Gen Z More Likely to Swap BNPL for Store Cards

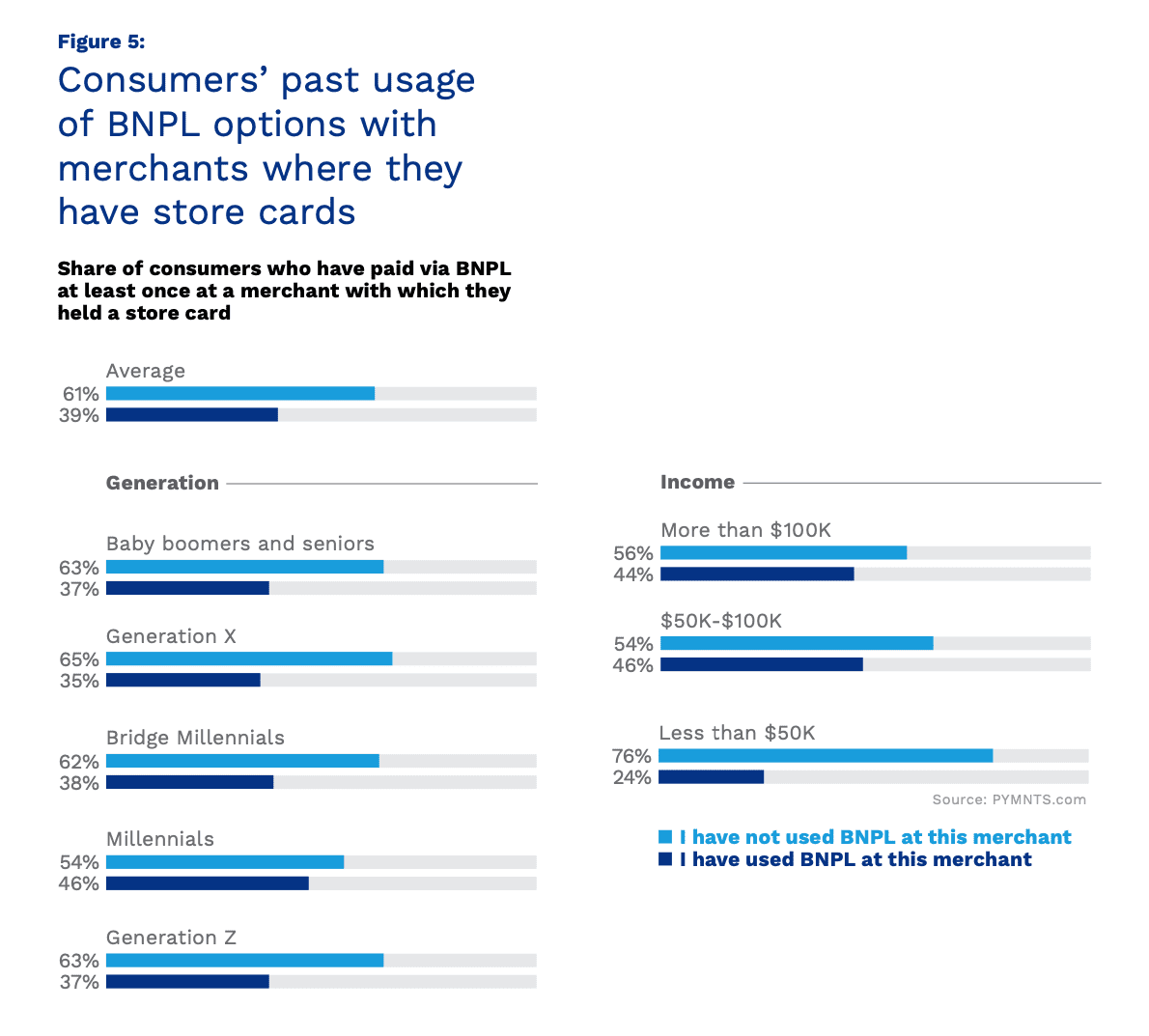

Thirty-nine percent of consumers have paid at least once using buy now, pay later (BNPL) options at a store where they held a store card, according to “The Truth About BNPL And Store Cards,” a PYMNTS and PayPal collaboration based on a survey of 2,161 U.S. consumers.

Get the report: The Truth About BNPL And Store Cards

Millennials are the most likely of all generations to have used BNPL at these merchants, as 46% have done so at least once.

Among the other four generations identified in the report, between 35% and 38% have used BNPL at a store where they held a store card.

