The Data Point: 72% of Consumers Interested in Super Apps

The connected economy is quite real, but it’s far from fully connected. There’s a growing sense that the bewildering number of finance and payments apps is holding back its potential, energizing talk around super apps that better deliver on its promise.

For the study “The Super App Shift: How Consumers Want to Save, Shop and Spend in the Connected Economy,” a PayPal and PYMNTS collaboration, we surveyed nearly 10,000 consumers in Australia, Germany, the United Kingdom and the United States, finding a serious appetite for one app instead of a half-dozen to navigate the pillars of the connected economy.

“A core advantage of a super app is its elegance,” the study stated. “Such a solution takes what once was a tangled thread pile of apps, websites and channels and spools it into a single, centralized experience.”

The study added that “specific personas of consumers heavily correlate with certain super app integrations — for example, more than 90% of consumers primarily motivated by convenience would integrate a super app into any given area of their lives.”

Get the study: How Consumers Want to Save, Shop and Spend in the Connected Economy

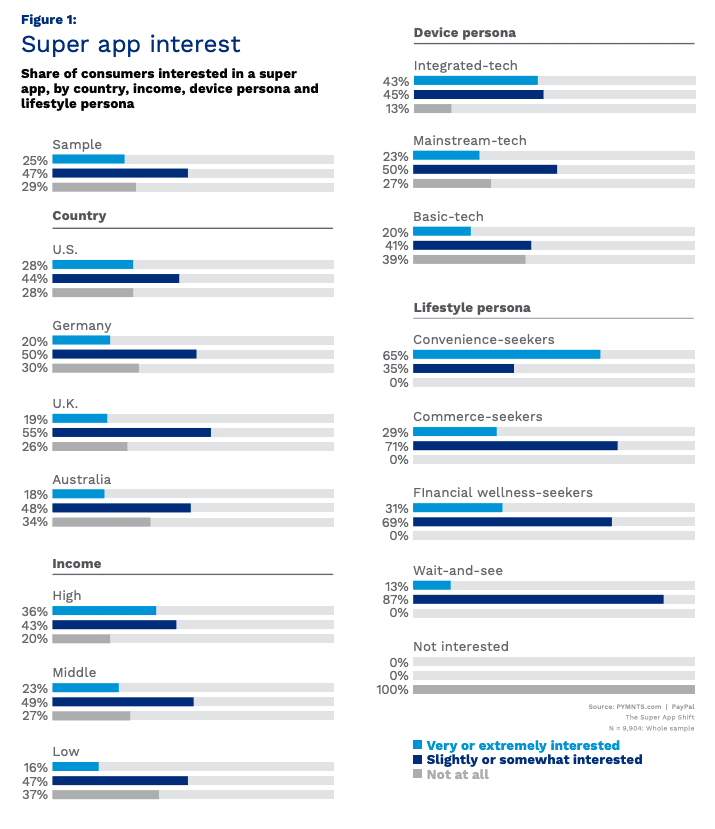

- Seventy-two percent of all respondents are at least “slightly” interested in a super app.

Finding seven in 10 consumers surveyed aware of and more than a little curious about how a full-featured super app could simplify and streamline digital interactions in an increasingly connected world, the study indicated this could be the next app innovation.

Moreover, enthusiasm is global.

“At a minimum, approximately two-thirds of respondents in all countries we surveyed reported interest in a super app,” the study stated. “Naturally, there are subtle variations: 8% to 10% more U.S. respondents are ‘very’ or ‘extremely’ interested in a super app than consumers in other regions. The most significant share of consumers who are ‘slightly’ or ‘somewhat’ interested in a super app — a group that exhibits great potential for future super app providers — hails from the U.K. and measures at 55%.”

Read more: How Consumers Want to Save, Shop and Spend in the Connected Economy