The accounts receivable (AR) function of a business relies on timely payment for goods and services provided, which can help optimize the cash conversion cycle and help businesses grow.

Frictions in the process, however, present companies with hurdles which can directly impact cash flow and reduce operational efficiency. Payment-related delays have been identified as the most important source of business disruption by 41% of chief financial officers surveyed, with 68% saying they experienced some form of it in the last six months.

Frictions in the process, however, present companies with hurdles which can directly impact cash flow and reduce operational efficiency. Payment-related delays have been identified as the most important source of business disruption by 41% of chief financial officers surveyed, with 68% saying they experienced some form of it in the last six months.

Implementing specialized AR automation solutions can help overcome these hurdles by automating invoicing and collection processes. CFOs of firms of all sizes credit automation with reducing disruptions along the order-to-cash continuum by helping reduce errors, automate customer service and provide instant tracking.

In “Accounts Receivable Automation Smooths Order-to-Cash Continuum,” a PYMNTS and Corcentric collaboration, we surveyed 100 CFOs of United States-based firms from different segments that generate $250 million or more in annual revenue to explore the frictions CFOs experienced in the order-to-cash cycle that resulted from payment delays, how they use automation to alleviate these issues and their inclination to add more automation to their AR processes.

Other key findings from the playbook include the following.

When automating AR, the size of a firm can dictate the type of solution it chooses based on its strategic needs.

While automation in general is capable of addressing many AR disruptions, there is no one-size-fits-all solution. Choosing the right configuration depends on the size of the firm and the complexity of its revenues and billing processes. For example, among firms that generate more than $1.5 billion in revenue, 69% of CFOs said they use digital technology applications for cash posting. In addition to size, it is important to consider how long the business has been operating, as well as its global footprint and strategic growth priorities.

CFOs credit specialized automation with reducing friction across the order-to-cash continuum.

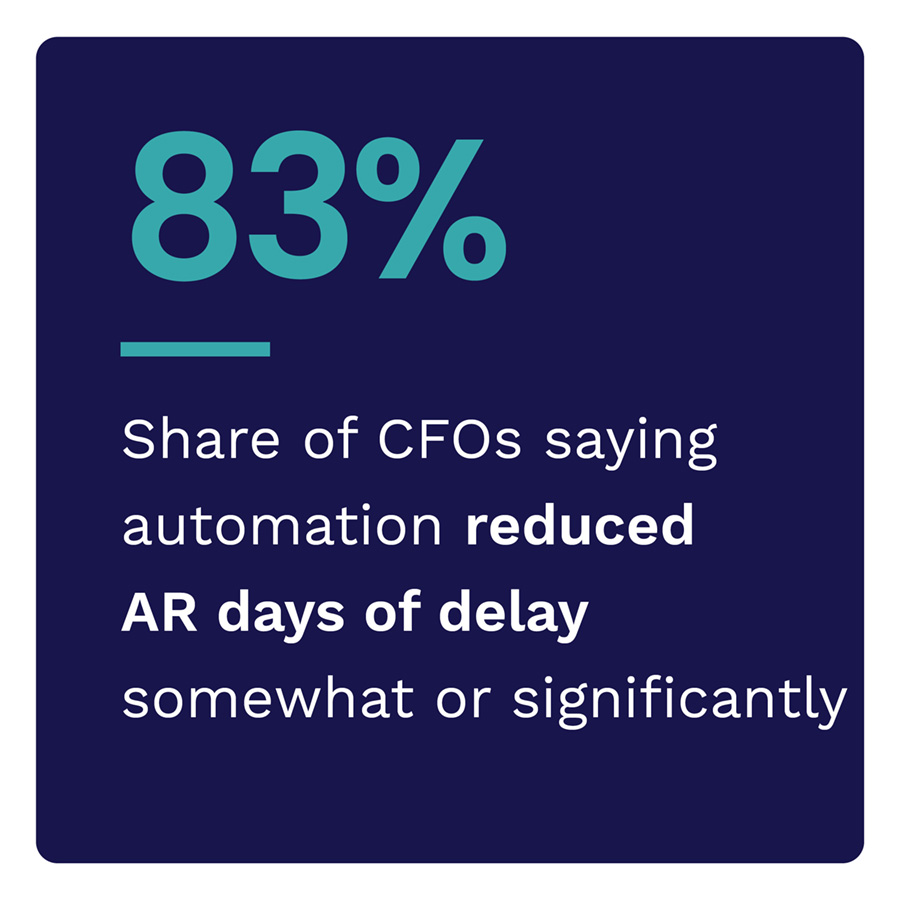

Synchronizing the efforts of different departments involved in the AR process can go a long way to reducing frictions in the order-to-cash cycle. Specialized automation also enables CFOs to have better visibility into the entire process, helping to reduce invoice errors and billing discrepancies. Across businesses of various sizes, 40% of CFOs said automation significantly alleviates problems related to payments and exceptions around payments. This problem-solving capability was particularly important to firms generating between $750 million and $1.5 billion in sales, with 83% of CFOs of those firms saying automation reduced AR days of delay.

The ability of automated AR solutions to solve issues in the order-to-cash cycle makes them the need of the hour for 90% of CFOs.

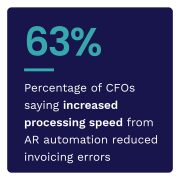

Although automating AR processes provides multiple benefits, many businesses still have not used the full extent of the technology’s capabilities. This will likely change, with 9 out of 10 CFOs demanding more automation, which suggests that businesses of all sizes will be investing in more software and digital technology to smooth their order-to-cash cycle. Areas of AR automation which might see more growth in the near future include customer service, which has a direct impact on cash conversion according to 72% of CFOs, and increasing order processing speed to reduce invoicing errors and hasten payments, according to 63% of CFOs.

There is a clear indication that firms will increase their use of digital technologies in financial management, and those that are unwilling or slow to automate may find themselves at a competitive disadvantage. Download the report to learn more about how AR automation reduces payment delays.