1 in 10 Consumers Use BNPL for Emergency Expenses

Financial struggles are a constant challenge for those with limited access to credit, especially when unexpected emergencies arise.

PYMNTS Intelligence research backs this up, showing that when faced with unforeseen expenses, 56% of all consumers and more than 80% of credit-marginalized consumers — individuals who have been rejected for credit products at least once in the past year — encountered further credit problems.

These unexpected costs primarily led to a drop in credit scores for 30% of consumers overall. For credit-marginalized individuals dealing with these unexpected expenses, 22% were forced to take on high-interest loans while 24% were charged overdraft fees.

These are some of the conclusions drawn from “The Credit Accessibility Series: Unexpected Expenses and the Demand for External Financing,” a report by PYMNTS Intelligence and Sezzle. The study was based on a survey of over 2,500 U.S. consumers and examined how they address these emergency, unforeseen expenses.

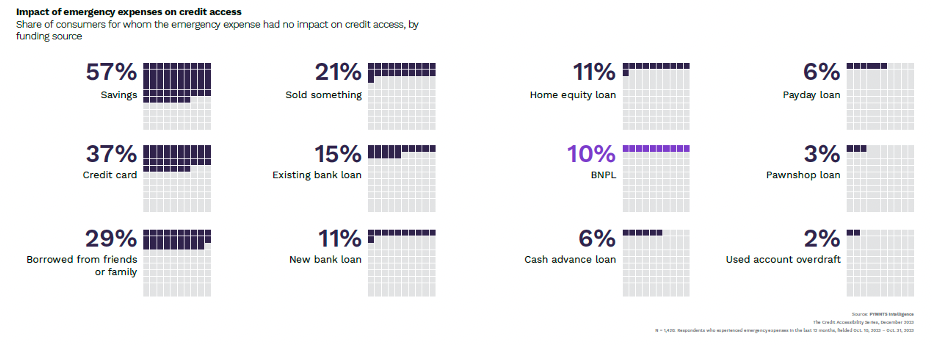

Per the study’s findings, individuals using buy now, pay later (BNPL) methods for emergencies were five times more likely than those resorting to overdrafts to report no negative impact on accessing credit due to these expenses.

Specifically, 10% who used BNPL to cover an unplanned expense reported no adverse effects on their credit because of that cost compared to only 2% of those who used overdrafts. Moreover, the 10% BNPL rate is comparable to that seen with new bank loans or home equity loans but notably higher than those facing negative credit impacts when resorting to payday loans, pawnshop loans or cash advances.

Overall, 10% of those who used BNPL in the past year cited it as their go-to resource for tackling emergency expenses, higher than the 4.6% average reported among all consumers who did the same.

“This suggests that BNPL is winning over users as an emergency tool,” the report noted.

Examining the data further showed that this trend toward BNPL is stronger among credit-marginalized consumers. Approximately 9.1% of these individuals opt for BNPL when facing unforeseen expenses, a stark contrast to the 2.5% of credit-secure consumers selecting the same method. The gap could partly stem from the broader range of affordable choices available to those with stronger credit standings.

In summary, as savings levels decline and unexpected expenses become more common, the positive impact of BNPL on credit cannot be overlooked. The product is emerging as a promising tool, particularly for credit-marginalized individuals, offering a pathway to cover emergencies without detrimental effects on credit access.

However, this trend underscores the need for broader financial inclusivity and more accessible options for all individuals facing unexpected financial burdens. Balancing convenience with sustainable financial choices remains pivotal, ensuring that emergency expenses don’t become enduring barriers to financial stability and credit access.