Digital fraud is a constant challenge for organizations, as bad actors are deploying a plethora of methods to steal data, funds and other valuables. One of the most widespread types of digital fraud is new account fraud, which occurs when fraudsters leverage false identities to open bank or business accounts that serve as staging grounds for committing financial crimes. Identity fraud cost consumers more than $56 billion in 2020 alone, and there are as many ways of obtaining false identities as there are ways of using fake accounts, making new account fraud extremely difficult to deter by conventional means.

Behavioral analytics is one strategy that organizations are using to curb this fraud, however. The following PYMNTS Intelligence explores how and why fraudsters stage new account fraud and how behavioral analytics can examine user interactions behind the scenes to identify and stop bad actors.

What Is New Account Fraud?

Fraudsters employ many strategies when perpetrating new account fraud. Identity theft is the most well-known and occurs when bad actors steal others’ identities and use them to open new accounts for fraudulent purposes. These identities can be stolen directly from victims or purchased from dark web marketplaces, but in either case, their origins are usually phishing. Other fraudsters fabricate synthetic identities: new personas forged out of whole cloth, often cobbled together from bits of other individuals’ credentials. Fraudsters will exploit new accounts opened with these identities to conduct illegal activities such as money laundering or applying for credit cards they have no intention of ever paying off.

New account fraud is a relatively new phenomenon, and banks considered it a low priority in the early 2000s due to the extraordinary level of technical skill required to harvest personally identifiable information (PII) en masse. It has since become commonplace, however, with 85% of financial institutions (FIs) reporting fraudulent activity in the account opening process. U.S. banks were expected to lose $3.5 billion to new account fraud in 2021, and this figure held relatively steady compared to the $3.4 billion in losses reported in 2018. While this can be interpreted optimistically to mean that fraudsters have not substantially improved their techniques over the past four years, it also suggests that businesses have not gotten any better at preventing these losses.

A new solution is needed to stem new account fraud and depopularize it to the relative rarity it held in prior decades. Historical prevention techniques have proven largely ineffective, but behavioral analytics could be the linchpin to curbing this fraud for good.

Preventing New Account Fraud Through Behavioral Analytics

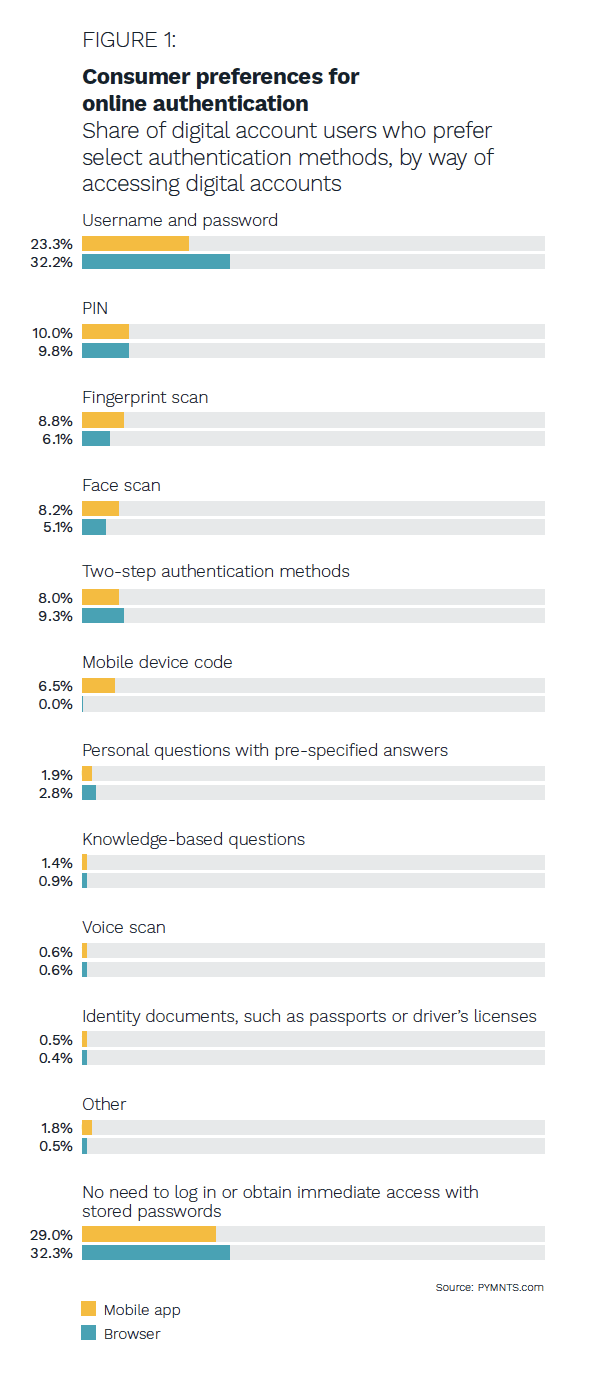

In the past, defenses against new account fraud relied on keeping personal information secure to deny bad actors the means with which to stage these attacks. Fraudsters often use stolen PII to open new accounts, so locking this information away is one way to thwart them. This is traditionally done with knowledge-based authentication methods such as passwords, but these are not nearly as secure as their popularity would indicate. While 32% of consumers prefer to use passwords when accessing online services on a browser, 44% of individuals use just two to five passwords for all their accounts, meaning they all may be compromised in the event of a data breach. In addition, 37% of Americans share their passwords with others, creating another massive opportunity for data theft.

Behavioral analytics offers a much more secure approach to new account fraud prevention. This method works by analyzing applicants’ data entry while onboarding and identifying deviations from new customers’ typical behaviors. Legitimate customers will type their names with little error, for example, while bad actors leveraging stolen or synthetic identities might hesitate or rush in this process, misspelling or copying and pasting data from another field. Case studies have shown that behavioral analytics has the potential to decrease fraud rates by up to 35%, a significant reduction.

Behavioral analytics could go a long way in putting a stop to new account fraud, which might never go away entirely, but any way to reduce the losses that have been stagnant since 2017 would be a critical improvement.