New Data: Twice As Many Online Shoppers Believe Credit Cards Are More Secure Than Debit Cards

It is well known that shoppers tend to behave differently online than they do in brick-and-mortar stores — and this extends to how they choose to pay at checkout.

It is well known that shoppers tend to behave differently online than they do in brick-and-mortar stores — and this extends to how they choose to pay at checkout.

One of the more notable differences is their tendency to favor credit cards online and other options such as digital wallets over debit cards. What’s more remarkable is the resistance to using debit online even though debit use overall has been growing during the pandemic — a phenomenon attributed to the economic anxieties and budgetary concerns it has engendered.

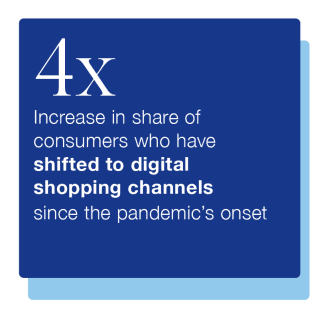

PYMNTS’ latest research report, “Online Security And The Debit-Credit Divide,” a PYMNTS collaboration with Elan based on a survey of 2,466 U.S. consumers, offers an in-depth examination of how and why consumers choose to pay online. These questions have vital significance amid the unprecedented shift to online commerce since last March. The report finds that 45% of U.S. consumers have shifted to digital shopping channels to purchase retail products, a fourfold increase since the start of the pandemic.

PYMNTS research reveals that security is at the heart of distinctions between consumers’ attitudes toward using debit, credit or other options to pay online. Thirty-five percent of credit card users believe they offer protection against theft of funds — twice the share of debit card users with this same view of the payment method. Consumers also appear to have more confidence in the overall security of credit cards as 27% of credit card users cite data security as a motivating factor, while only 14% of debit card users cited it.

The report also takes a broader look at online purchasing trends during the pandemic, with research showing that the online payment mix is growing increasingly diverse. Forty-one percent of consumers prefer to pay with credit cards, for example, while 31% prefer debit and 15% prefer digital wallets.  This payment field is in flux, however as PYMNTS research shows 28% of credit card users have increased their use of the payment method since the pandemic, yet all three payment methods — debit, credit and digital wallet — also saw users shift to other payment methods.

This payment field is in flux, however as PYMNTS research shows 28% of credit card users have increased their use of the payment method since the pandemic, yet all three payment methods — debit, credit and digital wallet — also saw users shift to other payment methods.

These findings have important implications for card issuers. They may have to redouble efforts to keep their cards at the top of consumers’ wallets amid an increasingly competitive and growing landscape of online payment options. Card issuers’ efforts may have to begin with understanding the elevated security concerns consumers have when it comes to shopping online if they are to be successful.

To learn more about the key factors driving consumers’ online payment decisions, download the report.