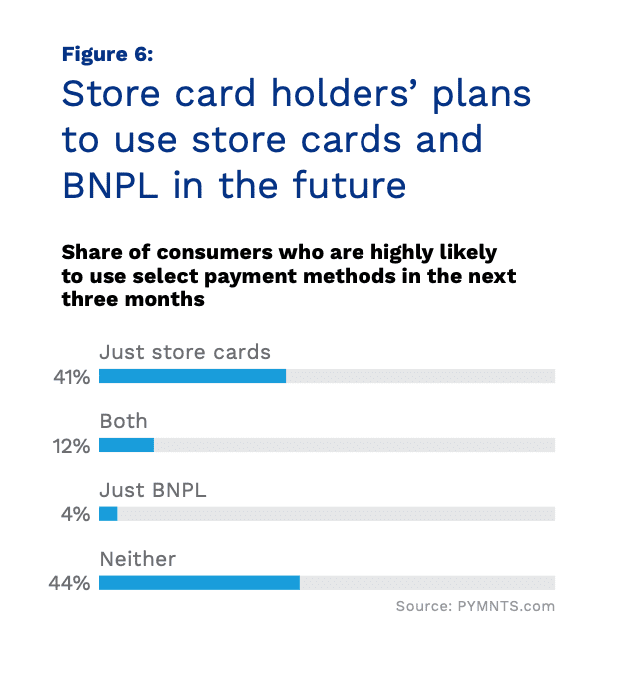

Going forward, 16% of consumers plan to use BNPL at a store where they hold a store card in the future, with 4% saying they are highly likely to use just BNPL in the next three months and 12% saying they plan to use both BNPL and store cards.

Forty-one percent of consumers plan to use only store cards in the next three months.

The remaining 44% of consumers plan to use neither store cards nor BNPL.

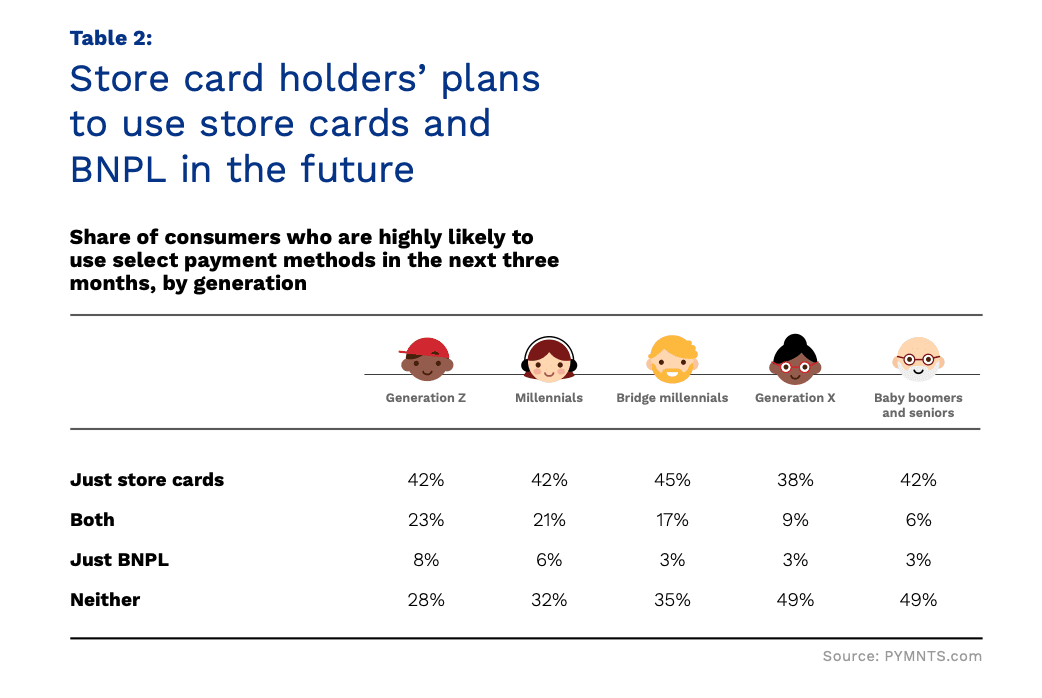

The share of consumers planning to use BNPL in the future varies by generation, with the younger generations being more likely to do so.

Gen Z and millennials are the generations most likely to use BNPL for future payments. Among Gen Z, 8% intend to pay exclusively using BNPL within the next three months, and 23% plan to pay using a mix of BNPL and store cards within the same time frame. Among millennials, 6% expect to pay with BNPL, and 21% expect to pay with a mix.

Baby boomers and seniors and Generation X are least likely to use BNPL for future payments.