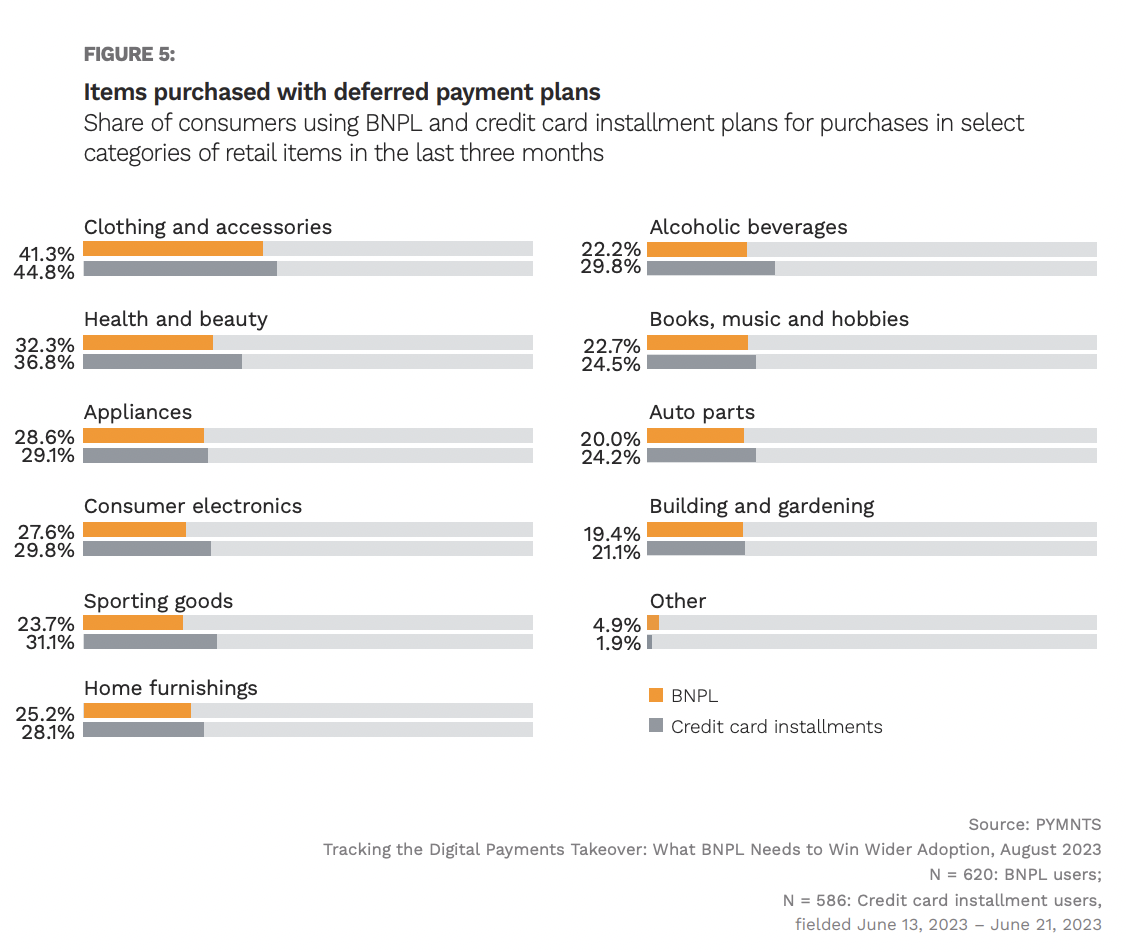

Consumers are especially inclined to use deferred payment plans to pay for apparel and accessories, PYMNTS Intelligence research reveals, be it buy now, pay later (BNPL) or credit card installments.

The PYMNTS Intelligence study “Tracking the Digital Payments Takeover: What BNPL Needs to Win Wider Adoption,” created in collaboration with Amazon Web Services, draws from a survey of more than 3,100 consumers in June about their usage of and expectations from deferred payment plans. Among other matters, the report dug into how many consumers use BNPL and credit card installment plans for purchases in various categories of retail items.

For BNPL and credit card installment plan users alike, clothing and accessories topped the list by a considerable margin, with 41% having used the former deferred payment plan to purchase such items in the previous three months, and 45% having used the latter — far more than said the same of any other kind of item.

Providing BNPL as a payment option has made fashion purchases more accessible, even in times of economic uncertainty.

“The pandemic caused widespread financial instability,” Pedro Bennasar, head of payment for Vestiaire Collective, told PYMNTS in an interview for the Buy Now, Pay Later Tracker®. “This financial adversity, however, did not cause consumers to stop shopping but rather to seek financial flexibility to accommodate their existing spending habits. This [change] resulted in major increases in the use of BNPL services. Consumers could enjoy the satisfaction of purchase without the pain of a big down payment.”

Moreover, BNPL is becoming more widely available.

“This is a seamless and frictionless way to expand the distribution of these payment products, and we’re offering this in line with the Google Pay experience users are comfortable with today,” Drew Olson, senior director at Google Pay, told PYMNTS CEO Karen Webster in an interview in December.