New Data: Security Concerns Overshadow Convenience in ‘Everyday App’ Debate

More consumers than ever now rely on mobile apps to manage their daily chores.

PYMNTS Intelligence found that a growing percentage of Americans click on apps to administer their bank activity (49%), bills and subscriptions (37%), savings and investments (26%), retail shopping (24%) and grocery purchases (14%).

So, would a single “everyday app” that can more efficiently manage life’s mundane tasks be a welcome resource?

Most consumers say yes, according to “Consumer Interest in an Everyday App,”which surveyed 3,320 U.S. and Australian consumers about their reliance on apps and their interest in an everyday app.

Most respondents from both countries said they would embrace one consolidated app. Seventy percent of consumers in the U.S. and Australia said they would welcome such an app to streamline paying bills and shopping, while 60% of U.S. respondents and 56% of those in Australia would deploy it to manage their banking activities.

However, the report also found that most consumers would be skeptical that such an all-encompassing app could deliver on the security front.

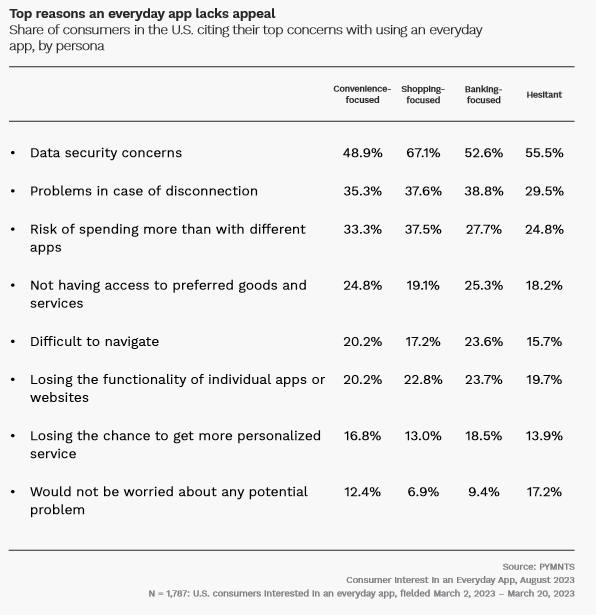

Sixty-four percent of both U.S. and Australian respondents “felt uneasy about an everyday app’s ability to safeguard sensitive personal and financial information,” making data security the top reason consumers would be reluctant to use an everyday app.

Zeroing in on U.S. consumers specifically, 67% of “shopping-focused” Americans said data security concerns would be the No. 1 barrier preventing them from adopting an everyday app. Nearly 53% of “banking-focused” American consumers cited the same reason for their reluctance.

So, which security features could help win over the skeptics?

Two-factor authentication topped the most-wanted list, according to 31% of Australian consumers and 25% in the U.S. Twenty-four percent of respondents in both countries said data encryption would also provide peace of mind.

The report also found that among those with no interest in an everyday app whatsoever, 27% of U.S. respondents and 23% of those in Australia might be swayed if data encryption was an added security feature.