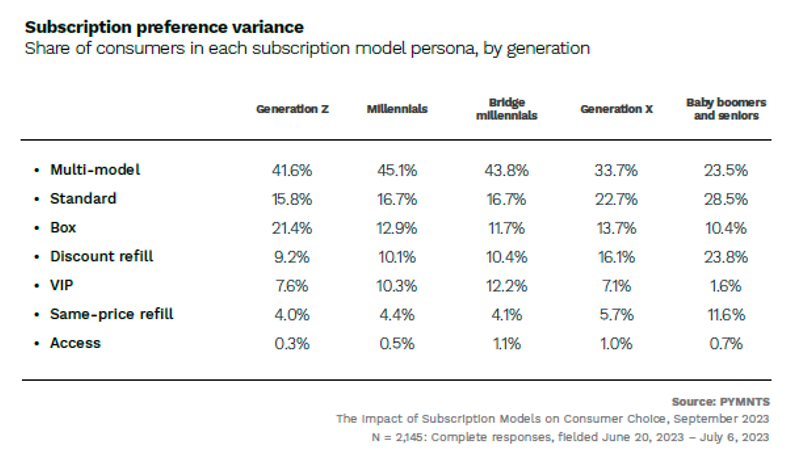

In “The Impact of Subscription Models on Consumer Choice,” PYMNTS Intelligence categorizes subscribers into seven distinct personas according to their subscription patterns, using insights from a survey of over 2,100 consumers. These subscriber personas are standard, box, access, discount refill, same-price refill, VIP and multi-model.

One interesting finding from the study is the rise of multi-model subscribers, the most common and valuable persona. These individuals have multiple subscriptions across different types, with no single model comprising more than half of their portfolio.

Accounting for 38% of subscribers, multi-model subscribers have the highest total lifetime value (LTV) across retail subscriptions, averaging $3,021. This group also comprises 50% of loyalists, the highest LTV consumers who keep their subscriptions the longest. Following closely are VIP subscribers, who focus on special, higher-tier memberships, and have an average LTV of $2,867.

The data also reveals that younger consumers, particularly millennials and Generation Z, dominate the multi-model and VIP personas, the two most lucrative subscriber groups. Conversely, baby boomers and seniors are relatively untapped in the VIP subscriber group, presenting an opportunity for subscription providers to focus on this demographic.

When it comes to adding additional subscriptions, subscribers tend to stick with the models they already prefer. For instance, 61% of VIP subscribers are highly likely to add another VIP subscription, while nearly 50% of box subscribers express a strong interest in additional subscriptions of the same type.

The data also shows that enjoyment and convenience are the primary factors driving subscription choices, as revealed by subscriber preferences. Cost, while still significant, takes a backseat, with 18% of subscribers citing it as the most important reason for subscribing. However, cost plays a role in churn, requiring providers to deliver competitive value.

The report further sheds light on the differences between VIP and discount refill subscribers or savers. VIP subscribers prioritize enjoyment and convenience, while discount refill subscribers place a greater emphasis on cost. Understanding these differences can assist providers in tailoring their strategies to align with their target customer base.

Subscription models are key to understanding subscriber patterns and increasing their LTV. By analyzing subscriber behavior, targeting specific demographics, and adapting their marketing and retention efforts to cater to these preferences, subscription providers can optimize their offerings and maximize customer satisfaction.