BNPL Holiday ‘Hangover’ Worries May Prove to Be Tempest in Teapot

First comes the holiday spending. Then comes the holiday spending hangover — the credit crunch that leaves consumers scrambling to meet, if they can, the newly accumulated repayment obligations.

The situation might be a dire one, as individuals find they’ve stretched themselves with the spirit of giving — and buy now, pay later (BNPL) plans may have made the struggle even more formidable.

That’s one scenario. As Reuters reported, more shoppers have embraced BNPL, and consumer advocates are warning about holiday debt exacerbated by BNPL. Credit analysts quoted in the article warned that interest rates charged on the BNPL loan can top 30% and that at least some consumers are not reading the fine print of the obligations that are ultimately incurred.

PYMNTS Intelligence data seem to point to a different and nuanced scenario — where, yes, there are risks, but the payment option has had a wide embrace among consumers who are responsible about credit, want to improve their credit standings and find value in the predictable payment schedules and obligations. In short, BNPL has been — and may continue to be — used as a budgeting tool.

In “The Credit Accessibility Series: BNPL’s Wide-Ranging Impact on Consumers and Merchants” report, a PYMNTS Intelligence and Sezzle collaboration, we found that coming into the last few months of the year and into the holiday shopping season, 16% of consumers overall used the product, while an additional 12% had used it in the past.

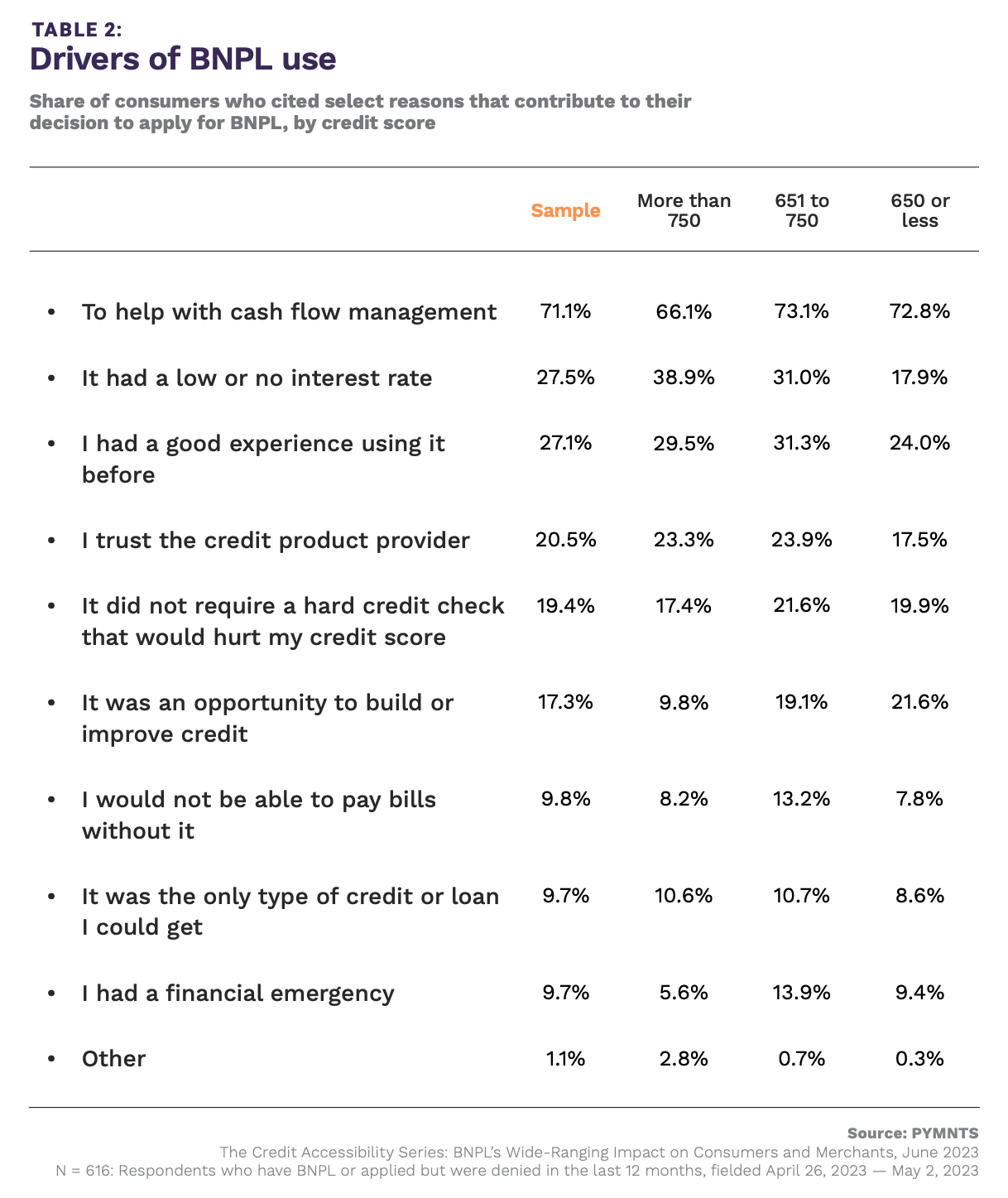

And among the top reasons for using the option, as reflected in the data: preserving cash and effectively managing credit lines are top priorities. More than 50% of respondents said managing their cash flow efficiently was the most important reason they opted for BNPL. The use of BNPL itself saw some significant tailwind, as Black Friday weekend data show that among the consumers surveyed by PYMNTS Intelligence, 4% of transactions were done via the split payment method in 2022, and accounted for 12.5% in 2023.

The Credit Profiles

Separately, our data show that about half of paycheck-to-paycheck consumers have super prime credit scores — and that roughly 80% of them have used or are currently using BNPL options. Overall, 4 out of 10 U.S. consumers used BNPL products at least once a month. This frequency was higher among millennials and bridge millennials, with nearly half of this segment using BNPL at least once a month.

The accompanying chart shows that a vast majority of consumers with higher FICO scores have been leveraging BNPL to help with cash flow management — and that only a small percentage state that they would not be able to pay bills without that payment method, or that it was the only credit they could get. Those last few data points hint that BNPL users are not pivoting to the option because they are in a financial pinch that would, down the line, make credit and repayment obligations unsustainable, spiraling into the aforementioned debt hangover.