43% of Consumers Will Delay or Cancel a Purchase If Merchants Don’t Offer BNPL

As consumers become increasingly accustomed to convenient and flexible payment options, buy now, pay later (BNPL) as a payment method has gained significant popularity both among consumers who can spread retail purchases in several installments and merchants looking to prevent cart abandonment and sustain sales.

In “The Credit Accessibility Series: BNPL’s Wide-Ranging Impact on Consumers and Merchants” report, PYMNTS Intelligence draws on a survey of over 3,100 consumers to assess the rising popularity of BNPL products as a credit option, consumers’ reasons for choosing to use it and the potential of BNPL to improve their credit profiles.

Findings captured in the study done jointly by PYMNTS and Sezzle show that consumers place a high value on BNPL as a payment method, so much that nearly half of BNPL users would delay or cancel a purchase if a retailer or merchant did not provide it as a payment method.

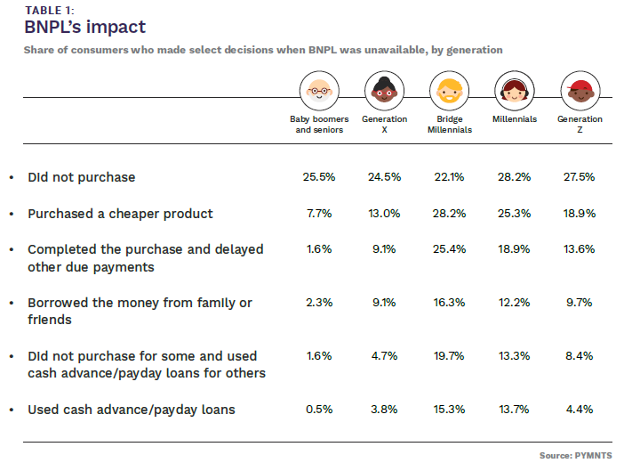

This sentiment was shared by 28% of both millennials and Gen Z consumers, highlighting the importance of BNPL for younger consumers. Similarly, nearly 26% of baby boomers and seniors also said they would cancel their purchase if BNPL was not available.

The availability of BNPL not only influences the decision to complete a purchase but also affects the choice of products. The PYMNTS Intelligence study found that if BNPL was not offered at checkout, 28% of bridge millennials would opt for a cheaper alternative. This suggests that offering BNPL can increase the likelihood of securing the sale of higher-value products, as consumers are less likely to compromise on their desired purchase when this payment option is available.

Furthermore, the absence of BNPL as a payment method can impact consumer behavior beyond a single purchase. Some consumers may choose to limit themselves to one purchase or delay other payments if BNPL is not an option.

This trend was particularly evident among bridge millennials, who were twice as likely as the average consumer to take such actions. This further highlights the significance of offering BNPL as a payment option given its ability to influence consumers’ overall spending habits.