As consumers look ahead to the rest of the year, many are not as concerned about retail inflation as they once were.

This month’s installment of the PYMNTS Intelligence “Consumer Inflation Sentiment” series, “Consumers Cautiously Spend More Amid Lower Inflation,” drew from a January survey of nearly 5,000 United States consumers seeking to understand their end-of-year spending habits in 2023 and what they might reveal about retail spending in 2024.

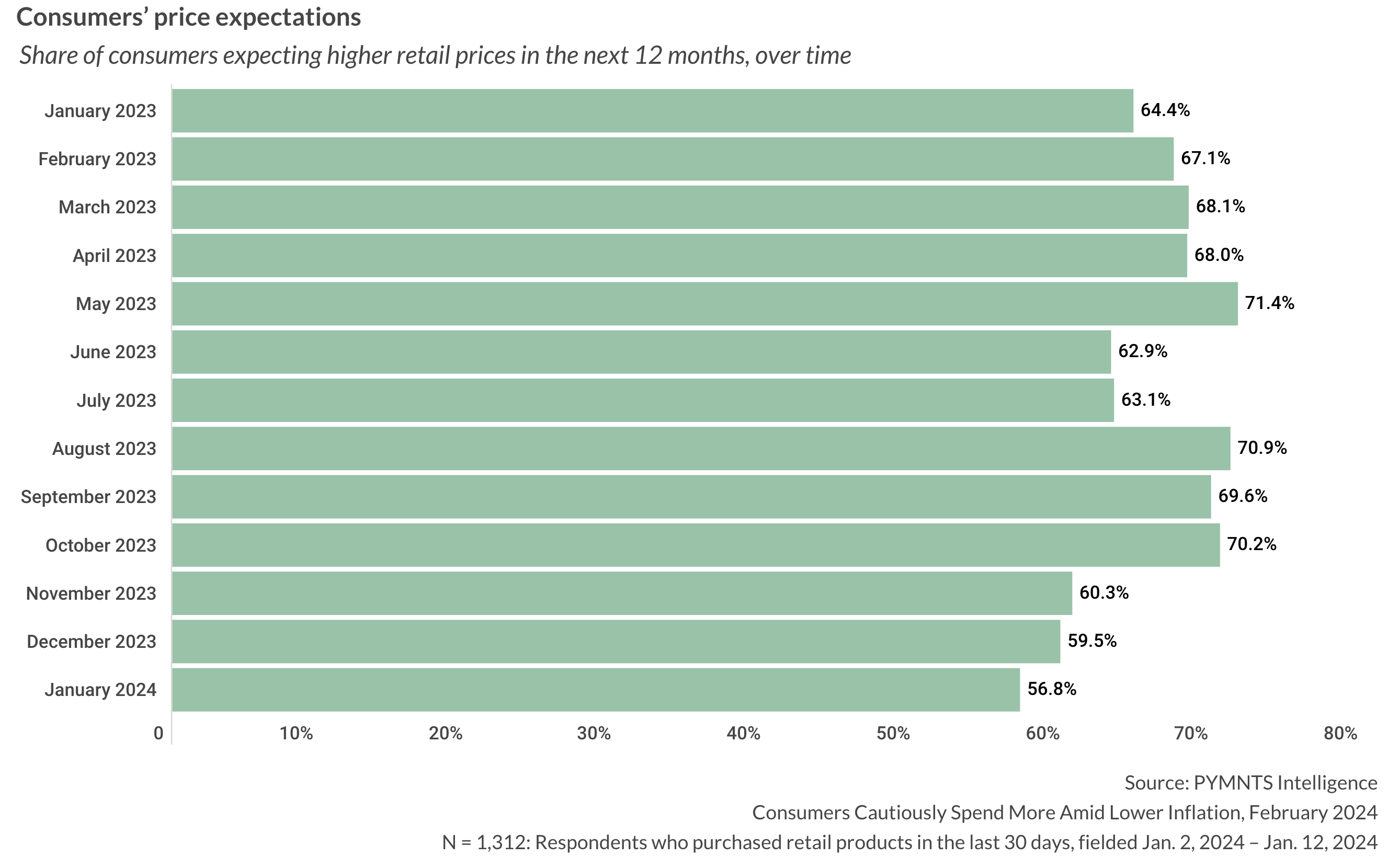

Shoppers’ expectations regarding retail prices are growing more positive. The percentage of consumers anticipating ongoing inflation in retail prices in the next 12 months decreased from 64% in January 2023 to 57% in January 2024, despite surges in inflationary concerns in mid-2023.

The decline in the percentage of consumers expecting higher retail prices suggests a shift toward more favorable expectations, which could influence their purchasing behavior and overall economic sentiment. Additionally, this trend may signal a potential easing of inflationary pressures in the retail sector, although other factors such as supply chain dynamics and macroeconomic conditions could still throw a wrench in matters.

Despite this rising optimism, retail sales are not necessarily trending positively. January’s 0.8% slide in retail sales, as announced Thursday (Feb. 15) by the U.S. Census Bureau, was worse than estimates, where consensus had looked for a 0.3% decline from December’s levels. The rise in December, over November’s levels, had been 0.4%.

The slide, although not universal among categories, was widespread. Nine of the 13 categories tracked were lower in January. The sole gainers were furniture and home furniture stores, up 1.5% in the month; food and beverage stores, up 0.1% (including groceries, which were up 0.6%); department stores, which eked out a 0.5% gain; and restaurants, which showed a 0.7% gain.

As consumers anticipate the year ahead, PYMNTS Intelligence research and Census Bureau data reveal that diminishing concern about retail inflation may not necessarily translate immediately to gains for retailers.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.