The digitalization trend that followed the pandemic has accelerated the automation journey for nearly one-third of mid-sized firms.

In the last two years, remote work requirements pushed 29% of firms to automate their accounts payable (AP) and accounts receivable (AR) processes. Benefits of automation in this area include streamlined processes, operational efficiency or enhanced accuracy, which result in savings and better cash flow management for businesses. However, automation is not occurring in the same way at all firms, as the size of a business affects its approach.

These are some of the conclusions drawn from “Accounts Payable and Receivable Trends: The Journey to Automation,” a PYMNTS Intelligence and American Express collaboration that explores the benefits and hurdles of making the switch to automation in AP/AR.

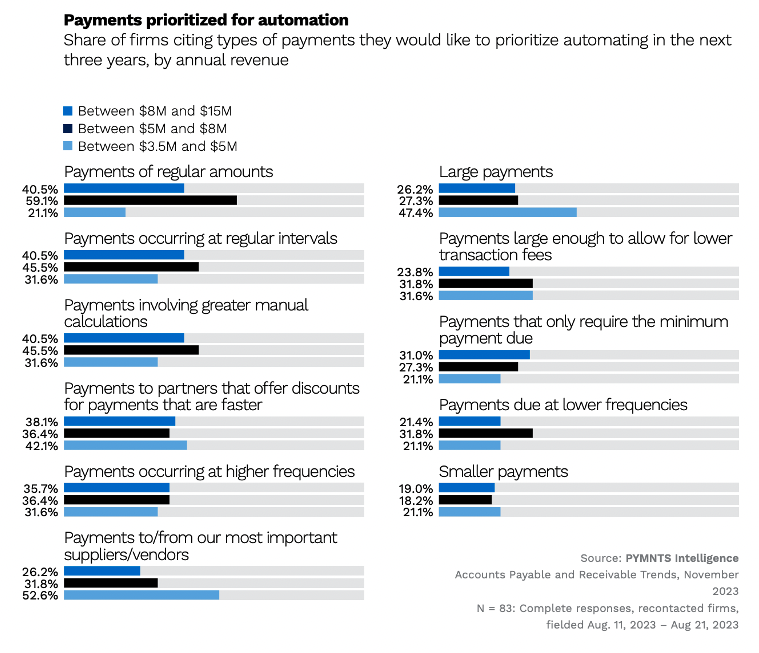

According to the study, large firms with more complex needs find remote capabilities crucial in their day-to-day operation. Small firms, conversely, prioritize payments that offer financial incentives such as discounts, which can yield immediate returns.

On the other hand, 42% of mid-size companies target payments of regular amounts, and 36% target those occurring at regular intervals. This approach reflects a focus on long-term operational efficiency rather than immediate financial gain. As a result, mid-size companies can allocate the resulting savings to buy inventory, pay suppliers or fine-tune operations.

Despite recognizing the need for automation, many firms face barriers to entry, including implementation costs and learning hurdles. Nearly half of the firms surveyed expressed apprehension regarding the cost of introducing new technology into their operations. This is especially true among smaller firms.

Advertisement: Scroll to Continue

Additionally, one-third of these firms cite the time required to grasp new systems as a major concern, constituting the second barrier to embracing automation in payments.

Mid-size firms are increasingly turning to automation to gain a competitive edge and enhance efficiency in the market. Leaders of mid-size firms should consider how societal shifts such as the expansion of remote working could serve as a catalyst for operational changes and prepare their businesses accordingly. In the long run, further automation may be translated into cost savings that can be allocated to fine-tune operations or foster growth.