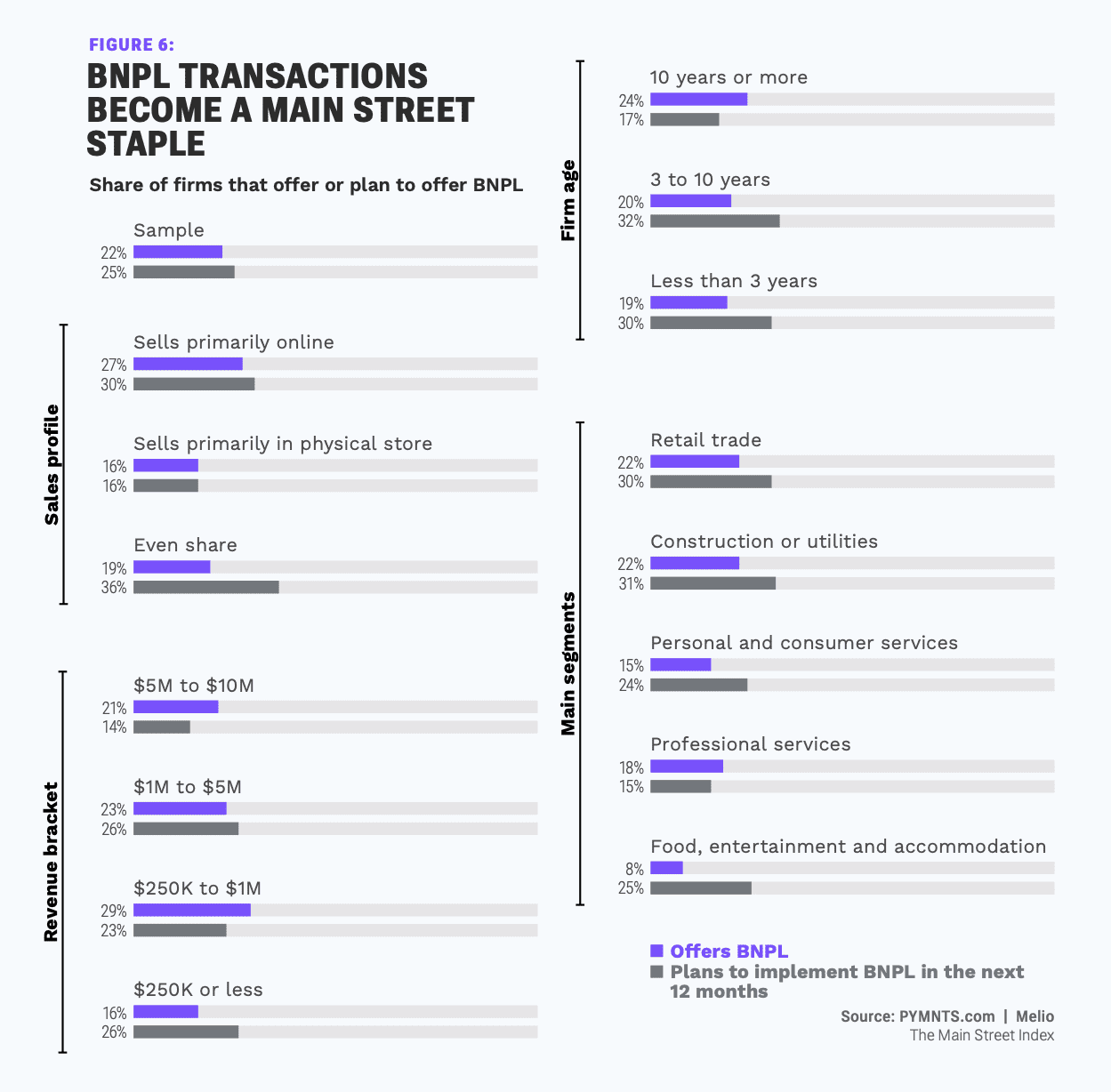

25% of Main Street Businesses Plan to Add BNPL in Next 12 Months

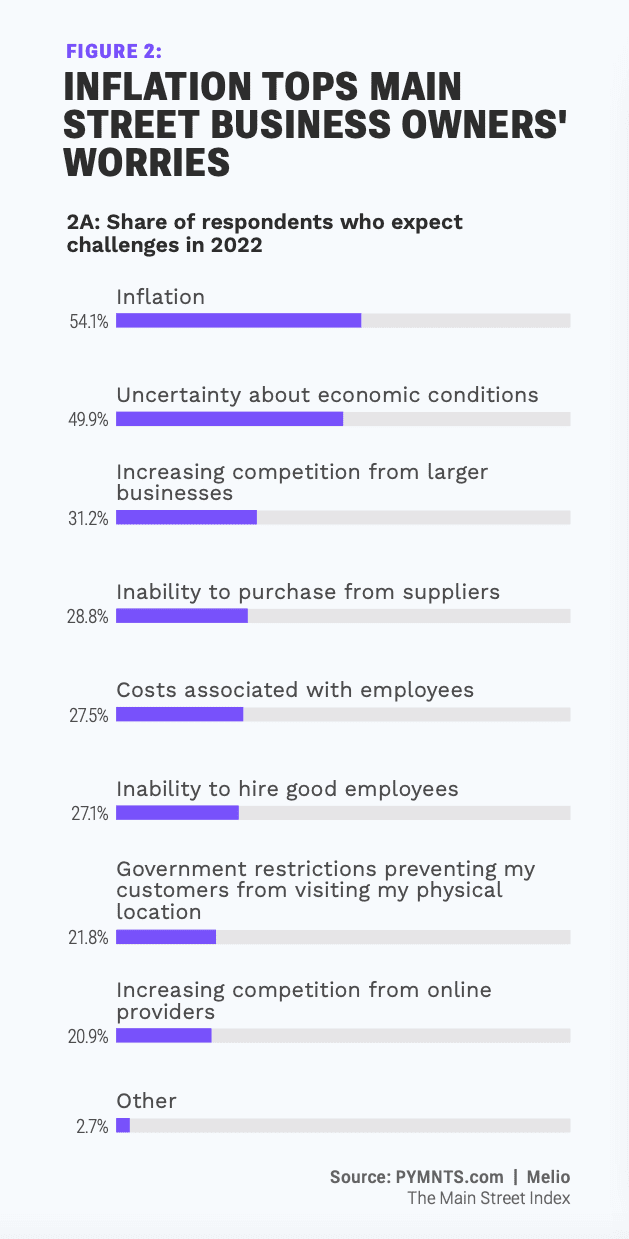

Inflation and uncertainty about economic conditions are the top concerns for Main Street businesses in 2022, according to The Main Street Index, a PYMNTS and Melio collaboration that draws from a survey of 765 business owners.

Get the report: The Main Street Index

The survey found that 54% of the respondents expect inflation to be a challenge in 2022, and 50% say the same of uncertainty about economic conditions.

Smaller shares of the business owners are worried about increasing competition from larger businesses (31%), an inability to purchase from suppliers (29%), costs associated with employees (28%) and an inability to hire good employees (27%).

To appeal to new customers and help retain existing ones, a growing number of Main Street businesses are using buy now, pay later (BNPL).

Today, 22% of the firms surveyed are offering this payment option.

The percentage varies across different industry segments. The segments most likely to offer BNPL are retail trade and construction or utilities, with 22% of the firms in each of these categories reporting they offer BNPL.

Lower shares of the other segments included in the study are currently offering BNPL: 18% in professional services, 15% in personal and consumer services and 8% in food, entertainment and accommodation.

These numbers will be growing, as another 25% of firms plan to implement BNPL in the next 12 months.

The two segments with the greatest shares of firms currently offering BNPL are also the ones most likely to be planning to implement it. Thirty-one percent of those in construction or utilities and 30% of those in retail trade plan to add it.

Although firms in the food, entertainment and accommodation segment are least likely to be offering BNPL today, they are third most likely to be planning to implement it. Twenty-five percent of these firms plan to do so.

The survey also found that 24% of personal and consumer services firms and 15% of professional services firms plan to implement BNPL in the next 12 months.