Cash-Back Deals Could Drive Consumer Adoption of Pay by Bank

Amid consumer hesitation to adopt account-to-account (A2A) payments, cash-back incentives could go a long way toward driving use.

By the Numbers

The PYMNTS Intelligence study “Tracking the Digital Payments Takeover: Consumer Familiarity Controls Account-to-Account Payment Growth” drew from a survey of more than 3,300 U.S. consumers to discover how they engage with A2A payment options.

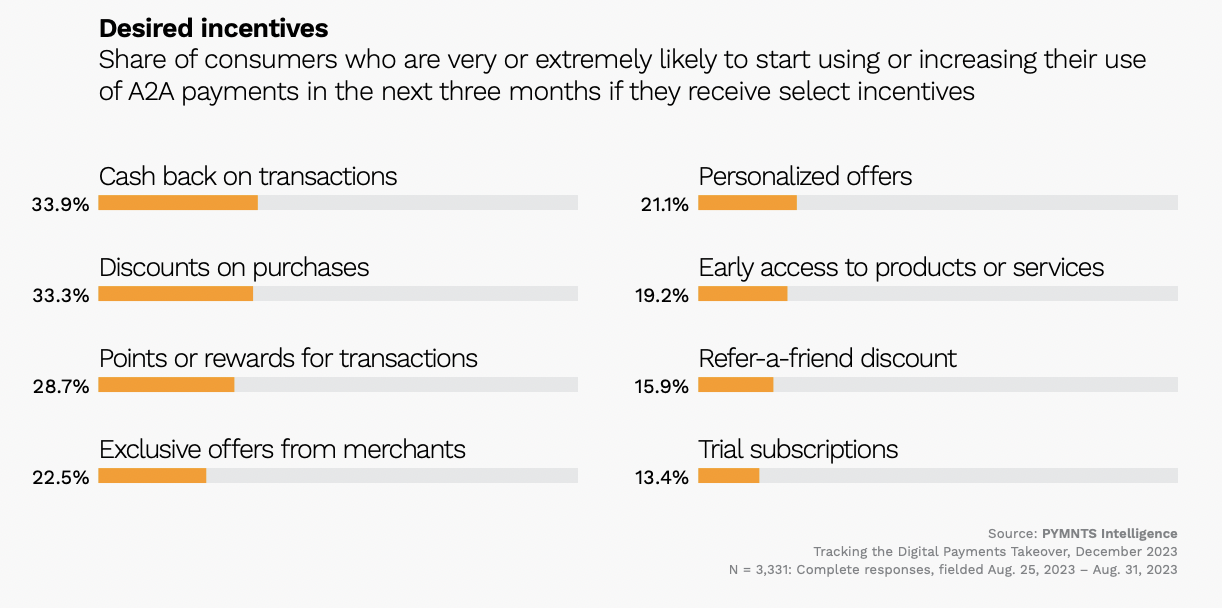

The results revealed that among the 41% of consumers who are “very or extremely likely to use A2A if offered incentives,” 34% would probably do so if offered cash back on transactions. Meanwhile, the second-most in-demand incentive is discounts on purchases, with 1 in 3 consumers likely to use the payment method if offered this perk.

The Data in Context

As Chris Jameson, managing director and head of GTS product management EMEA at Bank of America, told PYMNTS in an interview last year, A2A payments are quicker and more secure, allowing online shoppers to instantly pay from their bank accounts without the need for credit or debit card information.

“[It’s] an alternative to cards,” Jameson said at the time. “The payment will actually come from the consumer’s bank account through various API calls rather than going through the card rails.”

Yet the lack of consistent branding and nomenclature for these transfers can cause security anxiety around “new” payment methods that aren’t new, but rather preexisting technology repurposed for new uses, as Nuvei Vice President of Product Ed Dean told PYMNTS in an interview last June.

“When we talk about account-to-account, it goes by many names,” Dean said at the time. “Account-to-account, bank transfer, online bank transfer. I think the trend we’re seeing right now is the emergence of our online bank transfer concept, if you will. From a payment perspective, let’s just start by saying it’s all ACH.”

The fact that A2A payments, possibly better known to consumers as bank transfers, use ACH rails established over 50 years ago and are considered as secure as it gets when sending and receiving money, should put a lot of minds at ease, Dean contended.