Only 22% of Companies Tap Recovery Tools for Failed Cross-Border Payments

Many eCommerce merchants in the United States want to expand their businesses through cross-border sales, but cross-border transactions are not without pain points.

As PYMNTS Intelligence’s “Cross-Border Sales and the Challenge of Failed Payments” revealed, faulty cross-border payments took a toll last year, costing U.S. merchants at least $3.8 billion in sales.

The report drew on insights from 300 executives who identified the challenges they face when initiating cross-border payments.

Eighty-two percent of merchants said they find it difficult to identify the causes of failed payments. Those merchants with a high cross-border focus experienced an average failure rate of 11.4%, compared to 10.1% for those with a low cross-border focus.

Once the payments fail, other headaches may surface. Sixty-seven percent of respondents identified customer recovery as being a challenge. Sixty-two percent said the reputational damage that follows is problematic. Increased workloads after the fact are an issue for 59% of respondents.

When cross-border payments are unsuccessful, what sort of damage control follows?

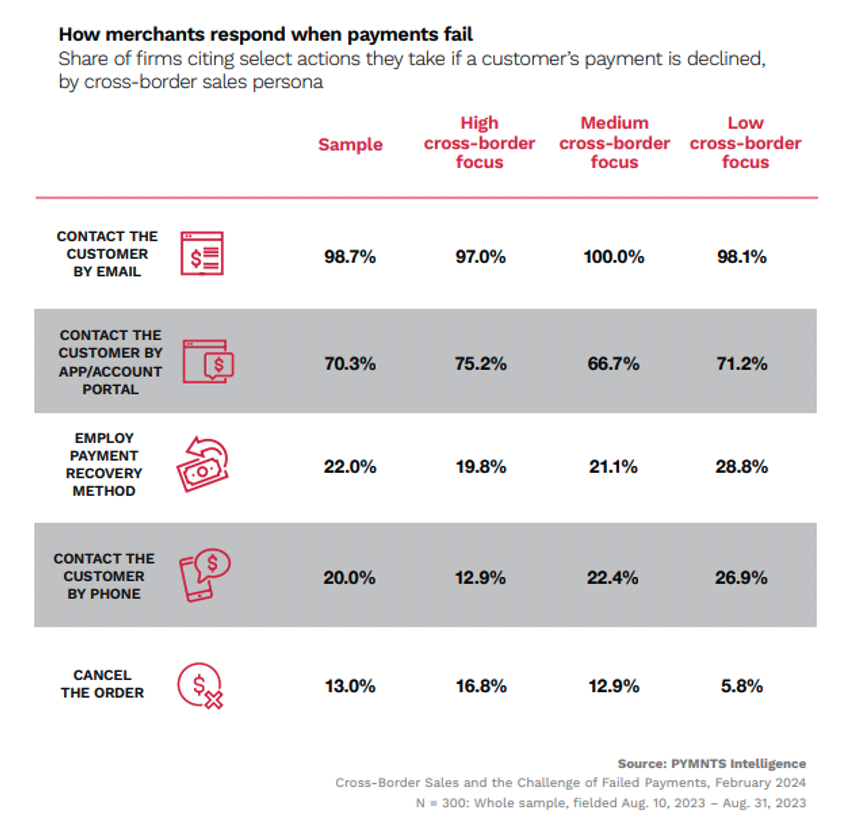

Nearly every company notifies their clients via email. Seventy percent said they contact their customers through apps or account portals, reflecting a missed opportunity for those remaining 30%. Twenty percent reach out by phone, which is most common among those with a low cross-border focus, at 27%. Thirteen percent simply cancel some orders — a costly reaction more common among high and medium cross-border focus firms, at 17% and 13%, respectively, than low cross-border ones, at 5.8%.

Few use recovery payment tools. Fifty-five percent of high cross-border focus firms use automatic retry solutions, ahead of their low cross-border focus counterparts, at 40%. Similarly, 61% of high cross-border focus merchants employ payment recovery software, versus 54% for low cross-border focus firms.

These rates are relatively low and may reflect a lack of collaboration between the companies and payment service providers (PSPs).

Given the fact that nearly $4 billion was lost last year in failed cross-border payments, merchants, especially smaller ones, should strengthen their collaboration with their PSPs. Such partnerships can create access to advanced tools and expertise that can reduce the headaches and losses business owners now endure.