Don’t blame them, though. Customers would if they could.

The most recent PYMNTS/Entersekt collaboration, “Consumer Authentication Preferences for Online Banking and Transactions,” highlights the divide between how customers want to authenticate and how they actually do so when it comes to accessing financial accounts and making payments.

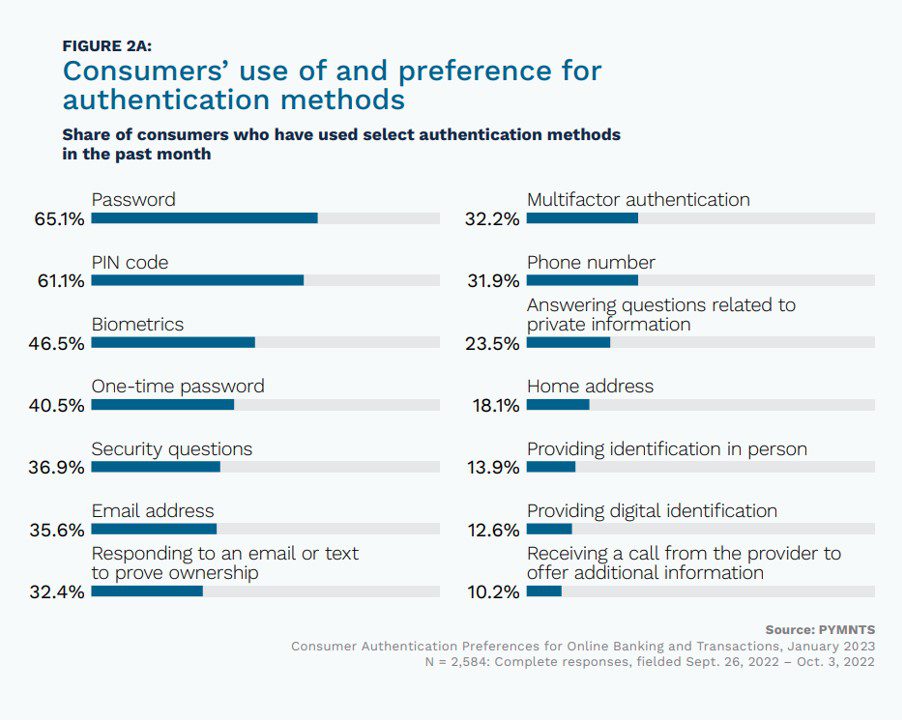

Customers used a range of authentication methods in the 30 days previous to being surveyed between Sept. 26 and Oct. 3:

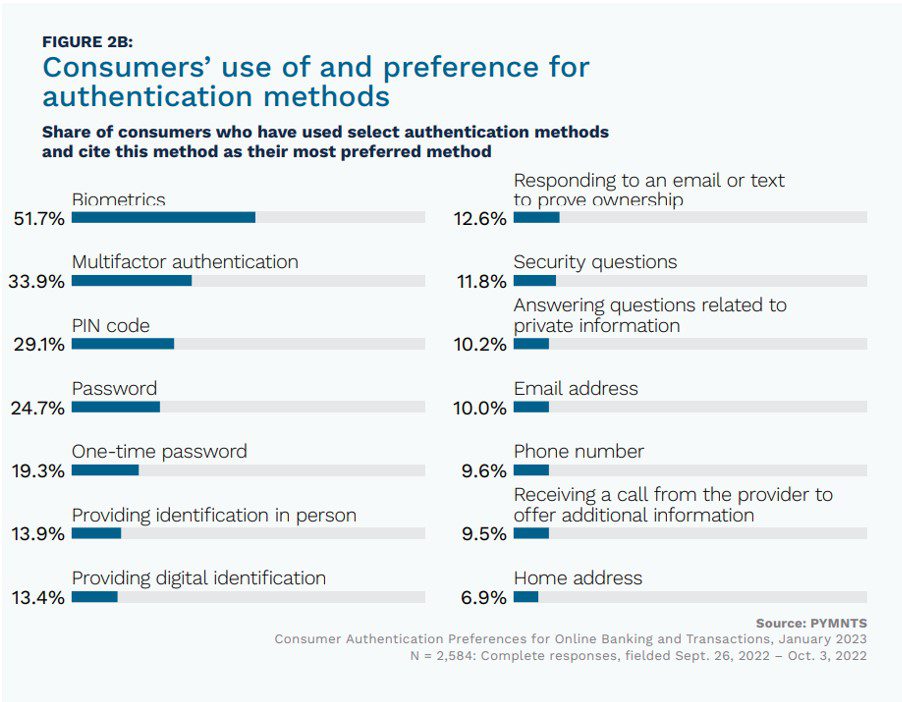

This is a clear contrast to the authentication methods customers would have preferred to use during the same time period:

It is somewhat ironic that customers are being shuttled to their least favorite — and in many cases, the least secure — authentication method. PYMNTS research has found that younger generations especially are ready to abandon passwords in favor of more advanced ID technology, such as biometrics.

Advertisement: Scroll to Continue

But like most habits, traditional password authentication use is hard to break. Fast Identity Online, the global digital password-less authentication standard, has been trying to move away from password authentication for over a decade.

In an interview with PYMNTS, Mzukisi Rusi, Entersekt’s vice president of solutions, explains that it will take time to disrupt the decades-old authentication system employed by both users and legacy FIs. “As much as we hate it from a security perspective, people still find [passwords] pretty easy. They are fairly ubiquitous, and they don’t need any special technology.”

Some banks are already jumping on the biometrics bandwagon. In Italy, Banca Sella Group announced a partnership in November with biometrics firm IDEMIA to launch a payment card powered by fingerprint sensors. The card will be released to select target areas throughout the five countries Sella serves.

Other major European banks are rolling out similar technology to enhance both security and the user experience. Also in November, Swedish firm Fingerprint Cards announced it had teamed up with card manufacturer Tag Systems to launch a biometrics solution for its global bank and FinTech customers.

Domestically, in October, biometric payment cards using fingerprint scanners got a push forward thanks to the publication of new specifications by EMVCo, the global card standards-setting body owned by Mastercard, Visa, American Express, Discover, JCB and UnionPay. These specifications are meant to hasten the evolution and adoption of biometric authentication for contactless card payments.

Just because passwords are the way things have always been done doesn’t mean FIs need to continue with “tradition.” After all, hackers, fraudsters and other bad actors certainly aren’t.